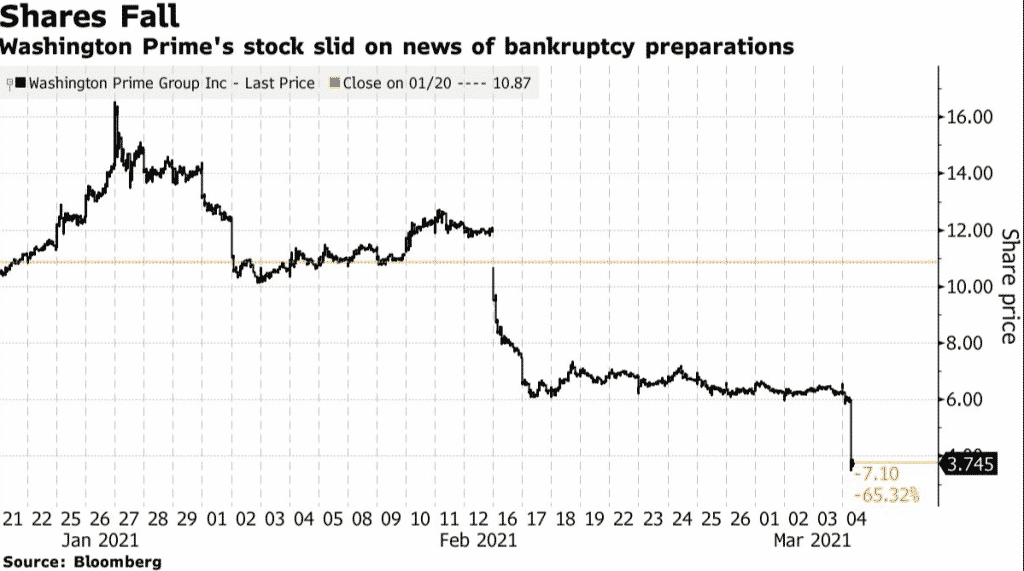

Mall owner Washington Prime Group shares fell as much as 63% as news emerged it is preparing a bankruptcy filing, reports Bloomberg. The filing comes after talks between the real estate investment trust and creditors faltered during the 30-day grace period set for negotiations.

The plan by Washington Prime to file for Chapter 11 protection is not final and could change if negotiations evolve or the company’s grace period extended.

Washington Prime has been working with advisers from law firm Kirkland & Ellis and investment bank Guggenheim to handle its loan maturities.

In December, the real estate investment trust attempted to convert about $260 million worth of its unsecured bonds into $175 million of preferred equity by a new special purpose entity.

The company’s rent collection rate fell to 52% during the second quarter of 2020 but improved to about 87% in the third quarter.

Washington Prime Stock is currently declining. WPG: NYSE is down 17.32%