AvaTrade is a trusted Forex and CFDs broker that is famous for its availability of trading platforms. Based on our findings, AvaTrade is excellent in its copy trading service and competitive in the diversification of trading platforms. Moreover, the industry average pricing and the education service may attract investors to assist this broker. However, the demerits about the broker are that it does not provide US traders trading services, nor does it accept any funds from within the US.

Pros

- Start trading with $100

- Social trading

- Multiple regulations from 7 different continents

- Variety of trading platforms

Cons

- Slow withdrawals compared to other brokers

- Additional fees apply for inactive accounts

- The account varieties do not attract different types of traders

AvaTrade is a well-established multi-regulated forex and CFD broker that was founded in 2006. The company is a member of Ava Group, headquartered in Australia.

Moreover, AvaTrade has its global headquarters in the Republic of Ireland to comply with international regulations. Furthermore, there are Japan, South Africa, Abu Dhabi, and the British Virgin Islands, among other regulated operations.

AvaTrade is the very first forex broker that has a 3A license in Abu Dhabi. Therefore, it is allowed to provide service at both retail and institutional levels.

Avatrade provides trading services in more than 55 different forex currency pairs, including 20 equity indices, 17 commodity CFDs, 500 stocks, and 14 cryptocurrencies.

Regulation

AvaTrade is a multi-regulated broker from different authorities. Therefore, traders can enjoy the trading environment that most international brokers allow.

Based on AvaTrade official site, the broker is regulated by the following authorities:

- AVA Trade EU Ltd — by the Central Bank of Ireland (No.C53877).

- AVA Trade Ltd — by the BVI Financial Services Commission.

- Ava Capital Markets Australia Pty Ltd — by the ASIC (No.406684).

- Ava Capital Markets Pty — by the South African Financial Sector Conduct Authority (FSCA No. 45984).

- Ava Trade Japan KK is licensed and regulated in Japan by the Financial Services Agency (License No.: 1662), the Financial Futures Association of Japan (License No.: 1574).

- Ava Trade Middle East Ltd — by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) (No.190018).

- DT Direct Investment Hub Ltd. — by the Cyprus Securities and Exchange Commission (No. 347/17).

- ATrade Ltd — by the Israel Securities Authority (No. 514666577).

It is often hard to find a broker with all of these regulations. Therefore, AvaTrade might work as a strong opponent based on rules. We have checked all regulating information and found AvaTrade listed on all of the authority’s websites.

Account Types

AvaTrade differentiates account types based on clients’ requirements and regulations. For retail traders, the retail account (EU) or the standard account (for the rest of the world) is suitable for most individual traders.

| Ava Trade EU Ltd | Ava Trade Ltd | |

| Trading products | FX, CDFs, FX options, spread betting | FX, CDFs, FX options |

| Account types offered | AvaTrade retail account, AvaTrade professional account, AvaTrade options account, AvaTrade spread betting account | AvaTrade standard account, AvaTrade options account, |

| Can you lose more than you deposit? | No, you have negative balance protection | |

| Range of markets | Forex, CFD equities and ETFs, commodities, cryptocurrencies, indices, FX options | |

| Trading platforms | Desktop, mobile (iOS, Android), avaTradeGo App, tablet (iOS, Android), Web trading |

Moreover, there are other account types as mentioned below:

- Professional account

The professional account requires ESMA regulation, but it is almost the same as the EU retail or global standard account. The significant difference between these two account types is the leverage.

The Retail EU has a maximum of 1:30 leverage as disposed of by the European Union’s legal limit. However, the professional account has a maximum of 1:400 leverage on forex and other instruments.

- Corporate account

It is for institutions and owned by a legal entity.

- VIP account

Anyone inside the EU or outside the EU is eligible for taking a VIP account. In that case, investors should invest a minimum of 10,000 Euro to get the VIP account. This account offers lower spreads than other account types.

- Spread betting account

It is offered only in the UK and Ireland.

- Islamic account

It is a swap-free account to allow investors to have an interest-free trading environment.

- Cryptocurrency account

Trading cryptocurrencies through AvaTrade is like trading other instruments. You have to make a minimum amount of deposit and start selling using the MT4 or MT5 platform.

Investors should invest as low as $100 except for the VIP account that requires 10,000 Euro or equivalent for every account type. Moreover, all account types have a demo facility so that investors can check the platform and get familiar with it before moving with the real money.

Fees and Commissions

The broker’s fees and commissions are important considerations while looking for a suitable forex or CFDs broker. Traders usually find a high regulated broker with a lower-cost facility. However, it is often difficult to match the requirement, but traders should adjust the cost with the maximum safety of funds.

