AVIA is a signal-providing company that has several accounts that work with different risk levels. The presentation looks simple and not informative. The system wasn’t revealed properly. So, we don’t know if our account is safe.

AVIA trading strategy

- We don’t know details of how the system decides when it’s the right time to open an order.

- It works with all possible trading pairs.

- We don’t know the time frame details.

AVIA features

The presentation looks short and it should be more informative. So, the people may not trust this service.

- The company provided an automatic MAM service.

- The system trades on all major cross pairs.

- There’s a detailed trading plan provided.

- The robot doesn’t execute orders during periods of high-impact news.

- The developers can handle fundamental indicators.

- The developers have some experience in trading.

- There are several levels of risk from one to four.

- We can handle “Levels of Risk Tolerance” details.

- It works automatically.

- We can customize drawdown levels until everything is good.

- We can work with any broker we want.

- We may ask developers to change our broker if we want.

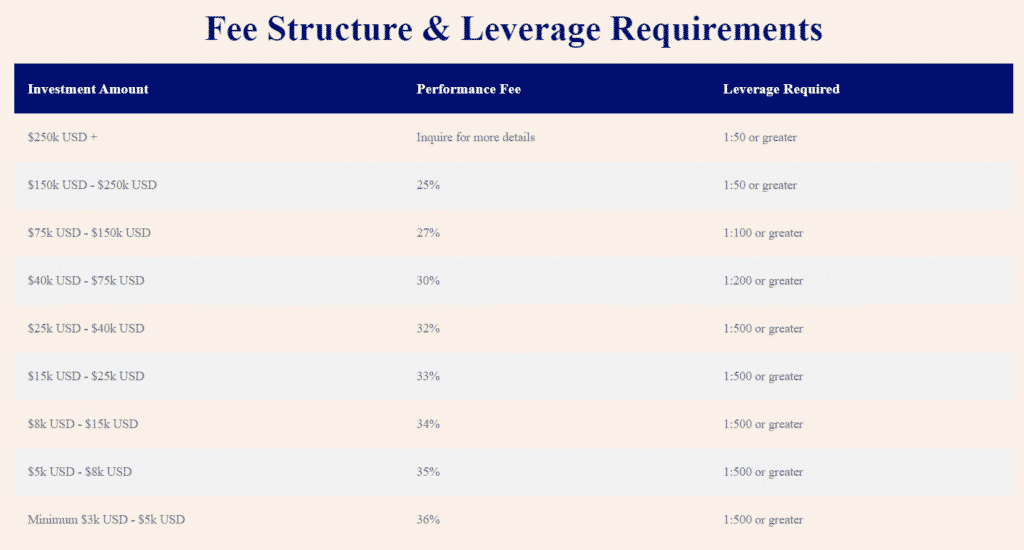

- If an account is less than 40k, the leverage should be 1:500.

- It should allow an unlimited number of open positions.

- We have to work on the accounts with hedge trading allowed.

- We can work with default lot sizes.

- The devs provide support within 30 days only.

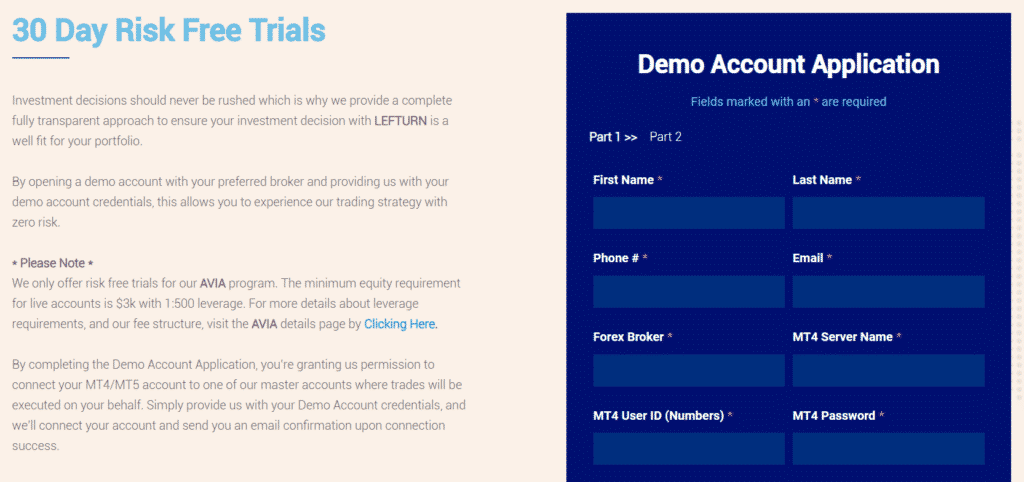

- We can give it a try on a demo account.

