As we can see from the name, Aeron Scalper plus Grid performs Grid and Scalper strategies. The presentation looks awkward because it’s weird to see a 1999 site in 2021 where there’s an endless wall of attractive site templates.

The developers insist that we need to know updates and information about their robot. For being in touch, we have to provide them our email.

The robot costs $230 for a copy as of several months ago. The first 50 copies may have been sold. So, the next price will be $349. There’s no additional information that could tell us whether the vendor supports the package with a refund policy, updates, upgrades, free switches accounts, and so on.

Aeron Scalper plus Grid Strategy

- Aeron Scalper plus Grid runs Scalping and Grid strategies.

- We can use it on USD/JPY, CAD/JPY, EUR/USD, EUR/JPY, and AUD/CAD currency pairs.

- It trades on the M1 time frame.

Aeron Scalper plus Grid Features

The site doesn’t include extended explanations about the system:

- The system can work automatically on the terminal.

- It performs a scalping strategy as the base one.

- Because of the low time frame, the system trades frequently.

- We can find a Grid with conservative Hedge strategies as the support ones.

- The money-management places Take Profits and Stop Losses for each open trade.

- Before entering the market, it calculates Lot Sizes for us based on the risks we set before.

- It can be profitable in both stable and volatile markets.

- We can work with Aeron Scalper plus Grid only on the MetaTrader 4 platform.

- It can be attached to the M1 time frame.

- It works with EUR/USD, EUR/JPY, USD/JPY, CAD/JPY, and AUD/CAD cross pairs.

- We are free to choose where the robot will work on a PC or on a VPS service.

- There’s spread protection that forbids opening trades if the spreads are over five pips.

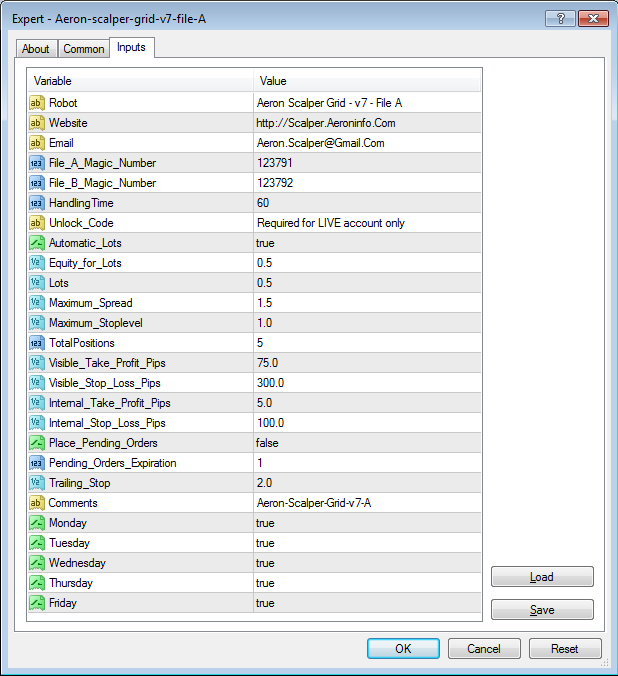

- We can check a settings list to know better what we’re going to use.

Aeron Scalper plus Grid Backtesting Results

The presentation isn’t featured by a backtest report. As a result, we can’t check if the system worked well on the past tick data received from brokers.

Aeron Scalper plus Grid Trading Results

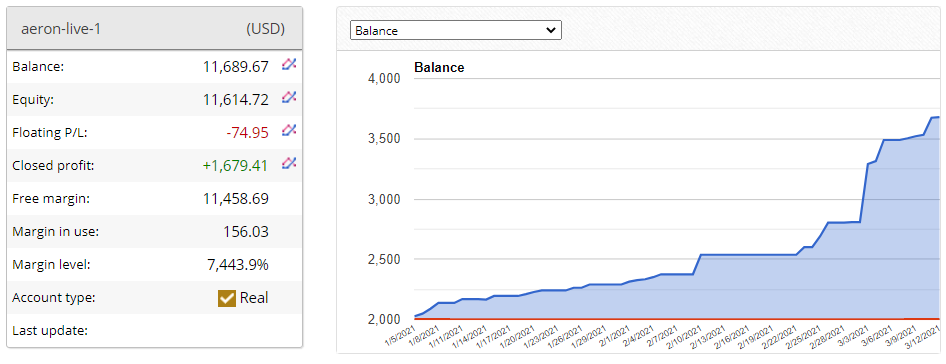

Aeron Scalper plus Grid works on a real USD account that was created on January 5, 2021, and deposited at $2000. Since then, the absolute gain has amounted to $11,689.67. The margin level is medium – 7,443.9%. The Floating Lose is -$74.95.

