Introduction

Tokenization is the process of converting a real tradable asset to a blockchain token or coin. Digitalization made it possible to create representational tokenized online versions of stocks that trade on traditional regulated exchanges, such as Apple, Amazon, and Tesla.

If Bitcoin was a stock that traded on the traditional stock exchange, you would be paying more than $60,000 to buy a single share. Since it is digitalized, you can buy a fraction of a bitcoin. Similarly, the tokenization of stocks makes it possible to buy tiny portions of shares. You can buy $1,000 worth of Berkshire Hathaway shares that cost more than $390,000 each, something that is just not possible on the traditional stock market.

You eliminate the need for an external broker or paying additional fees when you buy tokenized stocks.

Benefits of tokenized stocks

Tokenization of stocks is a far more efficient way of buying and selling traditional shares, eliminating the learning curve and a great deal of friction and confusion associated with the stock market.

Accessibility

Tokenization attracts a much wider audience because of the reduced minimum investment. Since the crypto markets are global and operate 24/7, you can get your hands on shares trading on stock exchanges in other countries and sell them whenever they want.

Affordability

The divisibility factor allows you to purchase small percentages of a share without having to worry about not being able to buy an entire share.

Faster and cheaper transactions

Buying and selling are done through smart contracts on the blockchain, eliminating the need for intermediaries and with lesser transaction fees.

Security and immutability

Once you buy a tokenized stock, ownership and transfer of ownership are extremely clear, without any scope for confusion.

Regulations for tokenized stock trading

Since the blockchain and cryptocurrency itself are still in their nascent stages and de facto decentralized, there is no clarity about regulations on tokenized stocks. However, there are positive indications that the traditional stock markets are slowly warming up to the idea of a token economy.

For example, the ex-chairman of the US SEC (the U.S. Securities and Exchange Commission) recently commented that 20 years ago, we used stock certificates, and today digital entries represent stocks. He said that he expects all stocks to be tokenized one day.

The chairman’s comments have given a boost to the tokenization of traditional shares, as regulatory clarity and acceptance from the bigwigs help in forming a clear regulatory framework.

ESMA (European Securities and Market Authority) is working on establishing a framework that will protect investors and ensure transparency. Malta and Switzerland have shown interest in accommodating new market places for tokenized stocks.

Many countries have not yet formed regulations on digital assets and tokens. International regulatory guidelines may not be possible, and we may be looking at token compliant mechanisms that vary between jurisdictions.

Tokenized stocks on various exchanges

Popular cryptocurrency exchanges like FTX and Bittrex now allow tokenized stock trading. Similar to cryptocurrency trading, buying, and selling, the tokenized stock market is open 24/7.

