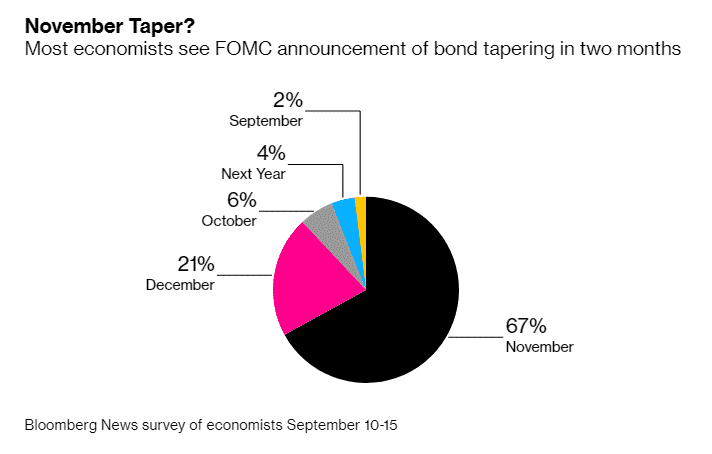

(Bloomberg) Two-thirds of 52 economists in a survey predict that the Federal Reserve will announce a bond tapering on the November 2-3 meeting. The prediction is earlier than expected in a July survey when the economists projected the decision to be made in December.

Fig: Predictions of Bond Taper by Fed

The economists expect the Fed to hold interest rates near zero in 2022 and then deliver a two quarter-point hike by the end of 2023. Three more increases are projected in 2024 to take the rate to 1.5% by the end of the year.

The Fed is expected to meet next week, in which the tapering question is expected to dominate talks. The central bank is expected to keep the $120 billion asset purchases intact.

Some regional Fed chiefs are still concerned about an uptick in prices, with calls for tapering in September. The fresh outbreak of Delta variant and cooling inflation is expected to prompt the Fed to push tapering to November or December.

The central bank is expected to project a 3.9% inflation for 2021, with price pressures cooling to 2.2% in 2022 and 2023. Unemployment is expected to hit a pre-pandemic low of 3.5% by 2023.

SPY is down -0.51%, DXY is up +0.13%.