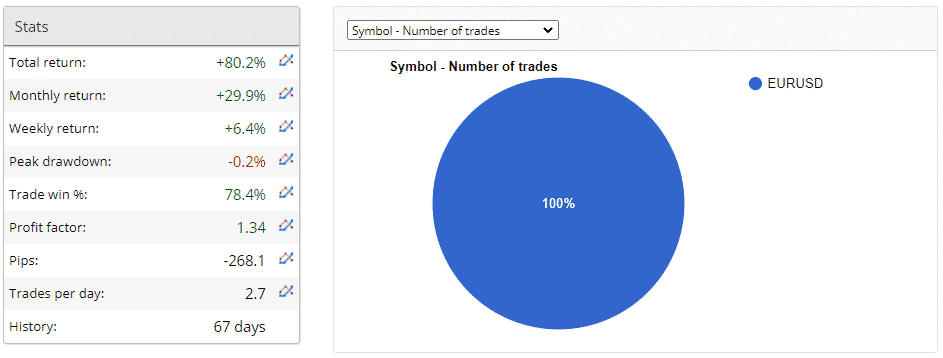

The Total Net Profit is +80.2%. An average monthly gain is +29.9%. The maximum drawdown is low – 0.2%. An average win-rate is 78.4%. The Profit Factor is 1.34. An average trade frequency is 2.7 deals daily. The robot has been managing the account for 67 days. It works with EUR/USD only.

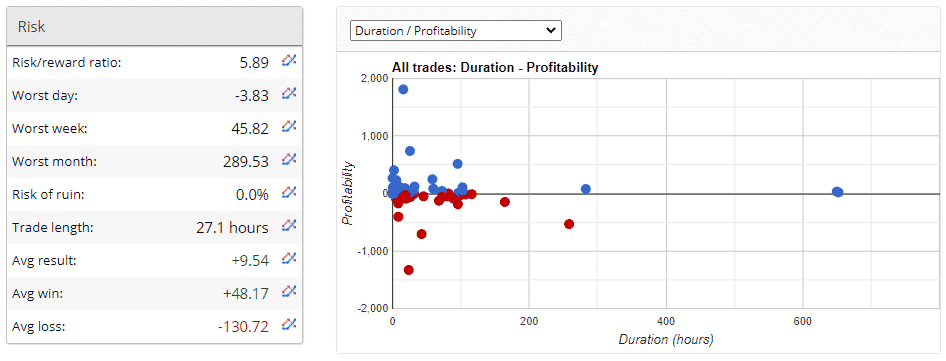

The Risk to the Reward Ratio is 5.89. An average trade length is 27.1hours. An average win +$48.17 when an average loss is -$130.72. An average result is +9.54.

The system trades the BUY and the SELL directions with the same trading frequency, but the most profitable one is SELL with $1445.69.

As we can see, there are two strategies. The #123791 strategy has brought -$51.44 of net loss when the #123792 strategy has made onlyl profits.

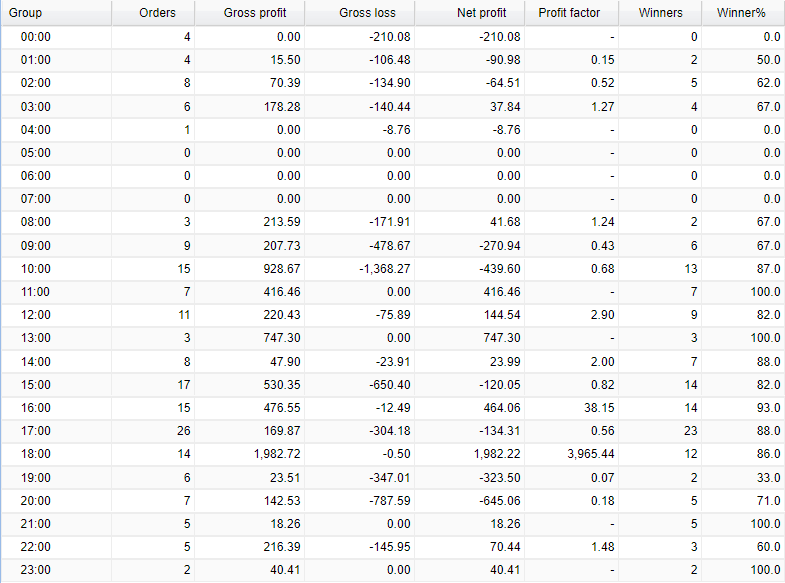

Most traded days are Thursday (52 deals) and Friday (48 deals). The most profitable days are Wednesday ($833.38) and Friday ($557.17).

