The fall of 2021 is around the corner. With stocks trading at all-time highs, it can be relatively difficult to find quality and affordable companies to invest in. In most cases, we always recommend that investors should have a portfolio made up of both fast-growing and income-generating stocks. This article will look at some of the best dividend stocks to invest in in fall 2021.

Royal Dutch Shell

Royal Dutch Shell is one of the largest oil supermajors with a market capitalization of more than $160 billion. It has operations globally and is one of the leading players in the oil and liquified natural gas (LNG) industries.

Shell stock price has struggled in 2021. Between January and August, the stock was up by about 15%. This compared to a sharp rebound of more than 40% of oil prices and the fact that most countries reopened. The Vanguard Energy ETF rose by more than 30% between January and August.

The weakness also happened even after the company published strong half-year results and boosted its share buybacks and dividends. Some analysts believe that the underperformance is mostly because the company was ordered to cut its carbon emissions substantially by 2030. This could see it make relatively unsustainable clean energy investments.

Still, Shell is one of the best dividend stocks to invest in fall of 2021. For one, the company has pledged to increase its dividend by about 4% in the next few years. Second, the firm has a strong and diversified franchise that includes both upstream and midstream operations. Third, the firm managed to shed most of its lagging businesses during the pandemic.

Shell stock price chart

Most importantly, Shell has a dividend yield of about 6% and is the most profitable of all oil supermajors. Its stock is also one of the most undervalued among the supermajors.

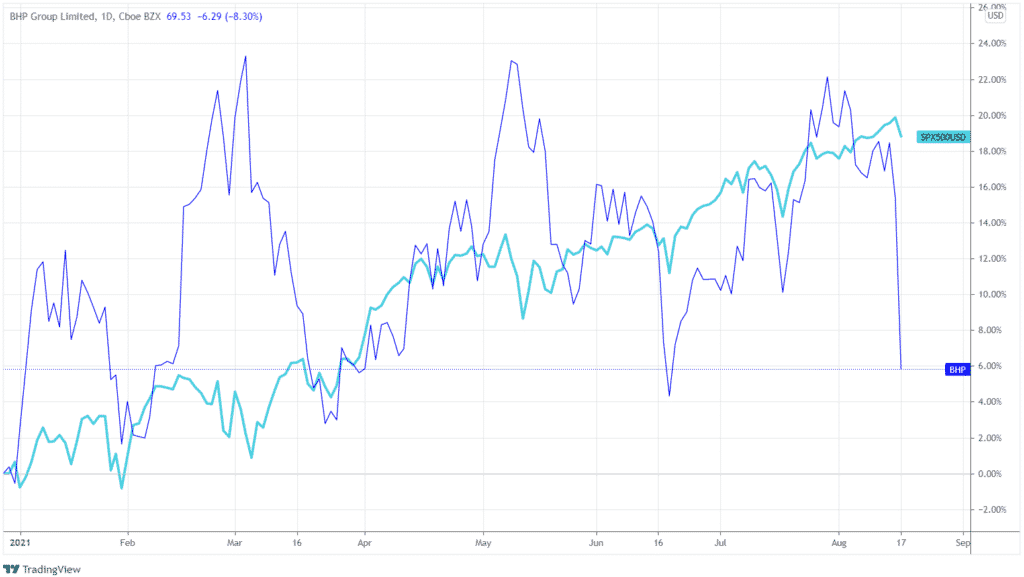

BHP Group (BHP)

BHP Group is the biggest mining company in the world with a market capitalization of more than $162 billion and annual revenue of more than $42 billion. It has made a net income of more than $7.9 billion.

The company has operations around the world, with the biggest ones being in Australia, Canada, China, Peru. Its top commodities are copper, iron ore, nickel, petroleum, coal, and potash.

Commodity prices soared in 2021 as demand for items soared in key countries like China and India. This helped push BHP and other mining giants’ revenue substantially higher in the first half of the year. As a result, most of them, including BHP, decided to hike their dividends and increase their share buybacks.

BHP is a good dividend stock with a key catalyst that could push its stock price higher. For one, there are reports that the company is considering spinning off its coal and petroleum business. By doing so, it will remain a major metal mining company with a lower carbon footprint.

As a result, it will become more attractive to investors who find it toxic because of its carbon emissions. The spin-off will also help it make more money to boost its dividends.

