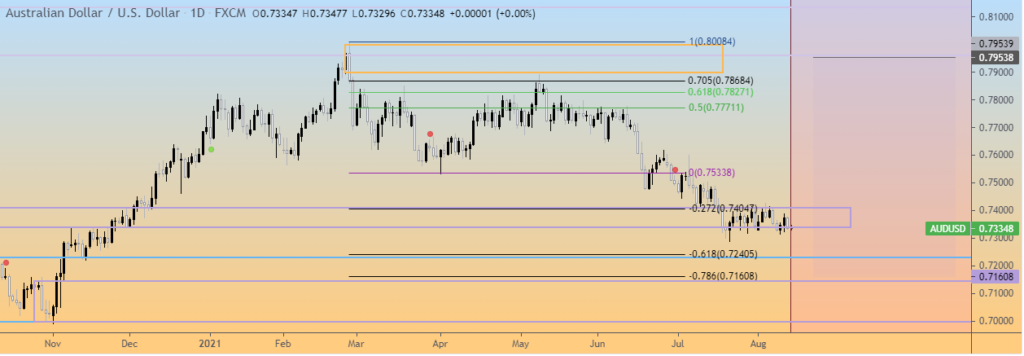

- Australian dollar weakness persists amid COVID-19 concerns.

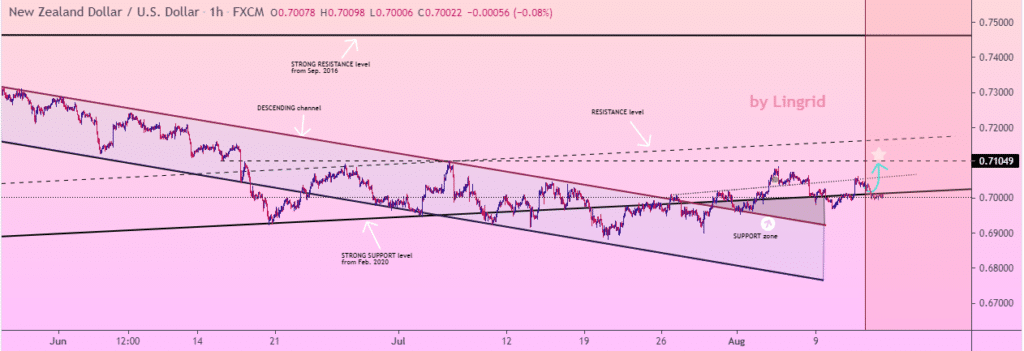

- New Zealand dollar trying to fend off dollar strength.

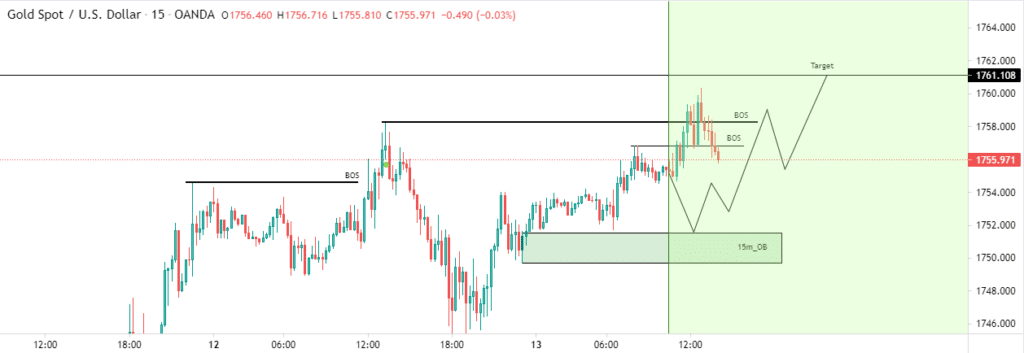

- Gold upward momentum gathering pace after bounce back.

- Bitcoin and Ethereum look bullish above crucial resistance levels.

The AUDUSD pair is holding steady below the 200-day moving average as bulls struggle to push the pair above the 0.7350 level. The pair has come under immense pressure in recent weeks amidst dollar strength across the board. Australian dollar weakness has also been exacerbated by the escalating Delta Covid situation in Australia.

Australian dollar weakness

After a recent slide, the pair has failed to make a run for the 0.7400 level, which has emerged as a strong resistance level above which bulls could be tempted to push the pair higher.

Below the $0.7350, AUDUSD remains susceptible to further losses which could see the bears pushing the pair to the 0.7240 level.

Australian dollar weakness looks set to continue as the COVID-19 situation continues to take a toll on the already struggling economy. The most populous state New South Wales continues to report a spike in cases, all but weighing negatively on the currency.

The surging cases have already pushed back talk of the Reserve Bank of Australia tapering leaving AUD bulls on the defensive. In contrast, the US dollar continues to strengthen across the board amid growing expectations that the Federal Reserve could taper bond-buying soon.

The divergent monetary policy view between the FED and the RBA continues to favor the greenback, consequently sending AUDUSD lower.

NZDUSD at support

The New Zealand dollar is another currency under immense pressure. The NZDUSD has already slid to a critical support level at 0.7000, with bulls on the defensive. In recent weeks, the pair has experienced heavy selling pressure on the dollar strengthening across the board amid tapering talk in the US.

A drop to 0.6960 could be on the cards as a bounce-back experienced mid this week has stalled.

The US jobless claims dropping for a third consecutive week close to pandemic lows of 368k has all but heightened expectations of the FED hiking interest rates and tapering. The chatter is already fueling dollar strength, likely to continue weighing heavily on the NZDUSD.

On the flip side, growing chatter that the Reserve Bank of New Zealand could hike interest rates at its next meeting on August 18 should continue to offer support against a slide below the 0.7000 on the NZDUSD pair.

Gold bullish momentum

In the commodity market, gold appears to have regained its bullish momentum after a recent bounce back from four-month lows below the $1700 level. XAUUSD is trading above a critical $1750 level, with bulls taking the fight to the bears.

A rally followed by a close above the $1760 level should pave the way for the bulls to steer XAUUSD to the $1780 region ahead of a rally to the $1800 level.

However, the bulls remain cautious ahead of the release of the US Michigan Consumer Sentiment data. A downside surprise on the key metric could weigh on FED tapering expectations, which the precious metal should be balanced.

US stock rally persists

US stock indices continue to set fresh records amid heightened buying spree in the equity markets. With stocks edging higher amid easing tapering expectations and the passing of a massive infrastructure spending bill, the Dow Jones Industrial Average and the S&P 500 set new record highs at 35,499 and 4,460, respectively.

The outperformance in the equity market stems from economic data showing the US economy is doing well amid the COVID-19 challenges. The labor market continues to recover from last year’s recession as inflation pressures also show signs of cooling off.

Crypto’s upward momentum

On the other hand, the cryptocurrency market cap bounced back to the $2 trillion mark, with Bitcoin and Ethereum trading above the $45,000 and $3000 levels, respectively. With these two levels holding firm, the crypto bull market appears to be in full play.

BTCUSD bulls look set to make a run for the $50,000 level as long as the $45,000 support level holds. Ethereum bulls could also make a run for the $4,000 level as the upside momentum gathers pace.