The robot focuses on trading break-out periods during the European and American trading sessions.

The robot uses not only Grid and Hedge but also conservative Martingale strategies.

Aeron Scalper plus Grid Reputation

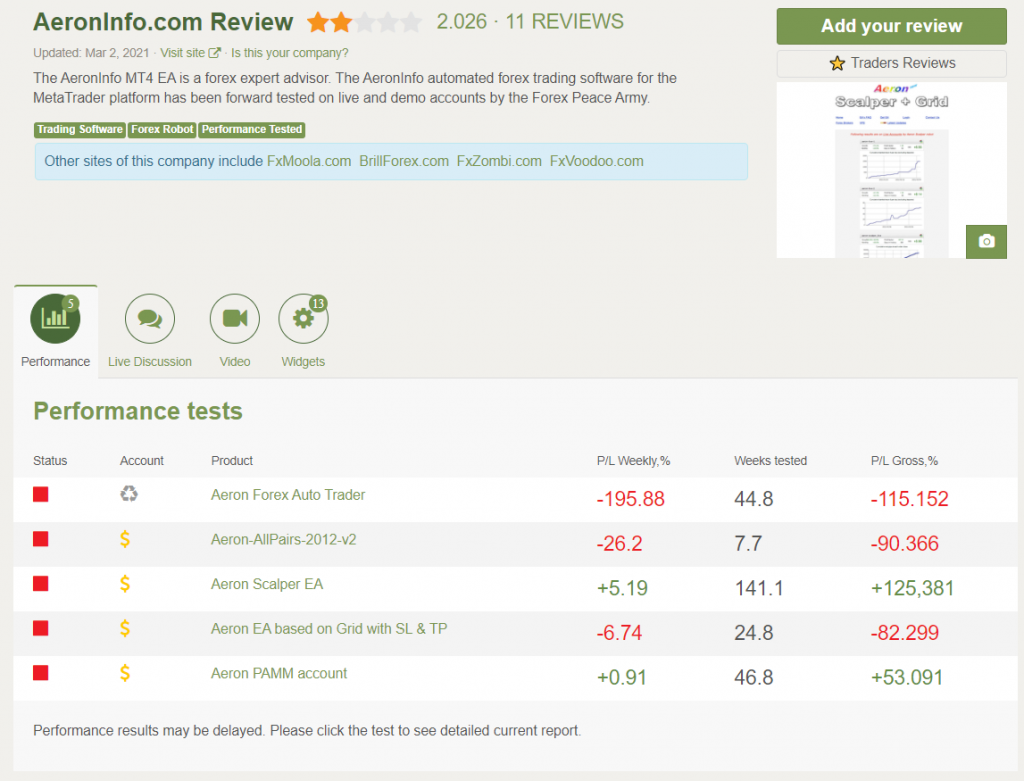

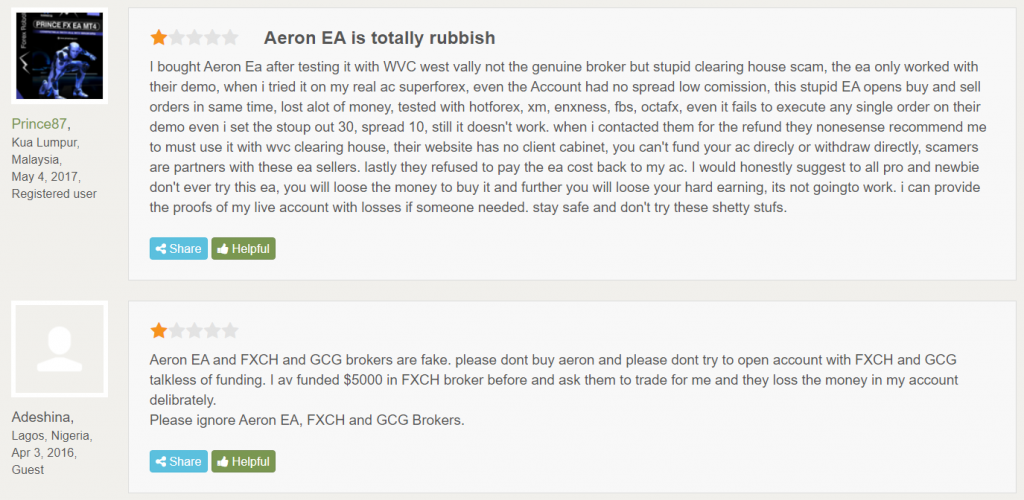

There’s a page of Aeron Scalper plus Grid on Forex Peace Army with 11 reviews and a 2.026 rate based on them. There are five accounts connected with various results. Anyway, all of them were stopped.