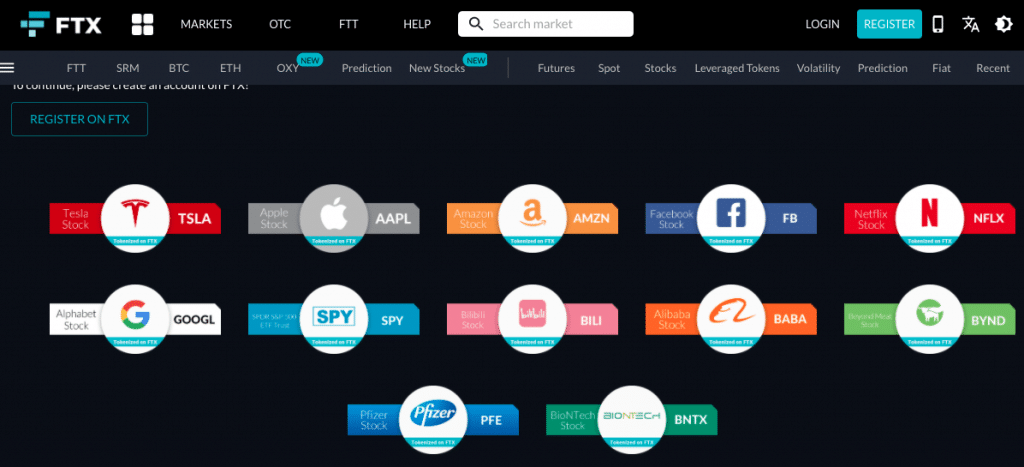

FTX Exchange

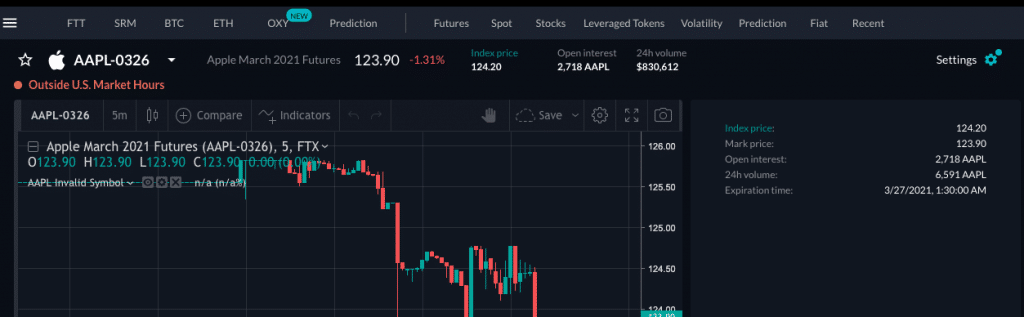

FTX offers both Spot and Futures trading on a wide range of US tokenized stocks of publicly listed companies.

While these tokens can be bought and sold with ease on FTX, you can only redeem them for its underlying stock through CM Equity, the custodian for the stocks, which also handles the KYC process. Signing up with CM-Equity is mandatory for all the tokenized stock traders.

KYC requirements: KYC Level 2 is a requirement for tokenized stock trading. All the KYC information will have to be submitted to CM-Equity.

Jurisdictions: Customers from restricted jurisdictions like the U.S., North Korea, Iran, and other countries will not be eligible to trade stocks. You will find the entire list of restricted counties on the FTX website.

