Investing in quality companies with strong moats, high cash-flows, quality predictable cash flow, and strong leadership has proved to be a good way of making money. However, with more than 4,000 public American companies, the challenge is on how to select the best investments. In this report, we will look at the best 5 blue-chip stocks you should buy and hold forever.

Procter & Gamble (PG)

- Industry – Consumer staples

- Market cap – $340 billion.

- Dividend yield – 2.3%

Procter & Gamble is the biggest American manufacturer of fast-moving consumer goods. The company operates its business in five main segments. Its beauty businesses sells well-known brands like Rejoice, Olay, and Head & Shoulders while its grooming business sells Braun, Gillette, and Venus. Its health care segment sells well-known brands like Crest and Oral B while its fabric and home sells Ariel, Downy, and Tide. Finally, the baby, feminine & family care business sells Luvs and Pampers.

In 2019, the company had an annual revenue of more than $70 billion. The beauty division had about $13 billion in revenue while the grooming segment generated more than $6 billion. In health care, the company made $9 billion while the fabric & home care and baby, feminine & family care had $23 billion and $18 billion, respectively.

There are several reasons why investing in Procter & Gamble is ideal for the long-term. First, while the firm operates in a highly-competitive industry, it has a substantial market share because of the popularity of its brands. Second, the company has a strong geographical presence, which helps it to diversify its income. Third, while most of the shopping has moved online, its products are among the most highly-ranked in the most popular platforms. Fourth, the firm is a dividend aristocrat that has raised dividends for decades. This is backed by a strong balance sheet.

P&G’s diapers are ranked high on Amazon

Target Corporation (TGT)

- Industry – Retail

- Market cap – $77 billion

- Dividend yield – 1.76%

The retail industry is going through turmoil, with some of the best-known brands going out of business. In recent years, brands like Sears and JC Penney have all gone burst and many others will follow. This is happening mostly because of the changing behaviours, with most of them now shopping online. Still, we believe that some well-run retailers like Target will not only survive, but, thrive in the future.

In the most recent quarter, Target had comparable sales of about 24.3% and revenue of more than $22.98 billion. Obviously, that unprecedented growth was because of the increased purchases as more people increased their purchases because of the lockdowns. But it also sent a clear picture that Target was a reasonably strong retail brand that is growing in its retail locations but also online. Indeed, its digital sales jumped by almost 200%. Obviously, this growth will slowdown after the pandemic, but it shows just how strong the growth is.

Target has a strong brand but it is also an excellent rewarder of its shareholders. It has not only increased its dividends in the past decades, it has also returned a substantial amount through share repurchases. It also has a strong balance sheet and a strong presence in many locations.

Target total return vs S&P 500

Costco Wholesale (COST)

- Industry – Retail

- Market cap – $151 billion.

- Dividend yield – 0.86%

Costco is another well-known brand in this list. For starters, the company operates large big box wholesale stores across the country. The firm’s revenue has grown from $88 billion in 2011 to more than $166 billion in 2019. At the same time, its profits increased from more than $1.4 billion to more than $4 billion.