- It opens orders daily.

- “With conservative risks, we can make 12% monthly with 7-10% drawdowns. The minimum investments are $3,000.”

- “With moderate risks, we can make 18% monthly with 9-12% drawdowns. The minimum investments are $3,000.”

- “With aggressive risks, we can make 25% monthly with 13-17% drawdowns. The minimum investments are $3,000.”

- “With very aggressive risks, we can make 34% monthly with 15-20% drawdowns. The minimum investments are $3,000.”

AVIA can be used if we would like to pay commissions that the developers charge based on the account size. The minimum balance will be charged 36%. If we have an account of $150,000, the commissions will be 25%.

We can fill a form to get a free 30 days trial. We can copy these signals on MT4 and MT5.

AVIA backtesting results

The system is delivered without backtest reports. We don’t know if the advisor got proper testing before it was published for us. It’s a con because we don’t know what broker was picked to test and if tick data was handled well.

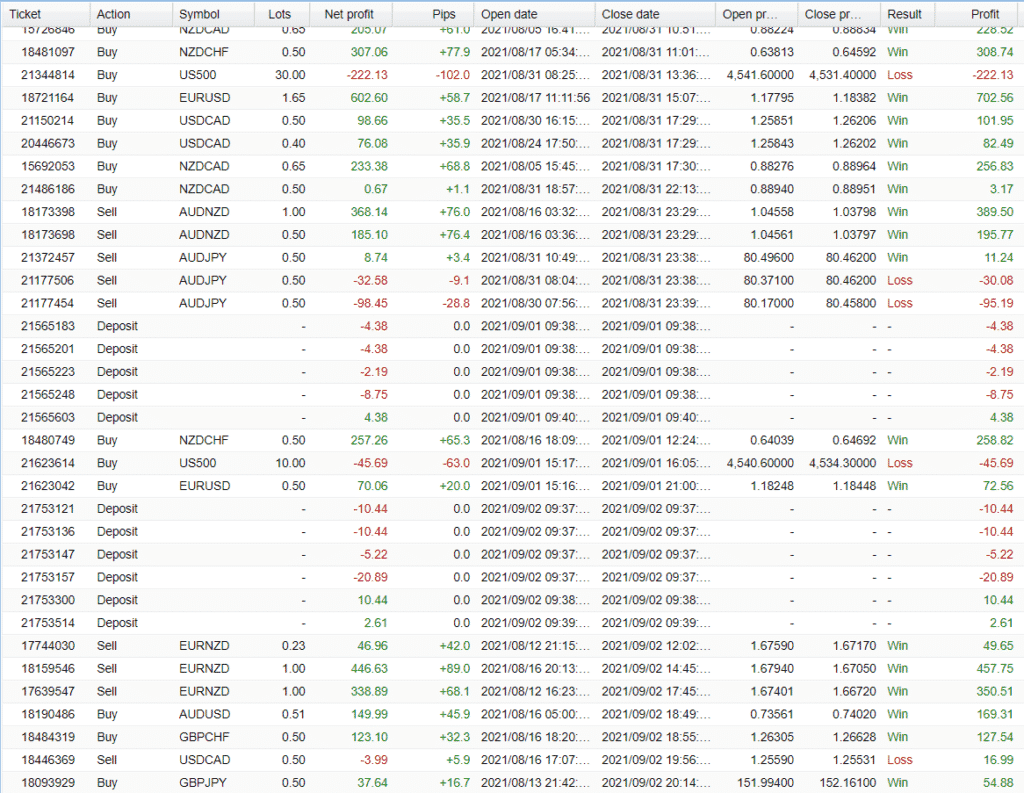

AVIA live trading results

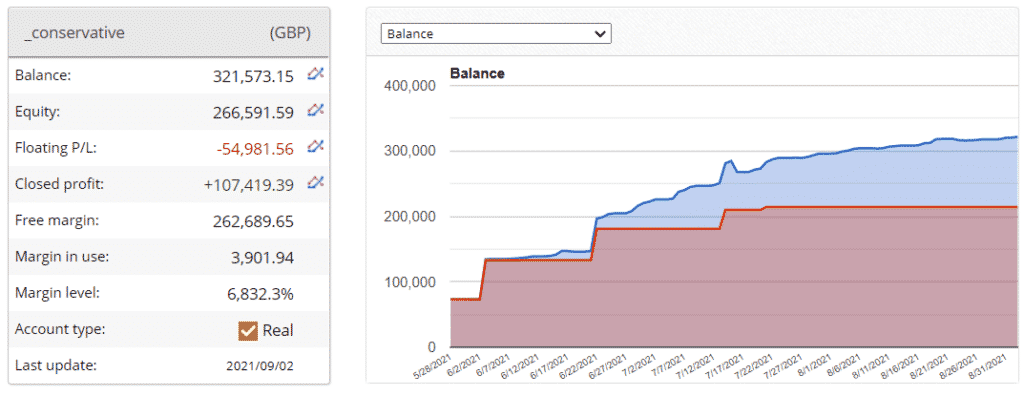

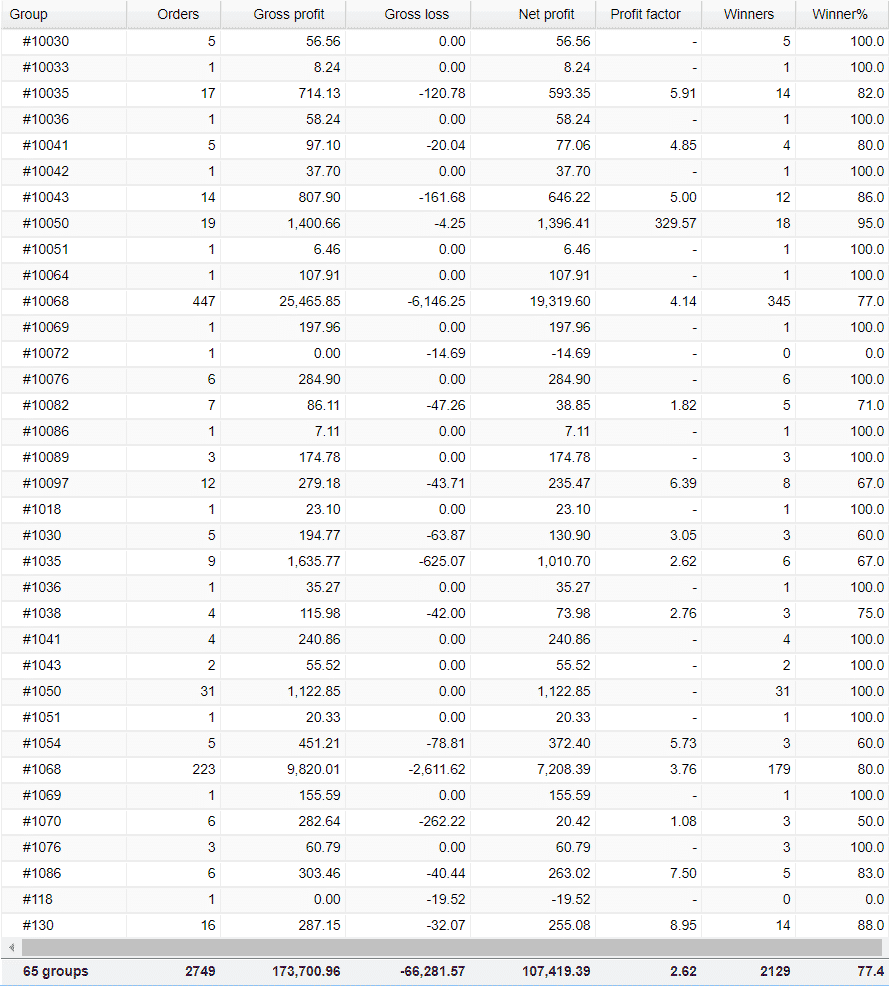

The robot works on a conservative account. It has £321,573 on the balance. The floating loss is deep – £54,981. The closed profit is £107,419. AVIA trading keeps a margin level high.

