Redshift is a new Forex expert advisor that was published on the MQL5 on December 31, 2020. The latest update of the robot was on February 19, 2021, and the current version of the software is 1.80. On the MQL5 page, we are told that the EA was designed for Intraday Trading and is based on Macd Indicator. The developer Marco Solito promises his robot can generate a high rate of winning trades for EURUSD, GBPUSD, USDCAD, AUDUSD, and USD/JPY currency pairs. Is the robot as good as described? Find the answer in our detailed Redshift EA review.

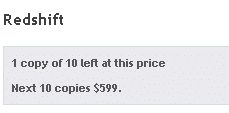

Interested in the software traders can easily buy the EA on the MQL5 market. The dev has an odd ladder pricing system. Although the robot was released less than 3 months ago, the price for every 10 digital copies of the software constantly increases. Now, the robot costs $399. This price is left for only 1 digital copy. We are informed that the next price will be $599 for the next 10 copies of the robot.

In addition to this, traders can opt for 1 month rental of the EA for $399. Setting this price for just one month of renting is madness. Traders are also provided with a Free Demo account to test the robot before purchase and moving on to the real account. It should be noted that the robot was 3379 times demo downloaded. There were 8 activations of the Redshift EA. The robot is not supported by a money-back guarantee.

Redshift EA Trading Strategy

It is based on the work of the MACD indicator. It determines entry points for new trades. The dev points out that the system does not use any risky or dangerous trading approaches like Martingale or Grid. We also know that the expert advisor trades EURUSD, GBPUSD, USDCAD, AUDUSD, and USDJPY on the M15 timeframe.

Redshift EA Features

Let’s talk about how the system works and what key features it covers:

- The robot works fully automatically on the MT4 or MT5 platform

- It promises high win rates

- It was backtested on the real tick data with 99,99% of modeling quality, actual spreads, and additional slippage

- It is based on counter trend and trend trading strategies

- It places SL and TP levels for each open deal

- ECN broker is recommended by the vendor

- A low latency VPS is recommended to run the robot with high execution speed keeping the EA constantly profitable

- The recommended leverage is 1:10 or higher

- The recommended deposit is $100 or more

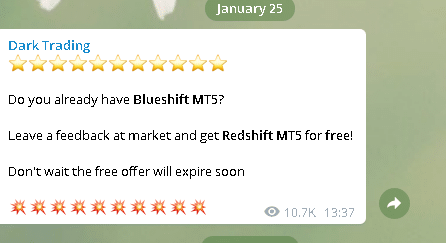

- If we buy the robot and write feedback about it on MQL5 we’ll get a second copy of the EA for Free

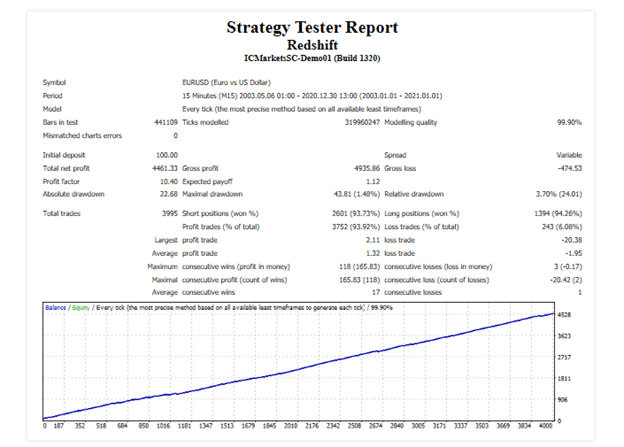

Redshift EA Backtesting Results

We are provided with multiple screenshots of bucketing results of the system. Here we have the backtest result for Redshift conducted throughout May 2003 to December 2020 on the EURUSD currency pair. The modeling quality was 99.90% with variable spreads. It traded on the M15 timeframe EURUSD currency pair. It was deposited at $100. For seventeen years of trading, it has traded 3995 trades and won 93, 72% out of them (3752 trades). With an extremely high-profit factor of 10, 40, the robot generated $4461, 33 of profit. The win rate for both Long and Short trading positions was high (94,26% and 93, 73%).