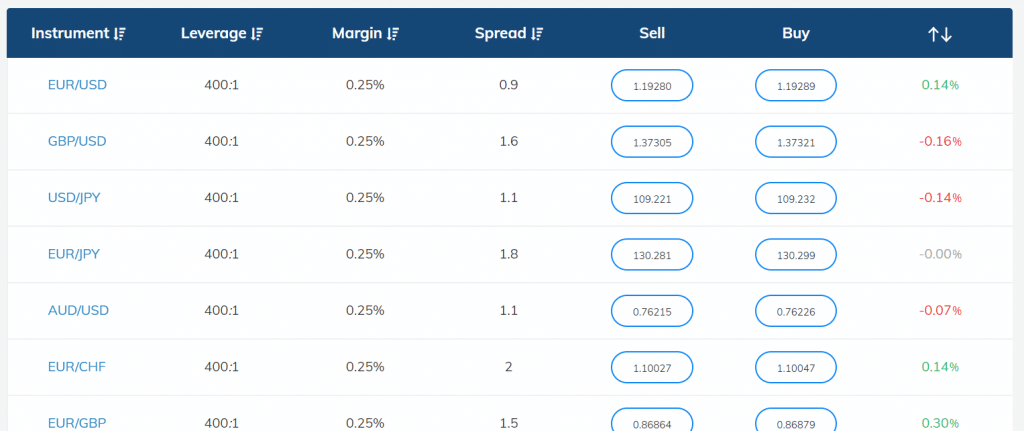

Let’s start with the spreads first. AvaTrade does not take any commission besides the feed, so its main charge is the spread.

The average spread of the EUR/USD is 0.9 pips, which is considered a satisfactory level compared to the industry average. Moreover, such a spread with a $100 deposit is another positive point for AvaTrade. However, there are other brokers that allow trading with 0.0 spreads. So, in some cases, we can find alternatives to AvaTrade in the industry.

Besides forex pairs, the average round trip fees and costs for other CFD instruments like stock, indices, and commodities are better than the industry average. We observed the trading cost during our review and found it near 0.13%, which is quite impressive.

Moreover, another essential fee regarding trading is the overnight fee charged to any open trades at 5 PM NY. Swing trades and position trades are the primary victims of overnight fees, but AvaTrade does not take any overnight fees, a plus for the broker.

Besides, there is an inactivity fee of $50 per quarter, but in that case, your account should not have any trading activity within the time.

Based on our findings, AvaTrade’s trading fees are competitive and within the industry average. Here investors can match the minimum deposit requirement with the low trading environment quickly and get the maximum benefit of a VIP account.

Payment options

AvaTrade has both bank and electronic payment options, but before that, traders’ accounts should pass both ID and address verification, as required by the regulating authorities.

AvaTrade deposits

There are three ways to deposit in AvaTrade, as mentioned below:

- Bank transfer

- Credit card

- Electronic wallet — Neteller, Skrill, Webmoney

The сredit сard and wire transfer are available for global clients, while electronic payments are not allowed for EU and Australian clients.

The wire transfer may take a maximum of 7 days to complete while payments with a credit card are instant. Moreover, Electronic payments require a maximum of 24 hours to complete the deposit.

The minimum deposit requirement is mentioned here:

Credit card deposit:

- USD account — $100

- EUR account — €100

- GBP** account — £100

- AUD** account — $100

Wire transfer deposit:

- USD account — $100

- EUR account — €100

- GBP** account — £100

- AUD** account — $100

** Make sure that the GBP account is for UK clients, and the AUD account is for Australian clients.

AvaTrade withdrawals

Before making a withdrawal request, make sure that your account is two steps verified using your NID/passport or driving license.

Like other brokers, you should choose the same withdrawal method as your deposit. The overall process may take a maximum of two days to complete.

Available Markets

Now, we will see the list of available markets on the AvaTrade platform. In AvaTrade, you can diversify your trading portfolio from forex, stocks, indices, commodities, and cryptocurrencies.

Forex

- AvaTrade offers forex trading liquidity from several Tier-1 liquidity providers.

- You can trade majors, minors, exotics with a single platform.

- Forex trading is allowed in MT4, MT5, and brokers’ proprietary platforms.

CFDs trading

- Avatrade offers trading opportunities with seven regulations across six continents.

- Large availability of CFDs on ETFs, stocks, bonds, commodities, etc.

- Availability of multiple trading platforms for CFDs trading.

