XM is a multi-regulated CFDs broker specializing in providing services through MetaTrader 4 and MetaTrader 5 software. It is famous for its human-based approach to clients from 196 countries. Overall, this broker offers various trading and education support, with promotions at attracting traders’ attention.

Pros

- Multi regulated broker

- Lots of available trading instruments from forex, stocks, indices, commodities, cryptocurrencies, etc

- Provides trading opportunity through widely-used MT4 and MT5 platform

- Lots of research and education materials to keep clients profitable

Cons

- Europe clients may trade only CFDs, forex, and crypto products

- Does not provide cTrader platform

- Weak password protection since you cannot use special characters when entering

XM Group is a group of brokers from the mother company Trading Point of Financial Instrument Pty Ltd. It started the business operation in 2009 and got regulations from the Cyprus Securities and Exchange Commission (CySec 120/10).

After that, Trading Point of Financial Instrument Pty Ltd. launched in 2015 for regulation from ASIC. Finally, among other components of the group, XM Global started the operation in 2017.

Currently, the company provides service in 196 countries and over 1.5 million clients. Its excellent customer service and personalized approach create faith in the company in this industry.

Regulation

XM holds regulation from multiple authorities from leading places. During our review, we have found this broker and its subsidiaries as regulated by these authorities:

- Trading Point of Financial Instruments Ltd. — authorized by CySEC (Cyprus) registration no 120/10

- Trading Point of Financial Instruments Pty Ltd. — authorized by ASIC (Australia) registration no 443670

- Trading Point MENA Ltd. — authorized by Dubai Financial Services Authority (DFSA) reference No. F003484

- Trading Point of Financial Instruments UK Ltd. — authorized by FCA (UK) registration No.705428

- XM Global Ltd. — authorized by IFSC (Belize) registration no. IFSC/60/354/TS/19

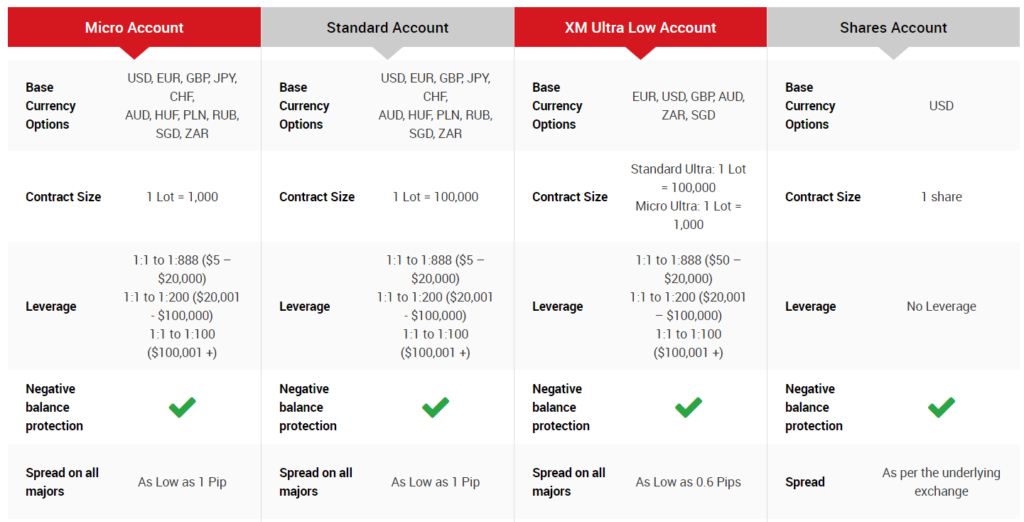

Account Types

XM tried to attract investors from beginner to advance and focused on providing account types covering all types of traders. Moreover, besides CFDs trading, XM provides particular account types only for share traders.

Let’s see details of the XM account types.

XM micro account

Micro account is perfect for every new trader who just started trading and doesn’t want to join the standard leverage.