BHP stock price vs S&P 500 chart

BHP Group has a dividend yield of about 4% and a payout ratio of 77%. This means that it can cover its payout comfortably with its current free cash flow. Other mining dividend stocks you can consider are Rio Tinto, Anglo American, and Glencore.

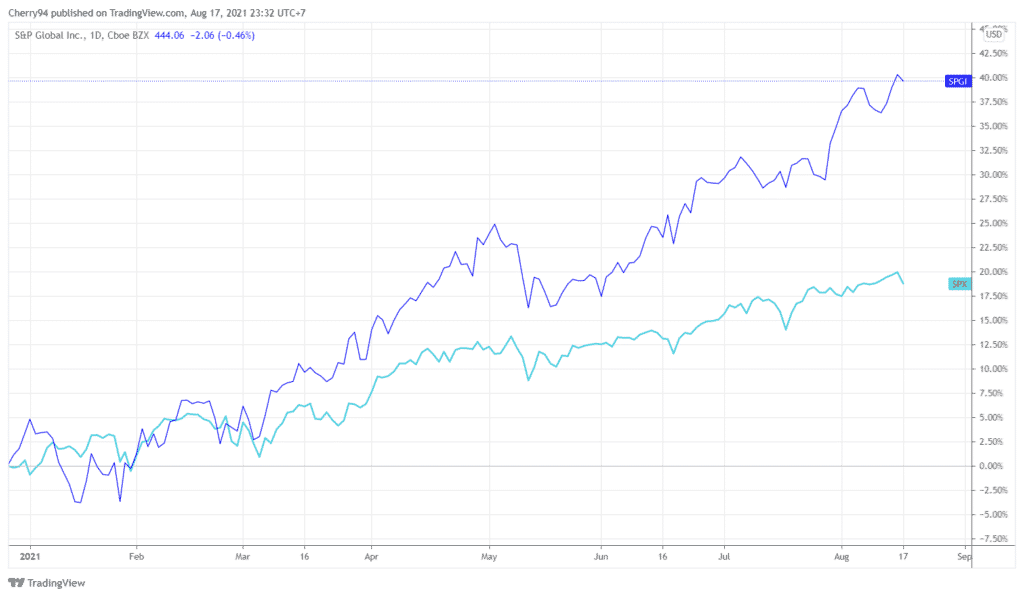

S&P Global (SPGI)

S&P Global is a leading financial technology company with a market capitalization of more than $106 billion and annual revenue of more than $7.2 billion.

S&P Global is best known for the S&P 500 index, which is one of the leading indices in the world. Still, the firm is significantly broader than the index. It operates in several segments, including ratings, market intelligence, platts, and indices.

Its ratings business provides credit ratings for companies and countries. As a result, investors use this information to determine the state of these firms. Its market intelligence provides customers with key information on different sectors while its platts business is in the energy sector.

S&P 500 vs S&P Global

S&P Global is in the process of acquiring IHS Markit, a leading London-based provider of key financial data. The company has one of the most stable businesses in finance since its clients are governments and large financial companies. It is also a leading dividend aristocrat that has increased its dividend in the past 24 years.

Intercontinental Exchange (ICE)

ICE Group is one of the largest financial companies that most people have never heard about. Yet it is one of the most important firms in the world. It owns key companies like the New York Stock Exchange (NYSE) and 11 exchanges internationally. Its business has segments like exchanges, mortgage technology, and fixed income and data solutions.

ICE makes its money in several ways. For example, it makes funds from all companies listed in its exchanges. It also provides data, clearinghouses, and origination services. As a result, its annual profit has grown substantially to more than $6 billion, while its total profit has risen to more than $2 billion. It has a dividend yield of about 1% and a payout ratio of 27%.

Therefore, it makes a good investment for several reasons. For one, it has a duopoly with Nasdaq, meaning that they cannot be disrupted. Second, the firm has a reliable business with excellent recurring revenue. Its dividend is also reasonably safe.

As such, with the number of companies going public rising, and with the volume of stocks trading rising, ICE will continue doing well. This makes it an ideal dividend stock to invest in.

Other dividend stocks

There are hundreds of other dividend stocks that you should consider investing in during the fall season. Some of the best you can consider are Verizon, Comcast, ExxonMobil, BP, and Moody’s. These are companies with strong businesses and higher yields.