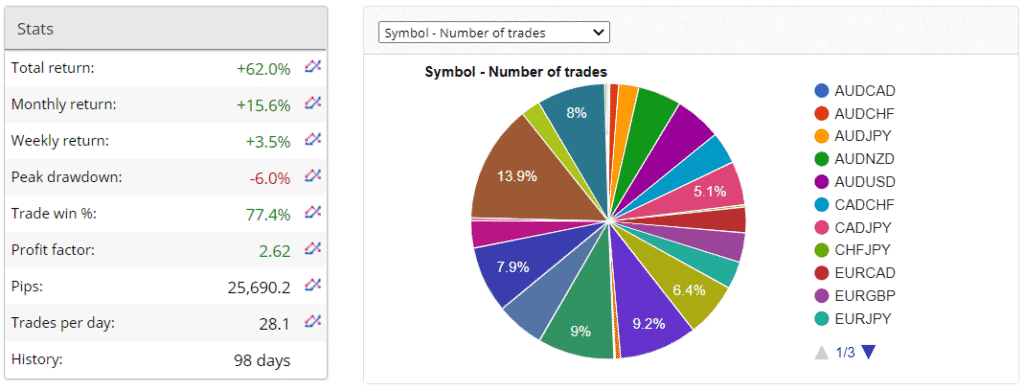

The absolute gain has become 62%. Since our last visit, it has gotten +6%. An average monthly gain is 15.6%. The maximum drawdown is 6.0%. The accuracy rate is 77.4%. The profit factor is 2.62. The robot has been working for 98 days. An average trade frequency is 28 orders daily.

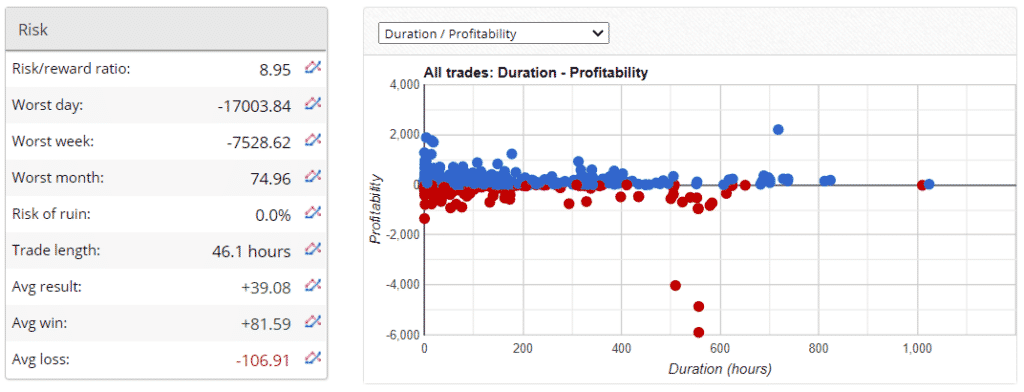

The RIO is 8.95. The risk of ruin is still 0.0%. An average trade length is 46 hours. An average trade is $39.08. An average win is $81.59 when an average loss is -$106.91.