- Base currency options: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size 1 lot = 1,000

- Leverage: 1:1 to 1:888

- Spread: minimum 1 pip

- Minimum trade volume: 0.1 lots

- Hedging: yes

- Minimum deposit: 5$

XM standard account

XM standard accounts are suitable for making profits and capable of trading with a good money management system. This account has all facilities that a full-time forex trader needs:

- Base currency options: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size 1 lot = 100,000

- Leverage: 1:1 to 1:888

- Spread: minimum 1 pip

- Minimum trade volume: 0.01 lots

- Hedging: yes

- Minimum deposit: 5$

XM ultra low account

For a professional or full-time trader, there is no alternative to a low-cost environment of trading. Therefore, XM introduced an ultra-low account to catch traders’ sentiment who look for trading with a minimum fee.

- Base currency options: USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR

- Contract size1 lot = 100,000

- Leverage: 1:1 to 1:888

- Spread: minimum 0.6 pip

- Minimum trade volume: 0.01 lots

- Hedging: yes

- Minimum deposit: 50$

XM shares account

XM shares account is a particular account for those who look for share trading only. Many instruments in shares and investors can take part in share trading besides earning money from forex or CFDs.

- Base currency options: USD

- Contract size 1 share

- Leverage: no

- Spread: as per the underlying exchange

- Minimum trade volume: 1 share

- Hedging: no

- Minimum deposit: $10,000

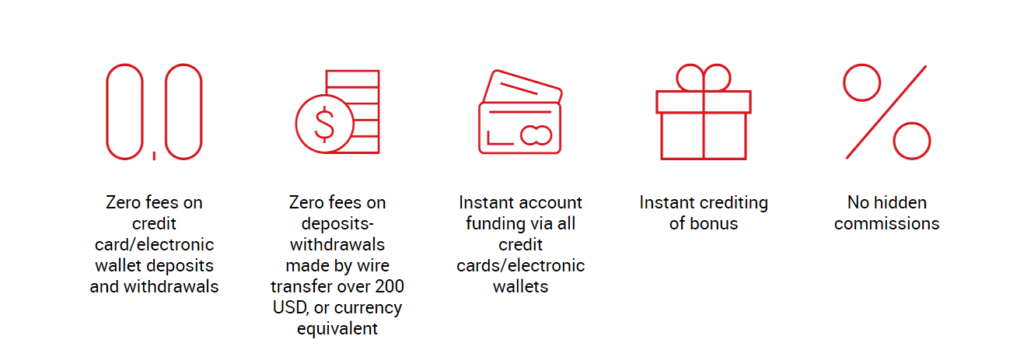

Fees and Commissions

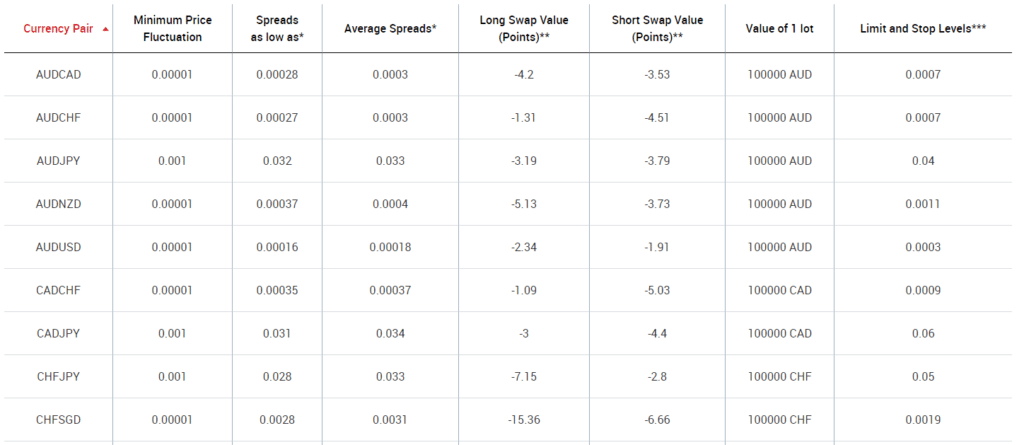

Like other financial institutions and interbank liquidity, XM offers floating spread to all instruments. However, a fixed spread is usually higher than the floating spread, as mentioned on XM’s website.

