- Bitcoin powers through $30,000

- Dollar weakness offers a reprieve to cryptocurrencies

- Elon Musk reiterates Dogecoin payment credentials

Cryptocurrencies are on the front foot at the start of the week amid a buildup in buying pressure. Bitcoin leads the bounce back, powering through the pivotal $30,000 level as Ethereum also eyes the elusive $2,000 level. Dogecoin is another coin showing signs of edging higher, supported by a string of positive developments.

Dollar weakness

The rally in the cryptocurrency market is being fuelled by the dollar remaining under pressure as its correction from two-decade highs gathers steam. The greenback has been under pressure despite the US Federal Reserve hinting at accelerated rate hikes at its latest meeting.

The market expects the federal funds rate to range between 2.5% and 2.75% before year-end from the current range of 0.75% to 1%. The prospect of a 50-basis point hike at the next meeting was expected to fuel further dollar strength. However, that has not been the case. Treasury yields have also retreated in recent days, all but fuelling dollar weakness.

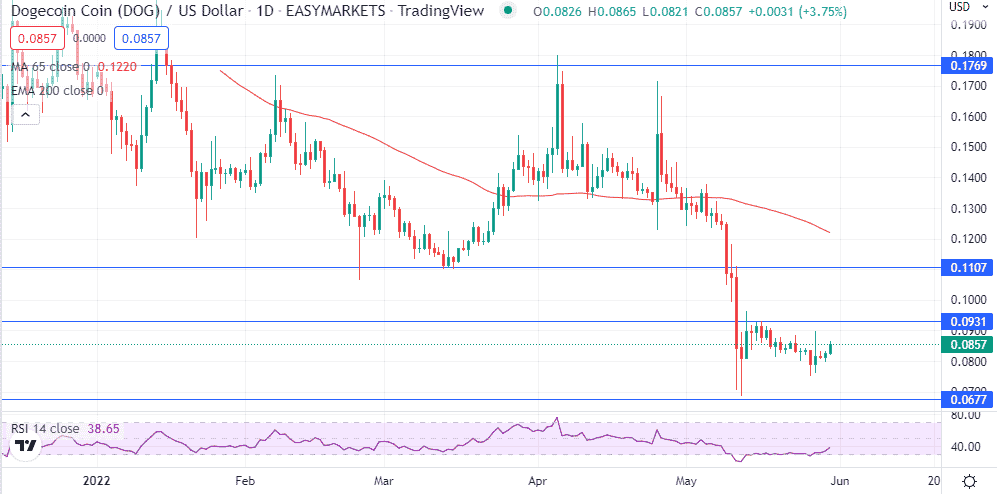

DOGUSD technical analysis

The dollar weakness is one factor that offers support for the DOGUSD to bounce back from all-time lows near the $0.06 level. The meme coin has since powered through the $0.08 level, with bulls eyeing the pivotal $0.09 level, which happens to be the immediate short-term resistance level.

A rally followed by a daily close above $0.09 could be the catalyst to attract more bulls that could help support further price gains. On the flipside, DOGUSD failure to power and find support above the $0.09 level could leave it susceptible to further losses in continuations of the downtrend. Below the $0.09 level, Dogecoin remains bearish.

However, the Relative Strength has started pointing up, signaling a buildup in buying pressure. A rally past the 50 levels should affirm the emerging uptrend. While Dogecoin has struggled to establish a powerful uptrend in recent months, things could change amid improving market sentiments.

Dogecoin SpaceX payment

Tesla CEO Elon Musk confirmed that SpaceX would start accepting Dogecoin as a payment option soon is the latest factor that continues to strengthen the meme coin sentiments in the market. The world’s richest man lending support to the coin is one factor that continues to affirm its growing utility in a crowded marketplace.

Tesla already accepts doge payments for some of its merchandise, a development that strengthens the coin’s sentiments in the sector. The initial indication is that the coin’s utility could be extended further with reports it could be a form of payment for Starlink subscriptions.

Musk has always insisted that DOGE is way more superior to Bitcoin as a form of payment due to its high transaction throughput. The remarks appear to strengthen investors’ sentiments in the meme coin, which is down by more than 80% in market value from all-time highs.

Final thoughts

After the recent broader cryptocurrency market crash, Dogecoin is still engulfed in a deep sell-off wave. However, the 80% sell-off is already fuelling suggestions of the coin being oversold as it is trading at a significant discount relative to its all-time highs.

Musk reiterating that the coin has a role in enhancing payments is one factor that affirms Dogecoin’s long-term prospects. As the broader sector bounces back from the recent sell-off, it is one of the coins well-positioned to power high as a bounce-back play.