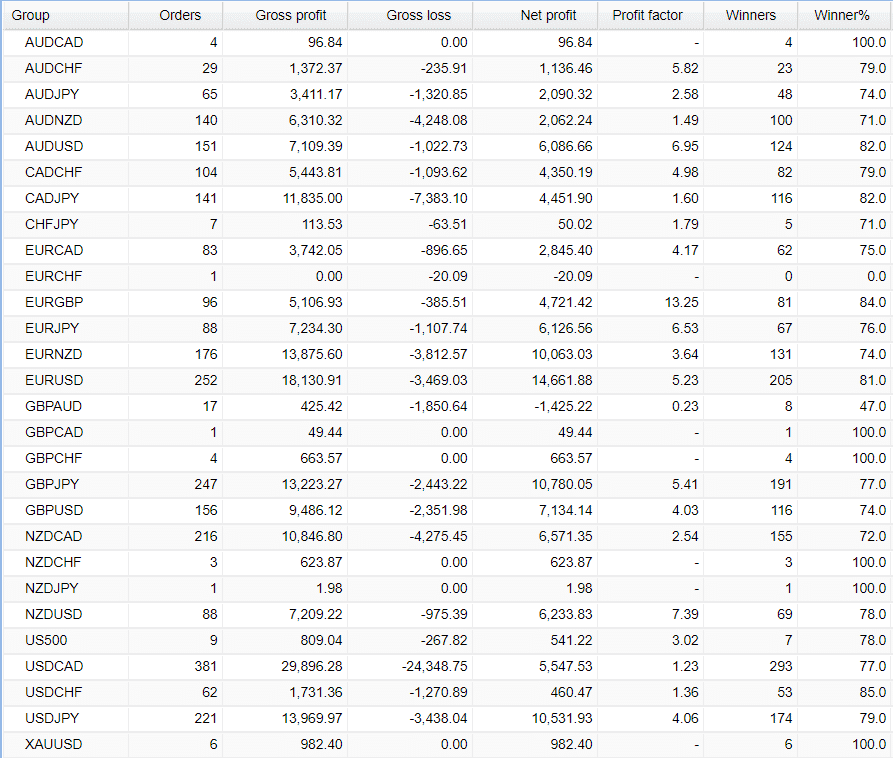

The system can execute orders on all available pairs on the terminal. The most profits were obtained on EURUSD (£14,661). The profit factor on it is 5.23.

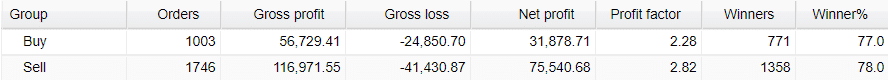

The advisor prefers trading the Sell direction, 1746 deals. The profit factor on it is 2.82.

The developers came up with 65 magic numbers. It’s an unstable factor because the system can be updated well without issues.

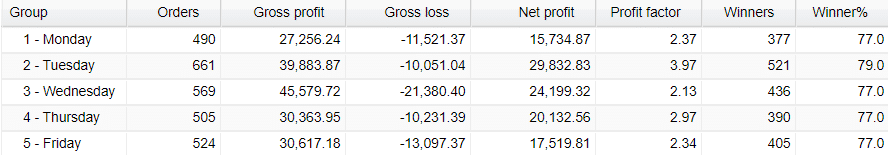

Tuesday is ahead in everything – executed orders (661) and profits £29,832.

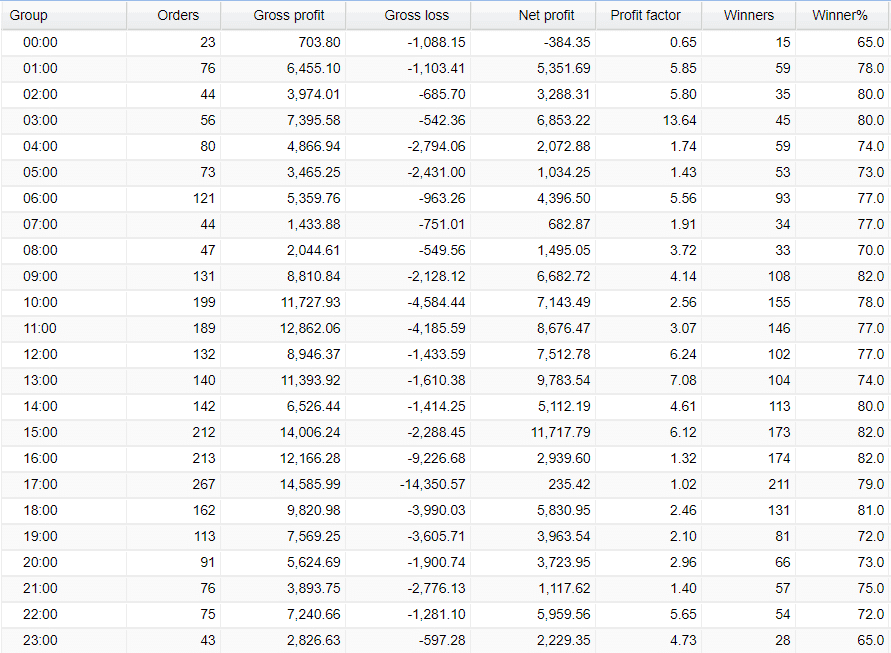

The most actively traded hours are the European and American ones.

