ZuluTrade is a copy and online social trading platform. Leon Yohai founded this firm in 2007, and it has clients from 183 countries of the world. Plus, it accepts over 50 brokers worldwide. Initially, Yohai wanted to create software that allows him to copy trades from the best traders. With this idea, ZuluTrade became possible.

Pros

- Signal providers earn commissions from the platform.

- Low trading commissions for profit-sharing account investors.

- No hidden fees.

- Well automated.

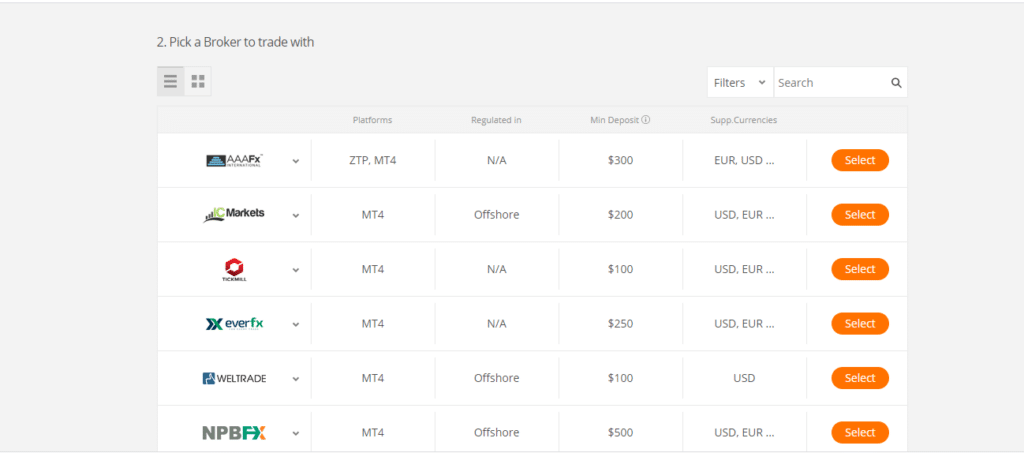

- More than 25 brokers to choose from.

- Unique copy trading features.

- Ability to help you select the ideal traders using ZuluRank.

- More than 10,000 expert advisors to copy strategies from.

- Avoid risk with real-time information about traders using the automator.

- Interact with other traders through the social platform.

- Its copy trading services abide by laws issued by established regulators in Europe. For example, the HCMC in Greece.

- Available in many countries.

- Adequate trading features. For instance, FX tools, calendars, social charts, among others.

Cons

- Minimum trading deposit varies depending on the broker.

- The assets you trade as an investor depends on the broker you choose.

- It’s not easy to become a signal provider.

- Commission incurs per trade on classic account investors.

- Overnight swap fees.

- 25% commission of the profits made using the profit-sharing account.

- $30 monthly fee for profit-sharing account traders

- It offers only three base currencies.

- Only MT4 and its trading platforms inhibit unique copy trading features.

- Pips vary depending on the broker and the asset pair.

- No compensation for the classic account traders.

- It offers few trading instruments compared to other platforms.

ZuluTrade bridges the gap between important money market data and trade execution by converting the recommendations of the best traders and the most talented traders around the world. Moreover, this platform allows traders to give feedback and exchange trading ideas at the same time. He can audit global traders and share his strategy with investors interested in their trading approach. Thus, it allows traders to conduct their trades into their live accounts with their chosen broker.

The platform does not operate fully as a broker but as a social trading platform that connects expert traders to a pool of liquidity providers to share their trading ideas, make followers, and earn commissions. The platform launched in 2007 as software designed to bridge the gap between valuable information about the financial markets and the ease of execution of trades.

Leon Yohai, the founder’s goal, was to make FX trading accessible and easy for everyone. His vision still proves to be the company’s main driving force as it targets to become the world’s largest social trading community in the world.

Currently, the company offers social trading services in more than 192 nations and integrates with multiple reputable brokers such as OANDA. The company provides more than 25 brokers to connect with. Still, advocates copy traders not using this trading platform for AAAFX as it owns and fully integrates with the Kingston-based brokerage company.

Zulutrade’s main office operates in Athens, Greece, and holds several trading licenses. The Hellenic Capital Market Commission (HCMC) in Greece certified ZuluTrade with a copy trading license for brokers in the EU.

The social trading company also complies with the MiFID laws as it holds an EU portfolio management license awarded in 2014. In addition, its regulation framework solidifies further as its 20+ brokers abide by their respective jurisdictions.

The platform allows expert traders to share strategies with investors through brokers of the following instruments; forex pairs, CFDs, cryptocurrencies, indices like Nasdaq, among others.

