Very Well Trader is a trading advisor that was published in Fall 2020. The presentation doesn’t look informative. The main claim is “Discover The Winning Forex Adviser.” So, we’re going to check this information.

Very Well Trader Strategy

- The developers didn’t disclose what the main strategy was.

- The robot trades AUD/USD, EUR/USD, GBP/USD, and USD/JPY currency pairs.

- The time frame to trade is M5.

Very Well Trader Features

We grouped up all features in the short list:

- The robot is an automated trading system.

- Setting up the system takes less than 5 minutes.

- We can use the robot on both 4 and 5-digits brokers.

- There’s welcome and ready-to-help support.

- We have broker protection that allows hiding our TP and SL goals from a broker.

- They have over 15-year experience in the Forex market.

- The system executes orders on the next symbols AUD/USD, EUR/USD, GBP/USD, and USD/JPY.

- The main time frame is M5. So, it doesn’t require much margin to support deals on the market.

- The money-management system proceeds deals from the opening to the closing.

- The M5 time frame allows running with low Stop Losses.

- The system doesn’t sit in dip drawdowns.

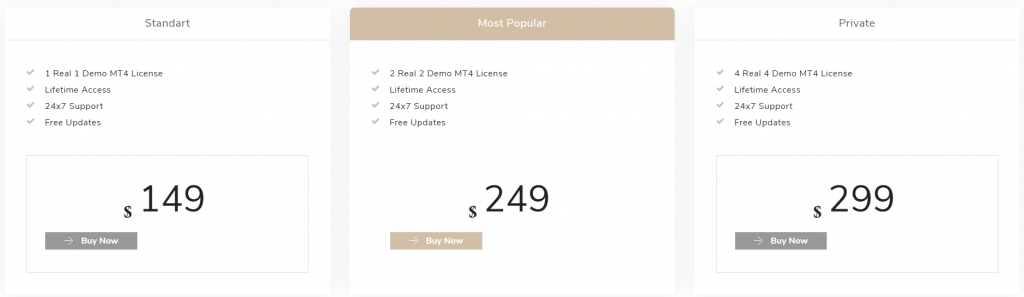

There are three packages: Standard, Most Popular, and Private. The Standard pack costs $149. The package has one real and one demo account license. The Most Popular pack can be bought for $249. It has two real and two demo licenses. The Private package costs $299. It’s featured by four real and four demo licenses. We can rely on 24/7 support, fee, and lifetime updates. The offer is supported by a 30-day money-back guarantee.

Very Well Trader Backtesting Results

The vendor decided not to provide backtest reports. It’s a solid con because we can’t compare trading results with how the system worked during the past years.

Very Well Trader Trading Results

We haven’t found backtest reports to check. So, we have no idea how the system handled the past data.

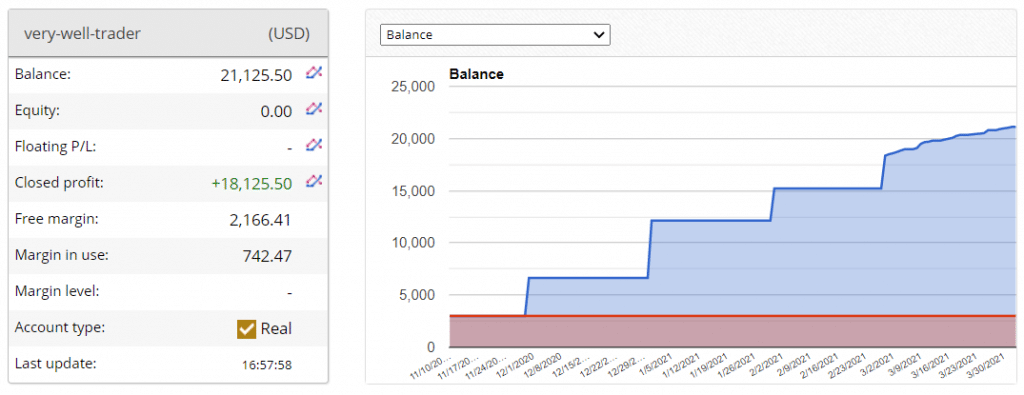

Very Well Trader runs a real USD account. The balance had increased to $21,125.50 since our last visit several months ago. The account was created on November 10, 2020. The developers deposited it at $3,000. The margin in use is $742,47. There are no open trades right now, so no Floating Profit/Loss is revealed.