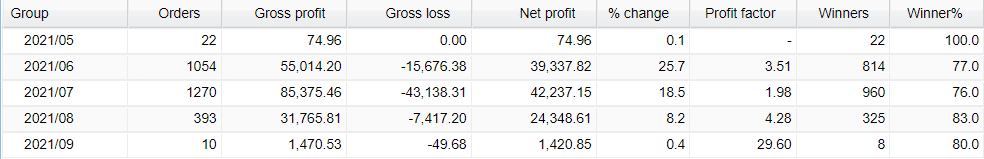

We may note that trading frequency has fallen three times in August 2021.

The system works with various risks on different pairs. Few traders would like to work with it.

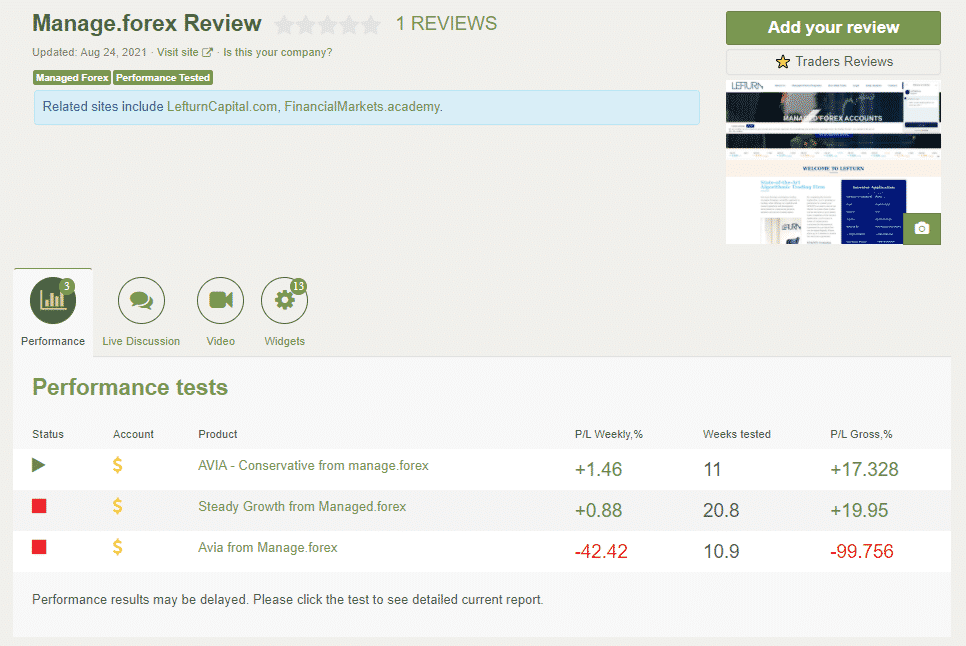

AVIA reputation

The developers decided to create a page on Forex Peace Army. We have a single review and three accounts connected where one of them is blown. It’s unprofessional to have a zeroed account if you provide management services.

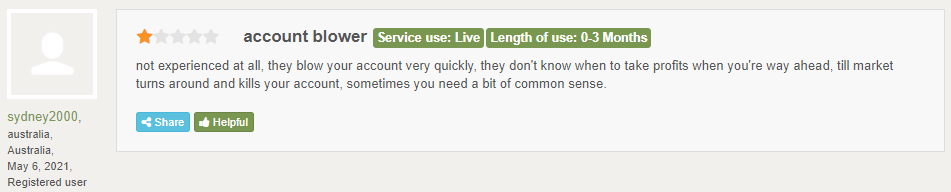

We have a negative testimonial from a client.

Do not trade with Lefturn!

Lefturn is a company with zero transparency and reputation among the forex community. Something went wrong and they decided to break all ties with Avia. They decided that changing the URL to their website and rebranding (now their forex account management service is called Alpha) would be enough to attract new traders. No naïves!

AVIA review summary

- Strategy – score (2/10)

- Functionality & Features – score (2/10)

- Trading Results – score (3/10)

- Reliability – score (2/10)

- Pricing – score (4/10)

AVIA is a management service company that provides signals from its accounts where the system runs with four levels of risks. Having checked trading results, we have noted that the system works with dangerous lot sizes increasing on many cross pairs. The listing loss is another dangerous option that a few would like to see on their real accounts.