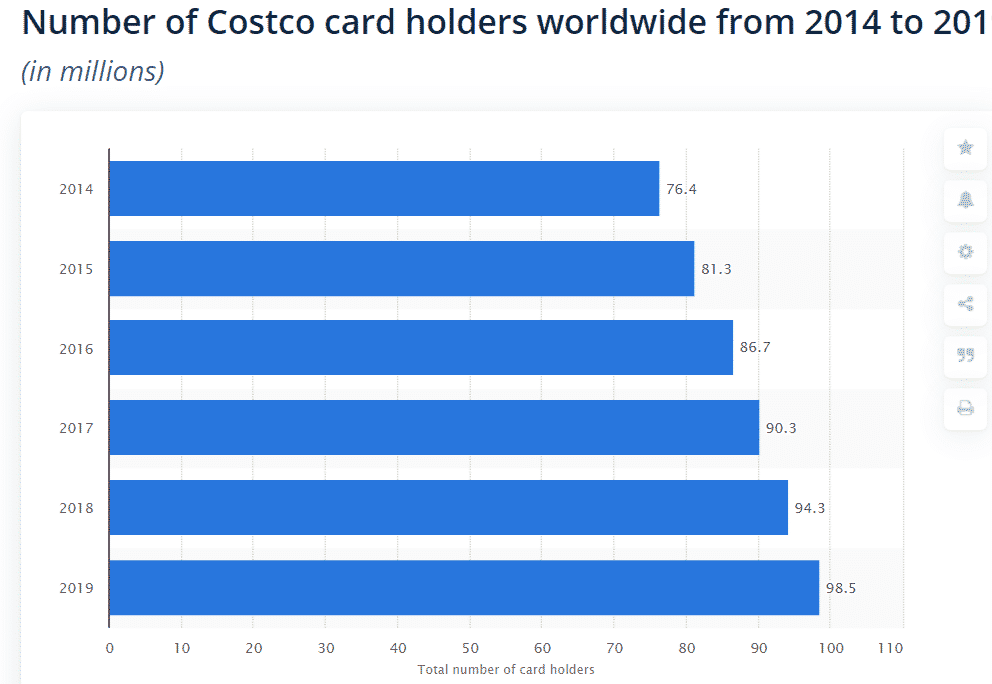

While e-commerce is growing rapidly, Costco is one company that is difficult to compete with. For one, it does not make a substantial amount of money by selling real products. Instead, it makes most of its income from its members. And it has a lot. In the most recent quarter, the firm said it has more than 58.1 million paid households and more than 105.5 million card holders. These people pay at least $60 per year for the privilege of accessing any Costco store.

In addition to its large market base, there are several other reasons why investing in Costco makes sense. For example, the company is expanding rapidly in China, where it is planning to launch more stores. While there are risks, the opportunities for being a successful brand there are enormous. Also, Costco has been actively expanding its margins, which translates to more income attributed to shareholders. Therefore, in Costco, we have a strong American brand with a large moat in the wholesale industry and one that has millions of people paying a fee to access.

Ecolab (ECL)

- Industry – Materials

- Dividend yield – 0.96%

- Market cap – $55 billion

Established in 1923, Ecolab has become one of the most valuable materials company in the United States with a market cap of more than $55 billion. It is also a blue-chip company and dividend aristocrat that has raised dividends for more than two decades.

Ecolab is not a well-known brand in the United States. However, the company is a well-known brand by companies in the water, hygiene, food and beverage, paper, and energy industries. That is why it generates more than $14.6 billion in revenue every year.

The company operates in four segments. Its global industrial generates more than $5.5 billion in revenue and $854 million in operating income. Its global institutional makes more than $5.2 billion in revenue and more than $1 billion in income. Its global energy makes more than $3 billion in revenue and $379 million in income. Finally, its other business had more than $907 million in revenue.

There are several reasons why Ecolab is a good blue-chip stock to own. First, it is a market leader in industries that are hard to get into. Second, it has a long track record of rewarding its shareholders through dividends and buybacks. Third, its revenue comes from around the world, which helps to limit its exposure to one location.

The Home Depot (HD)

- Industry – Retail

- Market cap – $289 billion

- Dividend yield – 2.23%

Home Depot is the biggest home improvement retailer in the world with a market value of more than $289 billion. The company has grown its annual revenue from more than $69 billion in 2011 to more than $110 billion in 2019. This revenue growth is expected to continue into the future as more people focus on staying at home and DIY projects. Its net income has grown from more than $3.3 billion to more than $11 billion. At the same time, its total cash and short-term investments have grown from more than $545 million to more than $14 billion.

Home Depot faces a lot of competition from Lowe’s, Amazon, and Walmart. Still, it has a proven record of delivering spectacular results over decades. It is also a leading dividend aristocrat that has grown its dividends for more than 25 years. Other reasons why Home Depot is a quality blue-chip stock to own are its strong brand, its moat in the DIY industry, and its long record of rewarding its investors.

Final thoughts

Investing in quality blue-chip stocks that have a strong moat in their industries, healthy balance sheets, and strong management teams is an ideal method of growing your income over an extended period of time. In other words, investing in these five stocks will give you a good night sleep. But they are not the only ones. Some of the other notable blue-chip stocks you should consider investing in are Microsoft and Amazon (leaders in their cloud computing), Salesforce (a leader in SAAS), Facebook and Google (leaders in marketing), and Tesla ( leader in electric cars).