Redshift EA Live Trading Results

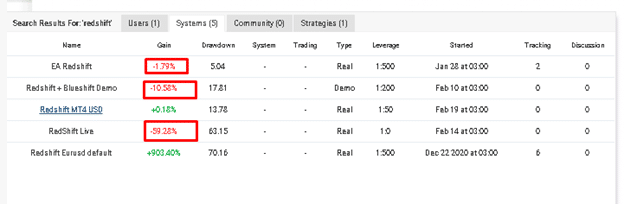

To analyze the trading performance of the EA we had to conduct additional research. As a result, we’ve found 5 trading accounts on myfxbook.com.

As you may see 3 out of 5 trading accounts ended with gain loss ranging between 2% – 60%:

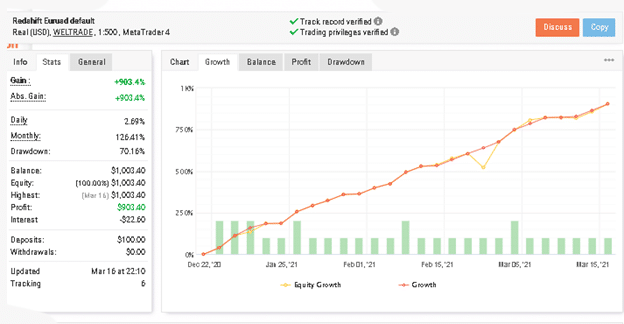

Well, let’s analyze the account that is running on default settings.

This trading account was added on myfxbook before the date it was published on mql5 – on December 22, 2020. It was deposited at $100. This Real USD account works under Weltrade brokerage on the MT4 platform. The leverage is 1:500. Since the date of its activation, the robot has traded 32 trades and all of them were profitable. It has brought $903 of profit. The average win for this account is 14.47 pips/$28.23 while the daily and monthly gains are 2.69% and 126.41%. Although things look quite promising, we do not like the high drawdown of the robot – 70.16%. Usually, we never recommend expert advisors that trade with drawdown that exceeds 30%. It may be too dangerous and risky for any trading account and can easily increase the risk of ruin.

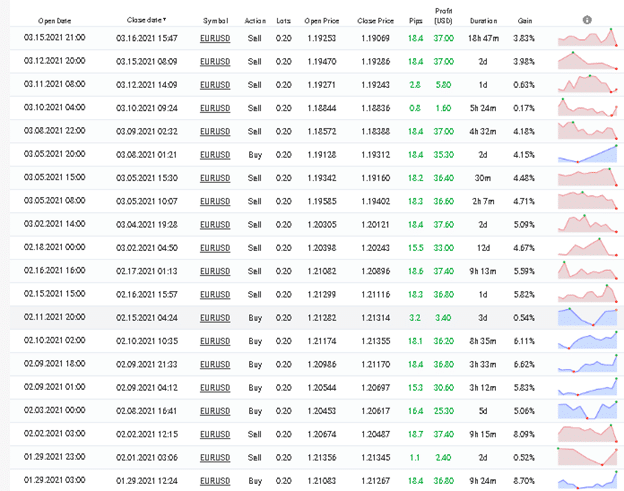

You can see, the EA trades smoothly without Martingale or Grid on the board:

Redshift EA Reputation

The developer and the vendor of his EA is Marco Solito, located in Italy.

Marco has a high 50016 rating among the MQL5 community. He also has a Telegram channel where he publishes hot news and updates of his EAs and indicators.

Unfortunately, there is no information said about the team that stands behind the Redshift robot.

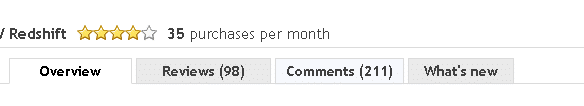

There is an endless wall of fake customer reviews. It seems that most of them were written to get another copy of the EA for free. Marco is an active person on MQL5 responding mostly to every customer review.

Redshift EA Review Summary

Although the Redshift EA shows good trading results, we cannot say with confidence that this is a system we can 100% trust. Lack of vendor transparency is the first drawback of this product. Second, there is no money-back guarantee included. And the least but not the last, pricing is too high as for a recently launched EA. Paying $399 for a 1-month rental is madness. There are a lot of reputable trading tools with much better vendor transparency, lower drawdown, and better trading results, going under $300-$350.

- Strategy – score (5/10)

- Functionality & Features – score (5/10)

- Trading Results – score (6/10)

- Reliability – score (3/10)

- Pricing – score (2/10)