As reiterated in this review, traders or investors can join the platform using the following:

- Real account

- Demo account

The demo account simulates the real trading environment and helps the trader garner some real account skills.

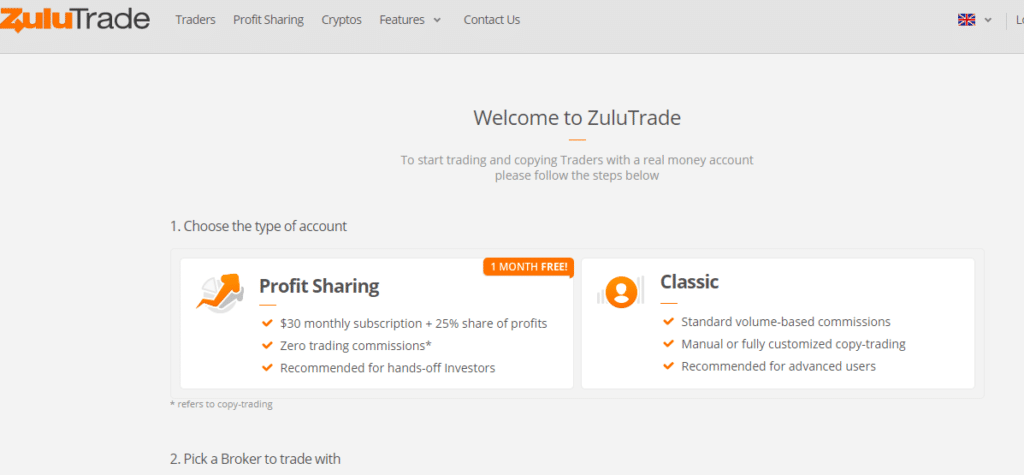

However, the platform offers two real accounts:

- The classic account

- The profit-sharing account

Both accounts come in handy when executing copy trading services, but the trading conditions vary. For instance, the classic account offers investors manual or semi-automated copy trading services while the profit-sharing account executes the copy trading strategies automatically.

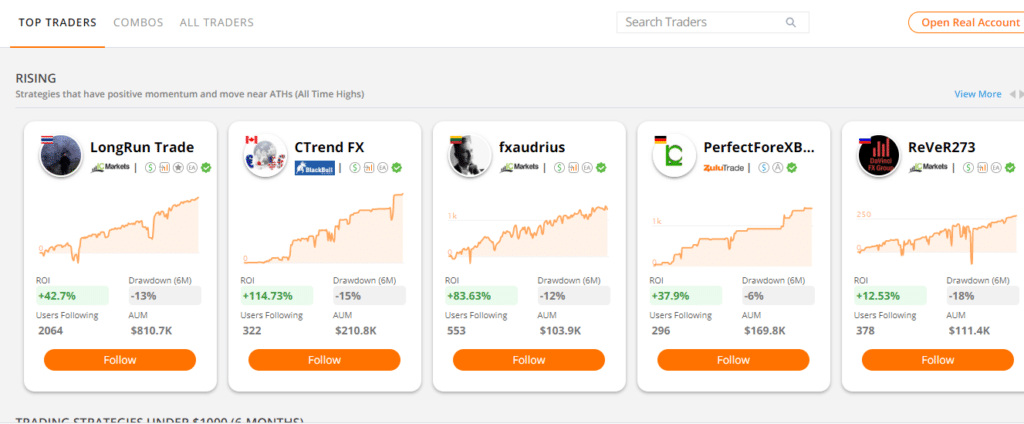

Veteran traders apply at ZuluTranders as signal providers to share their strategies with investors or other traders. The success of an expert trader’s strategy determines the commission they make at ZuluTrade. The number of investors or followers and login frequencies of the EA trader attribute to the total earnings he recoups at ZuluTrade. ZuluRank also uses the data to rank the signal providers.

Generally, at ZuluTrade, the investors include:

- Small investors — inexperienced traders, copy trading and following professional traders.

- Big investors — targeting top signal providers to make huge returns. They invest large amounts of money as well.

However, for any trader’s account to link with this platform, the account balance should be above $100. The minimum deposit depends on the broker, but most brokers allow a minimum deposit of $300. For starters, ZuluTrade’s broker AAAFX accepts $300 as the minimum deposit. Other trading conditions like the leverage, lot size, and the minimum floating spread, depending on the broker the investor or trader uses.