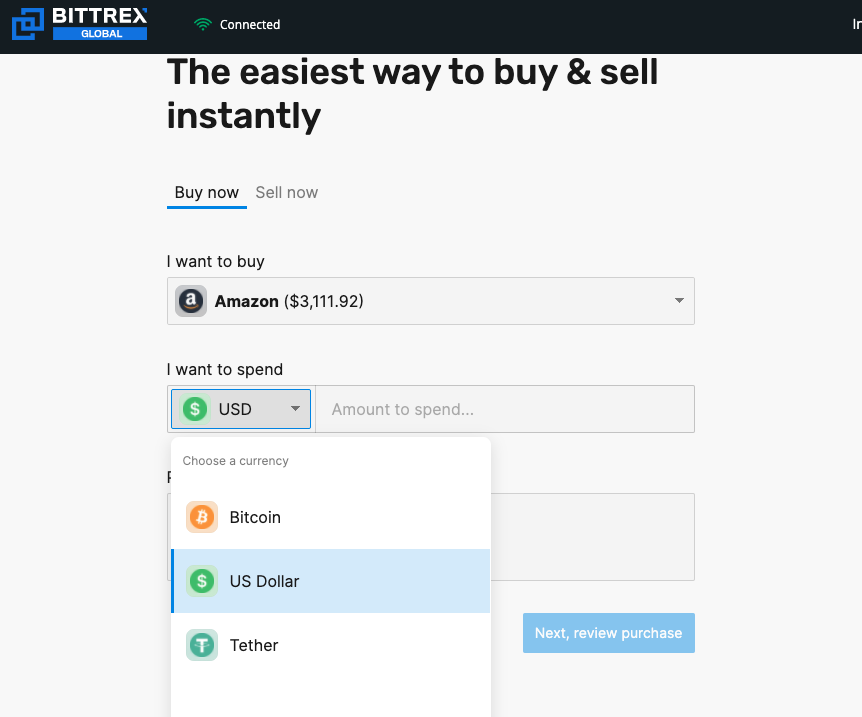

Bittrex Global

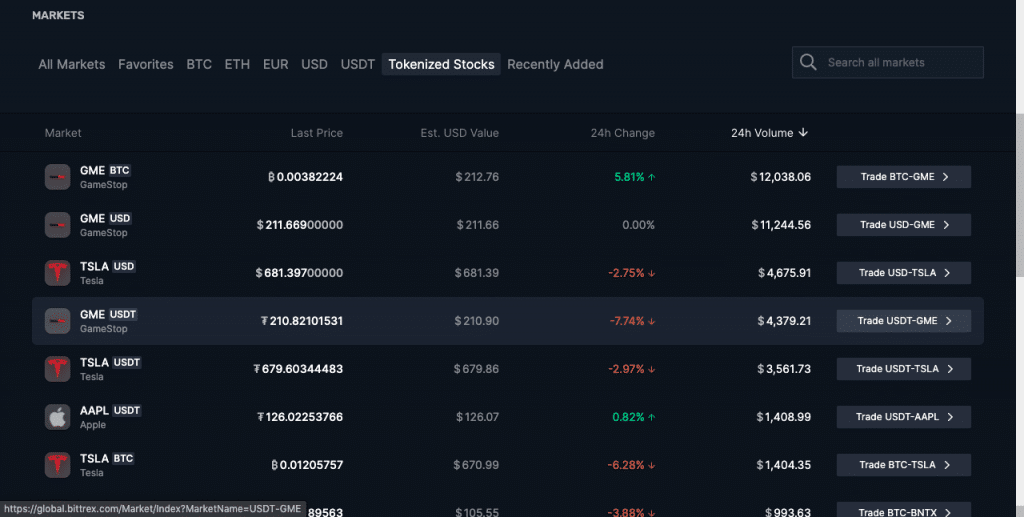

Bittrex currently has 19 tokenized stocks for trading. The exchange uses DigitalAssets.AG to tokenize shares of publicly traded stocks. You can buy them using cryptocurrency (BTC, USDT) or fiat (USD).

You can trade all their tokenized stocks on Bittrex spot markets. However, you cannot withdraw them to wallets/other exchanges or redeem the tokens for their underlying stocks. They are not on the futures markets.

KYC requirements: Two-factor authentication and KYC requirements are the same as they are for cryptocurrency trading.

Jurisdictions: Jurisdictional restrictions apply. United States, European Union, Switzerland, and United Kingdom users (please check the jurisdictions on their website) are not eligible for tokenized stock trading.

How to begin trading tokenized stocks?

Irrespective of what goes on behind the scenes, from a user’s point of view, tokenized stock trading is similar to trading cryptocurrencies on the spot and futures markets. Bittrex only offers spot trading, while FTX offers both spot and futures trading.

Let’s see how to get started on Bittrex.

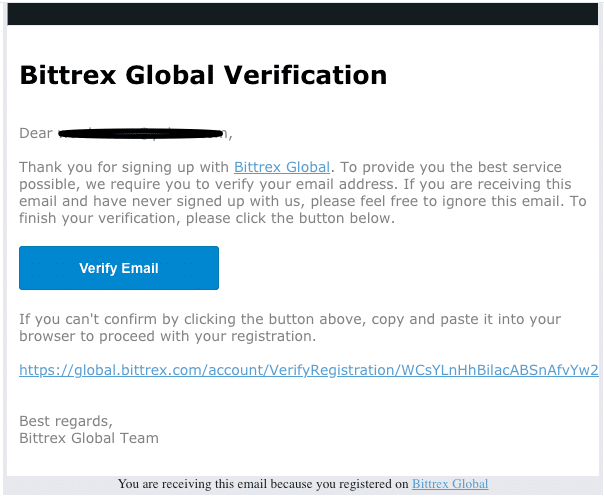

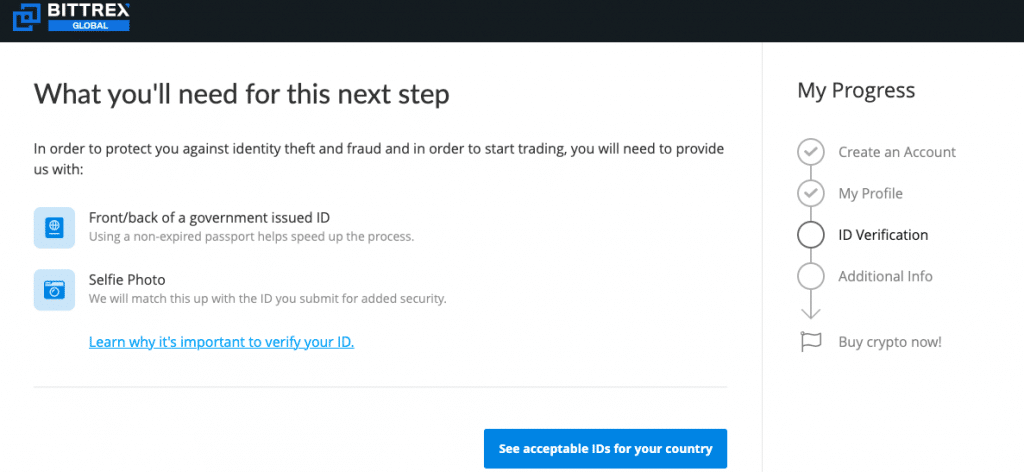

- Register with the exchange.

