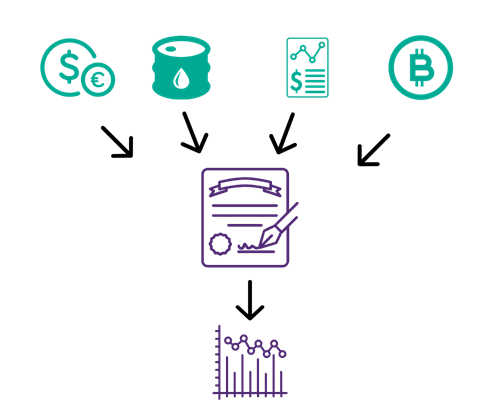

When new investors introduce themselves to the financial markets, one frequently used the term they see is CFD, which stands for contract for difference. With the rise of more electronic trading and the invention of new traded products, most markets nowadays are traded as CFDs.

The main attraction of CFDs is allowing investors to potentially profit from an underlying asset without buying or selling the physical product. In this article, we’ll go more in-depth about CFDs, how they work, and the pros and cons to note.

What is a CFD?

A CFD is a contract a trader enters with a broker or exchange to settle the difference between the opening and closing price of a derivative without any physical delivery of the traded asset.

Almost all of the popular instruments traded online are derivatives, meaning their value is derived from a real-world product. Everything from Forex, stocks, indices, commodities to metals, bonds, and energies is tradeable as a CFD.

For instance, instead of selling real US dollars to buy sterling in the hopes of the pound becoming stronger, one can simply trade the GBP/USD CFD market without having to exchange any real currencies.

If the pound strengthened against the dollar up to a certain level, the broker would settle the difference in cash as profit. Conversely, the trader would need to settle the loss up to a predefined point if the opposite occurred.

Broadly speaking, a typical CFD trade consists of three things: the spread/commission, the position size, and trade duration.

- Spread/commission: In most markets, the spread is the difference between the bid and ask prices. It is essentially the cost a broker or exchange marks up after passing the contract/order to a liquidity provider or market maker. In some securities, it might be a commission or a similar fee for executing every position.

- Position size: The position refers to the number of contracts or lots an investor allocates to a particular trade, measured in different units such as ticks, points, or pips, depending on the instrument.

- Trade duration: Unless someone is trading futures, there is no expiry date for how long a trader should hold their orders.

Pros of CFDs

Aside from the risks of leverage (covered later), the advantages of CFDs far outweigh the downsides, which is a testament to their immense popularity.

- Ability to go long and short: In the old days where investors traded fewer instruments, investors could only go long (buy) in a market. When the idea of shorting came about, it was initially only reserved for the elite few in financial institutions.

Most might assume the concept we now have of buying and selling a market always existed. CFD trading provides an equal opportunity also to go short (sell) and go long with no exceptions when performing either action.

- No need to physically own the underlying instrument: There are a few benefits to this point. For instance, instead of buying the material gold, which is inherently expensive with further considerations to storage, trading its CFD is much simpler, cheaper, and more efficient.

Secondly, the potential return on investment is a lot higher due to leverage which allows investors only to put down a fraction of the total value of the investment. When someone buys a physical metal like gold, they have to fork out the entire worth of the commodity.

While the increase in value between the actual product and its CFD would be the same as a percentage, one can realize the same gain without putting down as much in the monetary value.

- Ability to trade a wide range of markets: With just one platform and broker, investors can access an extensive selection of different CFDs, which aren’t limited to one exchange or central destination.

- Suitability to short-term trading: CFDs provide far more benefits for short-term traders instead of long-term ones.

Cons of CFDs

There is no good without the bad. Below are the main disadvantages of these derivatives.

- Leverage or margin risks: One of the primary attractions for CFDs is leverage, a tool drastically lowering the barrier to entry in capital and allows traders to make a lot more with much less.

However, the margin is two-fold in its ability to both equally magnify losses and gains. Thus, traders can lose all or a significant portion of their investment fairly quickly if they are not careful.

- No possession of the underlying asset: This aspect links in with the previous one. When trading a CFD, one employs stop orders to manage losses, which is especially crucial due to the leverage.

In contrast, someone retaining the underlying asset can hold it indefinitely even when it’s losing value in the hopes of a recovery, assuming they don’t sell. This is usually not possible with CFDs due to the leverage and the that most traders trade for short-term gains.

- Overnight fees: In most markets, leverage is seen as a form of a loan. When traders hold positions overnight, especially in forex, metals, and cryptocurrencies, they essentially pay interest (or are sometimes credited with it).

These charges are typically tiny, but they can add up to a noticeable amount for someone looking for long-term exposure. This aspect also links back to the lack of ownership. An investor wouldn’t need to worry about these costs for the most part if they owned the real thing.

- Unsuitable for long-term investors: Most serious investors, especially those with sizable capital, prefer to take ownership of the financial product with little or no leverage.

Final word

It’s evident to see why CFDs are popular. They provide a gateway for anyone to expose themselves to thousands of unique instruments they ordinarily wouldn’t have had easy exposure to.

CFD trading is excellent for the short term but has a few restrictions which aren’t so suitable for those trading long term or leaning more towards traditional investing.