The significant fee that a trader should pay is the spread, and based on our findings, XM offers a floating spread as low as 0.6 pips. Therefore, XM’s fee structure is average compared to other brokers, and there is no extra commission to trade.

Although there is no commission in trading, there is an overnight fee applicable to most of the trading instruments based on +0.5% for a long position and -1.5% for a short position.

Among non-trading fees, XM covers all deposit and withdrawal transfer fees for payments from the following payment methods:

- Neteller

- Skrill

- Credit cards: including VISA, VISA Electron, MasterCard, Maestro, and China UnionPay

- Bank transfer: above $200

Payment options

XM has both electronic and bank payment opportunities for traders. However, to make a deposit, you have to follow some simple steps after opening the account.

XM deposit options

To make a deposit, log in to your XM account using the user ID and password and click on deposit from the upper section of the page.

Later on, all deposit options will appear as shown in the image below:

- Credit/debit cards

- Neteller

- Skrill

- WebMoney

- Perfect Money

- SticPay

- Bank Transfer

- VLOAD

XM withdrawal method

The deposit and withdrawal method should be the same for making transactions with XM. To initiate a withdrawal, you have to login to the website and click on withdraw from the upper right corner.

Other withdrawal methods are mentioned below:

- Neteller

- Skrill

- WebMoney

- International Wire Transfer

- Perfect Money

Available Markets

XM provides trading opportunities in indices, forex, commodities, crypto, and shares. Therefore, the company has a strong position based on the availability of instruments and diversification opportunities.

Forex

- More than 50 trading instruments in majors, minor, and exotic pairs through 16 trading platforms.

- Leverage is a maximum of 1:888 for all forex pairs.

Stock CFDs

- Besides share trading accounts, XM offers CFDs trading in stocks so that investors can make money from both buying and selling.

- XM provides the opportunity of trading stocks from more than 17 countries.

Commodities

- XM offers commodities trading through most of its trading platforms.

- There are almost 8-10 commodities for trading, including wheat, cocoa, coffee, corn, sugar, etc.

Equity indices

- Equity indices show the market sentiment and work as an influential price director.

- Besides, you can trade equity indices through XM brokers that include AUS200, EU50, FRA40, GER30, etc.

Precious metals

- XM offers trading in silver and gold from the precious metals, futures CFDs in platinum, and palladium.

- Spreads in gold are as low as 0.3, and for silver, it is 0.03.

Energies

- XM allows trading in energies like crude oil, brent oil, and natural gas.

Shares

- You can buy shares from the USA, the UK, and Germany.

- You can buy many shares directly and without any CFD through this broker.

Cryptocurrencies

- XM offers cryptocurrency CFDs trading where investors can buy and sell cryptocurrencies like Bitcoin, Bitcoin cash, Litecoin, etc.