In addition, it allows traders and investors to fund their accounts through:

- Paypal

- Bank wire transfers

- ZuluTrade MasterCard

Regulation

- Regulated in the EU by the HCMC of Greece (holds a copy trading license from the agency)

- Holds an EU portfolio management license issued in 2014

- Complies with the MiFID trading laws

- Affiliated brokers hold trading licenses from top-tier agencies

Pros

- Well-regulated

- Over ten years offering copy trading services

- Available in the US through OANDA

Cons

- A few of its brokers fall under no regulation

Account Types

As noted, trading account types include:

- The profit-sharing account

- Classic account

Profit-sharing account conditions

- $30 monthly subscription + 25% share of profits

Traders/investors incur a $30 monthly subscription fee, and 25% of their profit earnings goes to the signal providers and ZuluTrade.

- Zero trading commissions

- Recommended for shadow investors/traders

Classic account conditions

- Standard volume-based commissions

- Offers manual or automated copy trading

- Recommended for active traders/investors

Comparisons

| Profit-sharing account | Classic account |

| Investors incur costs only if the strategy successes Low or no commissions Fully automated $30 per month as subscription fee Ability to follow combos (multiple traders) | Investors incur costs after every strategy they replicate Standard commissions Manual and semi-automated No subscription Inability to follow combos |

How to open a real ZuluTrade account?

Creating an account involves several steps:

Step 1. Log into the website and choose “make a registration”.

Step 2. Choose the account you prefer and the broker.

Step 3. The broker inquires if you already have an account with it or not and redirects you to fill an online form depending on each case.

Step 4. If submission goes well, you will receive login credentials in two or three business days.

Step 5. Fund the account through the broker after all the KYC documents get approved by the company.

Step 6. Start trading and maintain your balance above $100 for efficient connection.

Note: minimum deposit depends on the broker and other trading parameters.

Fees and Commissions

Fees incurred by an investor majorly depend on the account type. A classic investor will incur standard commissions and fees after copying strategies, while on the other hand, ZuluTrade waives those charges for the profit-sharing investor.

However, the same investors still pay monthly subscriptions of $30 and face a 25% cut-off on their earnings to cushion themselves from copy trade fees and overnight swaps. ZuluTrade alludes that the broker you trade with determines fees on markup spreads, withdrawal, deposit, and other trading conditions.

The only parameter the social trading platform emphasizes suggests that every investor’s account balance must be $100 and above.

Payment options

Brokers also determine the payment options. If you choose to fund the ZuluTrade account through your brokerage account, the payment options will depend on the accepted methods by the broker. However, it accepts direct deposits to its account via:

- ZuluTrade Mastercard

- Paypal

- Bank wire transfers

N/B investors and signal providers receive payment and make deposits depending on the broker they use. However, the platform offers direct transactions through the listed channel.

Available Markets

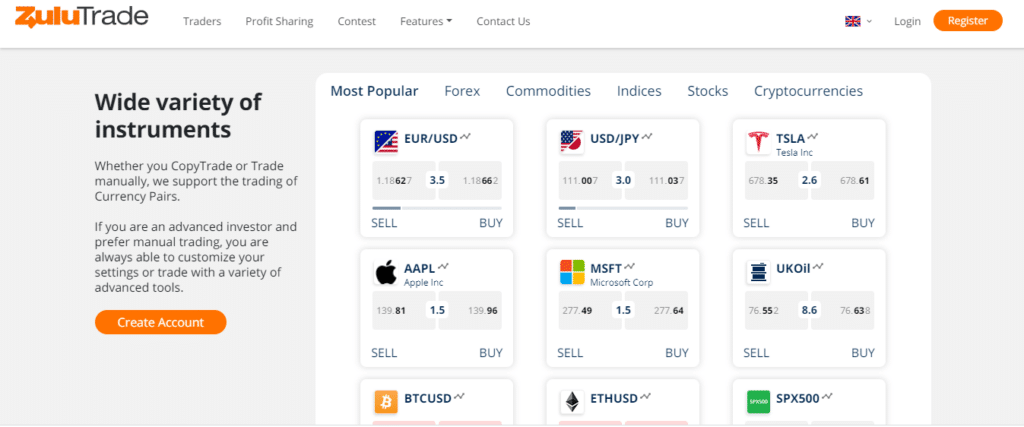

ZuluTrade offers investors copy trading services on forex pairs, commodities, indices, stocks, and recently cryptocurrencies.

Forex

Signal providers create strategies for investors on major currency pairs. ZuluTrade offers copy trading of nine major currency pairs against three main base currencies, USD, EUR, and GBP.

Indices & stocks

Copy-trading of indices and stocks occurs on eight indices and several stocks of the world’s largest companies. Some of the conglomerate stocks traded on ZuluTrade include:

- TSLA

- AAPL

- AMZN

- MSFT, among others, and some of the indices include bund, Nas100, etc.