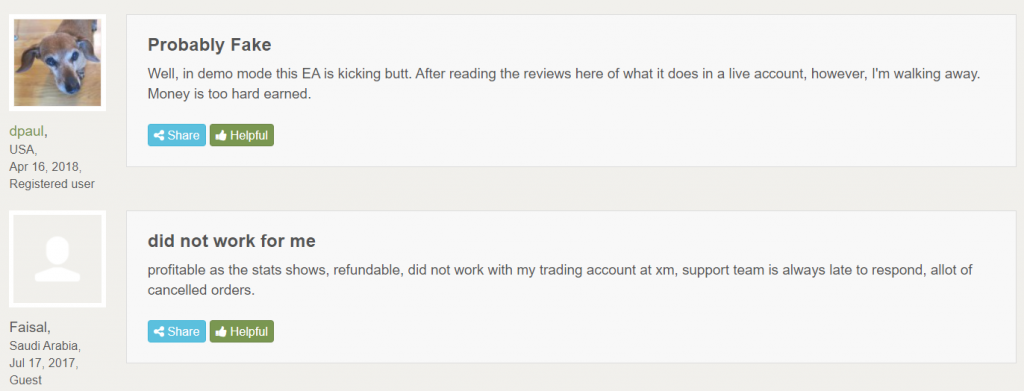

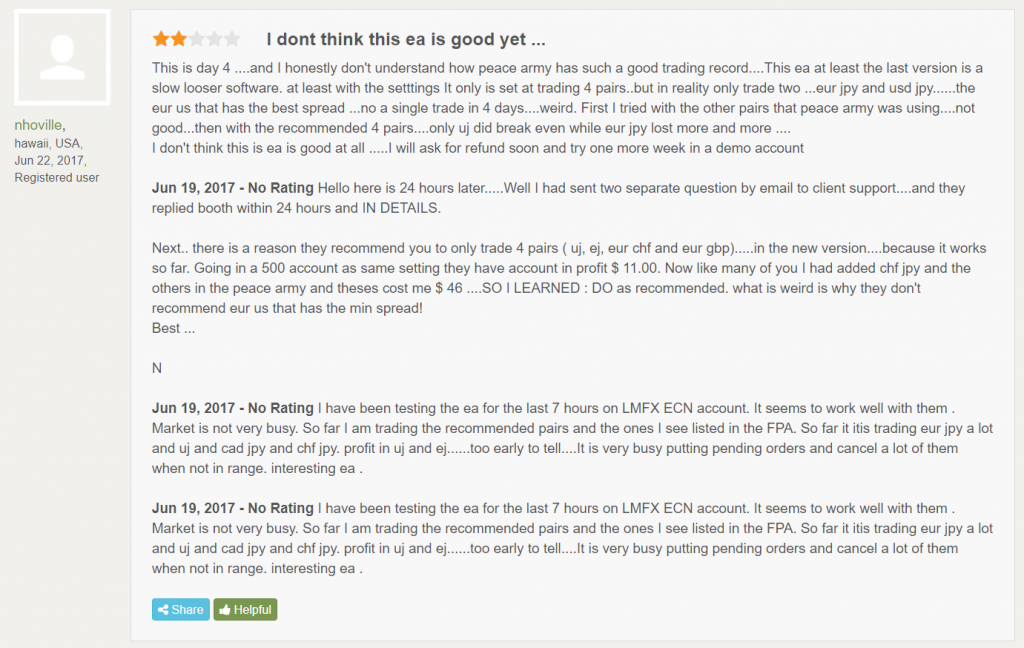

The people couldn’t handle it on real accounts. The problem can be that the robot isn’t profitable on the slow-executed terminals.

The system didn’t frequently trade four years ago.

Many brokers aren’t friendly to aggressive scalpers. So, execution can be delayed in many ways.

Aeron Scalper plus Grid Review Summary

- Strategy – score (3/10)

- Functionality & Features – score (4/10)

- Trading Results – score (6/10)

- Reliability – score (3/10)

- Pricing – score (3/10)

Conclusion

Aeron Scalper plus Grid is a robot that trades quite aggressively using Scalping, Hedging, Grid, and Martingale. There are so many risky strategies on the board. As soon as several Grids are closed with losses, the account will be halved. Trading with Aeron Scalper plus Grid is a risky decision.