- Complete the email verification.

- Once you accept the Terms of Service, you will be asked to enter personal details, such as your full name, address of residence, country of residence, etc.

- You will then be taken to the identity verification page, where you upload your ID and take a selfie. Requirements may vary depending on the jurisdiction.

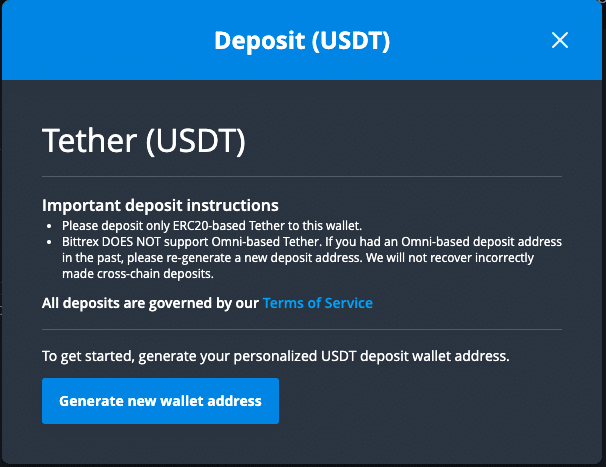

- Deposit Fiat or cryptocurrency.

- Go to the “Tokenized Stocks” section.

- Use spot trading or futures depending on what the exchange offers. Bittrex only offers spot trading.

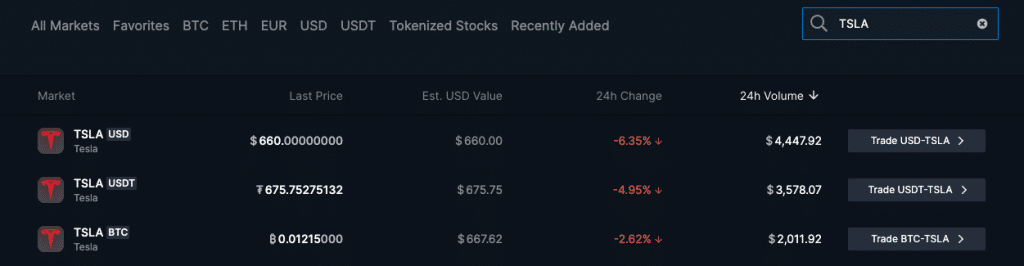

- Buying and selling are the same as cryptocurrency trading. Trade tokenized stocks against USD, BTC, or USDT.

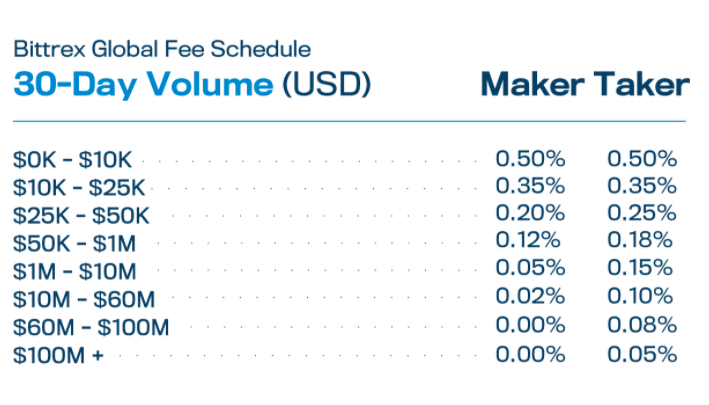

- The fee structure on Bittrex for tokenized stocks is the same as it is for cryptocurrencies.

How do futures on tokenized stocks work?

Tokenized stocks have been introduced on the cryptocurrency markets and the FTX exchange offers tokenized stocks quarterly futures.

This futures market works like other futures markets and is based on the spot tokenized stock index.

Based on FTX futures:

- Stock futures will not be adjusted on regular stock dividends.

- An adjustment will take place only on stock splits or spinoffs. In such cases, the denominators may change or by turning into a future on the whole basket for spinoffs.

- Futures expire to their index on the spot markets.

Summary

Tokenized stocks are a new category of financial products and the consensus is that they will fare well, keeping in mind the divisibility and accessibility they offer.The first exchange to take the initiative, DX.Exchange went bankrupt within a year of its launch. However, new players like FTX and Bittrex have taken the initiative and are paving the way for mainstream adoption. Hopefully, it won’t be long before major regulatory obstacles are overcome and invite compliance on tokenized stock trading from more jurisdictions.