Commodities

Physical goods traded on ZuluTrade consist of metals and energies. In total, only five commodities traded on the social platform. They include:

- XAG/USD

- UKoil

- Copper

- NGAS

- USOilSpot

Cryptocurrencies

Major digital currencies copy trade on ZuluTrade against the US dollar. The platform offers nine crypto USD pairs. They include:

- BTC/USD

- LTC/USD

- XRP/USD

- BCH/USD

- ETC/USD

- XMR/USD

- ADA/USD

- NEO/BTC

Trading Platforms

ZuluTrade platforms depend on platforms offered by its supported brokers. However, it advises investors for MT4 as it integrates fully with its copy trading features.

MetaTrader 4 platform

An external real or demo MT4 can be linked to a trader’s account using ZuluTrade. This platform is considered the most popular platform around the world, chosen and preferred by traders. This is because this platform has great features and functionality.

With ZuluTrade, when you connect an external demo or a live MT4 platform, the trader account becomes “read-only,” and any trading activity on the MT4 account will be copied to the ZuluTrade account. Make sure when choosing this platform that the broker you choose is compatible with the trader’s account. You can find this through the “settings” tab of the trader’s account.

Besides, ZuluTrade offers trading platforms that allow investors to manually or automatically execute trades as mobile applications. EA traders and investors can access them on the Appstore.

APPSTORE App and Android App

- Allows users to open, close, and edit traded positions

- Executes copied strategies automatically without monitoring the market

- Diversifies risk among multiple currency pairs and strategies

- Adjust the trade size you want your trader to trade

- Manually adjust stops and limits

Note: the features are similar on both the android app and the Appstore app.

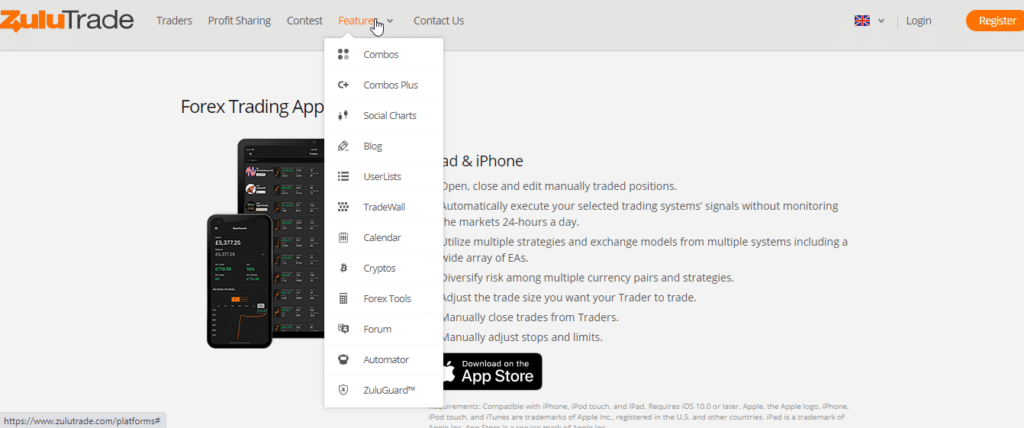

Features

The platform offers diverse copy trading features to investors and signal providers:

- Combos — allow investors to follow multiple expert traders.

- Social charts — offers traders and investors a platform to interact and share ideas.

- Blog — publishes the most trending news about the financial markets.

- TradeWall — displays the opened positions.

- Calendar — feeds investors and traders with upcoming events.

- Forex tools — include tools such as calculators that aid in the calculation of pips.

- Automator — offers fast execution speeds and suits both beginners and professionals.

- ZuluGuard — shields investors and traders from losses.

- ZuluRank — an unbiased platform that ranks expert traders for investors to follow.

Education

Trading tutorials offered at ZuluTrade include the following:

- Video tutorials — helps investors learn how to copy and execute trades and harness fundamental trading information.

- Trading guides — they provide investors and traders with descriptive information about copy trading.

- Social charts — traders and investors pass information through each other, and in the long run, they all learn from one another.

Customer Support

The customer support platform runs 24/5. Traders and investors get through to a customer via the following:

- Phone

- Chat

Review Summary

The trading platform helps investors mitigate losses experienced by traders when trading financial markets. Its features offer efficient copy trading services and best suit beginners and professional traders.

Traders either select a fully automated account or a manual and semi-automated account to copy trade markets such as FX, indices, stocks, commodities, and cryptocurrencies. Moreover, ZuluTrade is secure as it holds copy trading licenses from the EU and abides by the laws set by MiFID.