Cryptocurrencies

- Trading opportunity in the world’s famous cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

- Cryptocurrency trading in MT4, MT5, or AvaTrade Go Platforms.

- No wallet is required. Traders can directly trade with their investment in AvaTrade.

- No hidden fees or commissions for crypto trading.

Trading Platforms

AvaTrade provides MetaTrader 4 MetaTrader 5, and its proprietary trading platform to cover all trading needs.

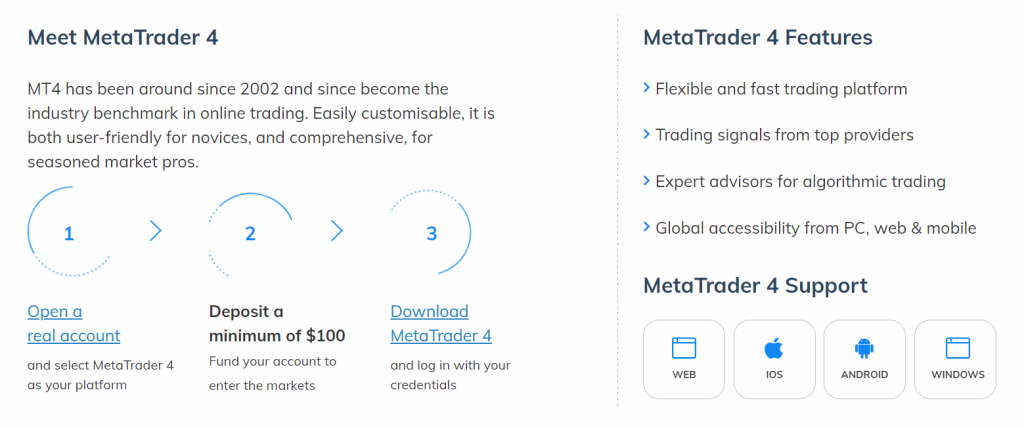

AvaTrade MetaTrader 4 platform

- Easy interface with nine timeframes and more than 30 built-in indicators.

- Available in mobile, web, desktop, and mac.

- Expert advisors with MQL4 language for algorithmic trading.

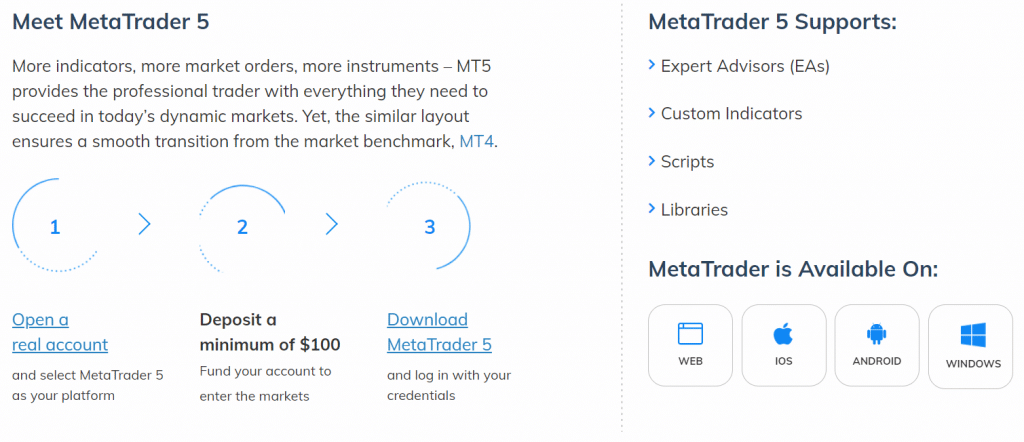

AvaTrade MetaTrader 5 platform

- MetaTrader 5 is a sophisticated trading platform that has more than 100 trading tools & indicators.

- Twenty-three timeframes and automated trading with MQL5 language.

- Available in mobile, web, desktop, and mac.