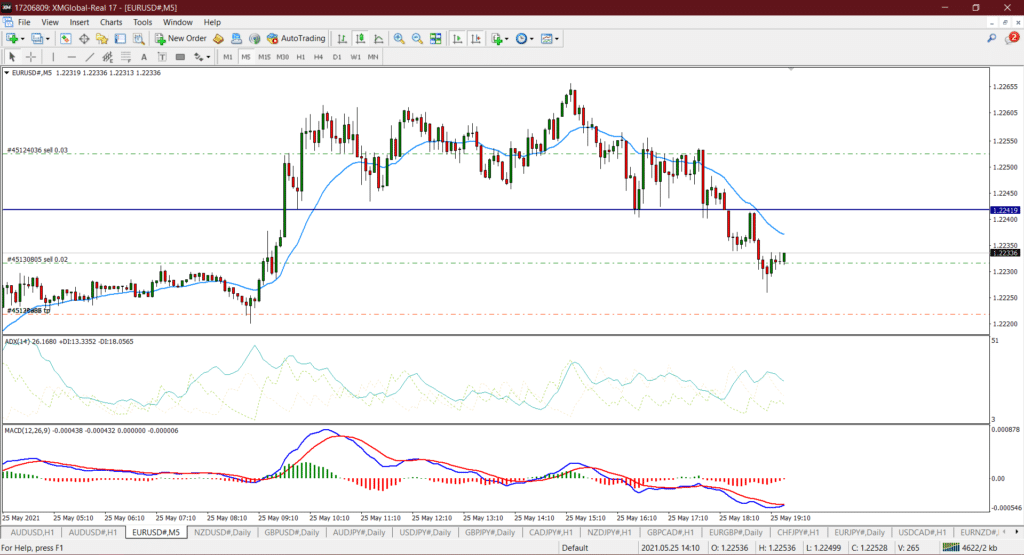

Trading Platforms

XM tried to catch all traders to introduce most platforms suitable for Mac, PC, mobile, and tab.

XM MT4 platform

It allows trading in a low-cost environment with a maximum of 1:888 leverage. In addition, this platform is easily accessible from both Windows and Mac.

Other functions are mentioned below:

- Over 1000 instruments, including forex, CFDs, and futures

- 1 single login access to 8 platforms

- Spreads as low as 0.6 pips

- Full EA functionality

- 1 click trading

- Technical analysis tools with 50 indicators and charting tools

- 3 chart types

- Micro lot accounts (optional)

- Hedging allowed

- VPS functionality

XM MT5 platform

MT5 is an advanced platform where traders can get the maximum benefit from the market. Moreover, here is the maximum number of timeframes and trading indicators with the opportunity of trading with an EA using the MQL5 languages:

- Over 1000 instruments, including stock CFDs, stock indices CFDs, forex, CFDs on precious metals, and CFDs on energies

- 1 single login to 7 platforms

- Spreads as low as 0.6 pips

- Full EA functionality

- One-click trading

- All order types supported

- Over 80 technical analysis objects

- Market depth of latest price quotes

- Hedging allowed

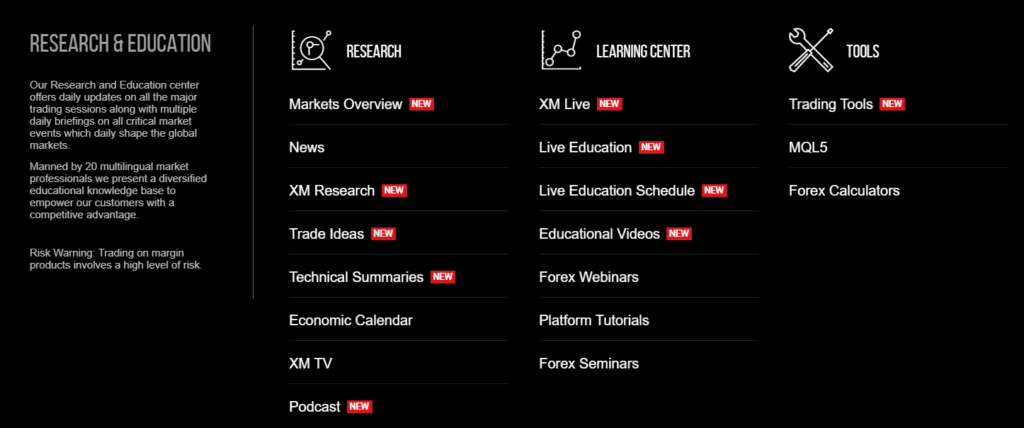

Education

XM focused on learning from their clients to take enormous steps so that every trader remains profitable. We have found that XM covers most of the communication and learning methods to keep their traders profitable during our review.

In the below image, we can see what XM provides to their client to make them consistently profitable traders.

Customer Support

XM website is available in 23 languages. Moreover, its FAQs are enriched with a lot of information for the broker.

However, the best way to contact XM is through their live chat that remains active 24/7. Moreover, the live chat has a multi-language function so that investors can quickly speak about their problems.

Based on our findings, we have found XM customer support satisfactory and practical.

Review Summary

In summary, we have found XM is a reliable forex broker that allows numerous trading instruments from forex, stocks, indices, cryptos, etc. Based on the safety of funds, XM is trustable as it uses tier 1 liquidity from multiple world-class liquidity providers. However, its drawback is that it does not offer trading in cTrader and other platforms except MT4 and MT5.