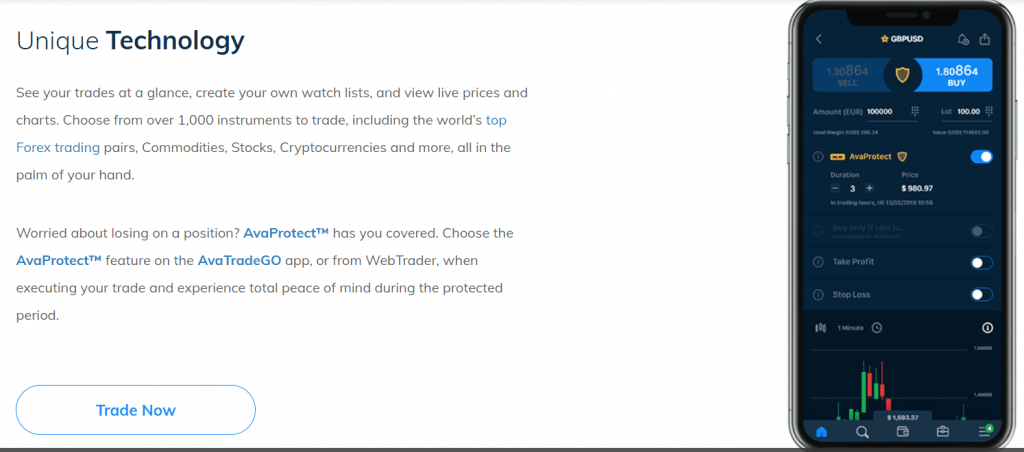

AvaTradeGO

- It is a unique platform made by AvaTrade where inventors can trade 1000+ instruments in a single place.

- Investors can protect losing positions with AvaProtect in the AvaTradeGo platform.

Features

Besides general features, AvaTrade provides more than a trader should know. Here we will see some elements that AvaTrade exclusively supplies:

Trading central

- AvaTrade offers technical analysis from certified traders through the central trading portal.

- AvaTrade technical analysis is available on WebTrader and AvaTradeGO platforms.

- Moreover, you can see analysis through the MT4 and MT5 platforms as well.

- Trading central offers 24 hours coverage across 85 markets, including stocks, currency pairs, options, and bonds.

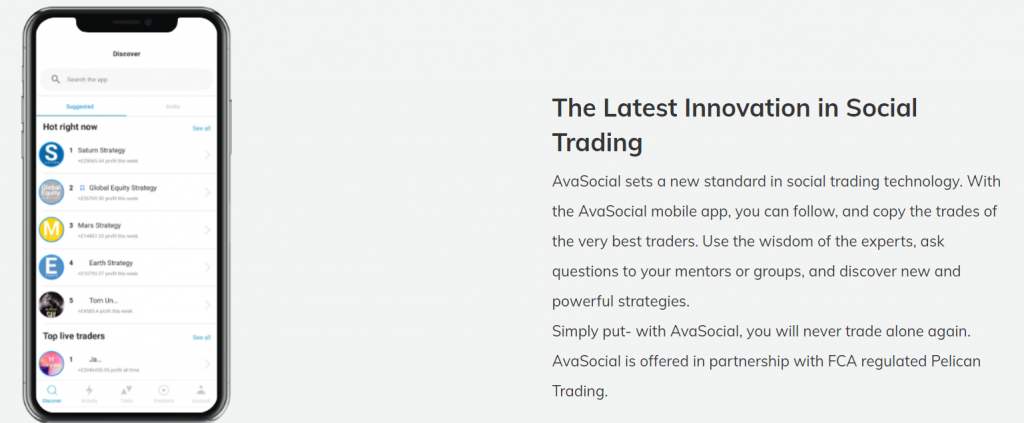

AvaSocial

AvaTrade provides social trading opportunities where multiple investors can follow successful traders. It is a win-win opportunity for both traders and investors. Investors should pay the trader and follow his trades directly to the account without any middleman. Here you can see the list of traders and their performance to choose the most reliable person.

Education

Education is the primary objective for a trader. So, AvaTrade focuses on keeping its clients profitable by providing sufficient educational materials.

Among necessary educational support, we have found these effective:

- Trading videos

- Trading for beginners

- Technical indicators and strategies

- Economic indicators

- Online trading strategies

However, we did not find any regular technical/ fundamental analysis or market updates on the AvaTrade website during our review. The only source we have found is the trading central. Besides, there are enough educational resources on technical analysis and other trading tools.

Customer Support

AvaTrade website is available in 29 languages. Investors of most other countries can access it. The support page is enriched with frequently asked questions related to trade and the company.

Moreover, you can directly contact them through live chat, which is the most effective contact method.

Review Summary

In summary, we can say that AvaTrade is a forex and CFDs broker that has strength in the regulation and trading instruments.

AvaTrade does not provide services for US clients, that might be the biggest drawback of the company. Plus there is an inactivity fee where traders have to pay an amount in case of keeping the account inactive.

On the other hand, AvaTrade is the multi-regulated forex broker where trading cost is relatively low. Therefore, based on our review, we can consider the broker as trustworthy.