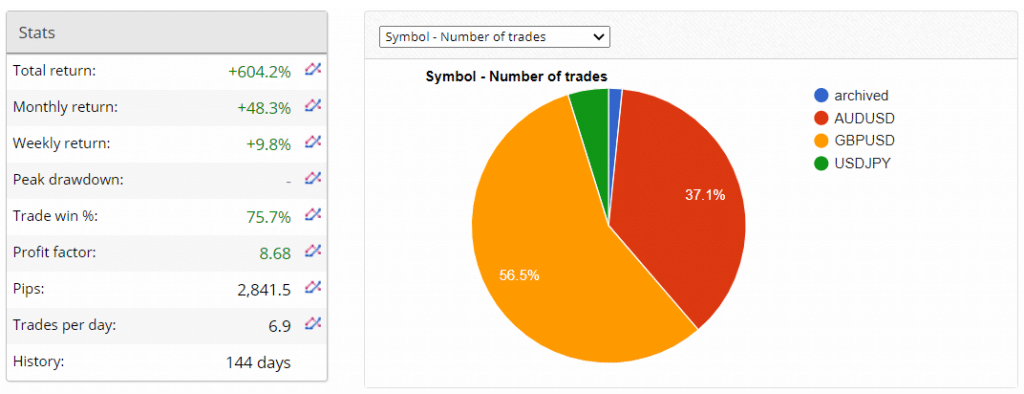

Very Well Trader works on AUD/USD, GBP/USD, and USD/JPY cross pairs. The account is live for 144 days. The total return has amounted to +604.2%. An average monthly return is +48.3%. The average win rate is 75.7%. The Profit Factor is 8.68. An average trade frequency is almost seven deals daily. There were 2841 pips gained.

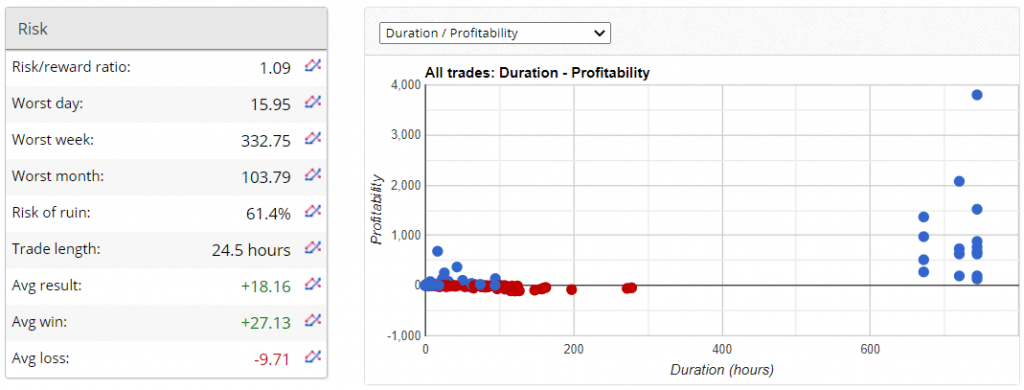

The Risk to the Reward Ratio is 1.09. An average win is +$27.13 when an average loss is only -$9.71. An average result is $18.16. The risk of the ruining account is sky-high 61.4%. The average trade length is 24,5 hours.

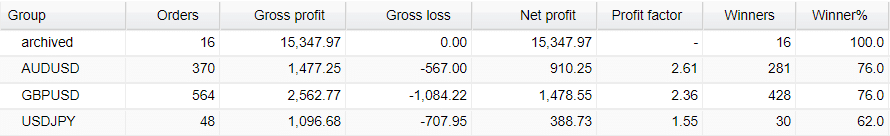

The most frequently traded symbol is GBP/USD with 564 deals. It has brought a profit of $1,478.

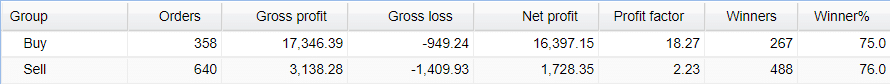

The EA prefers the Sell direction (640 deals) over the Buy direction (358 deals). The Long direction is much more profitable – $16,397.15.

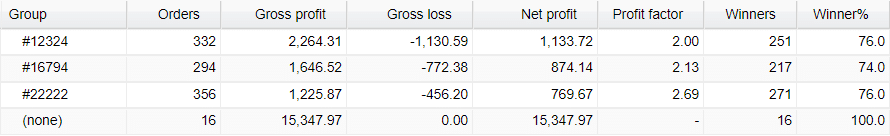

There are three magic numbers behind the system. The developers have closed 16 deals manually.

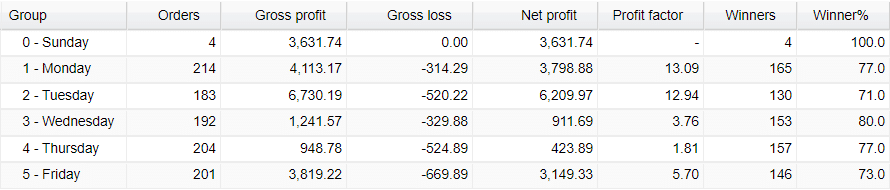

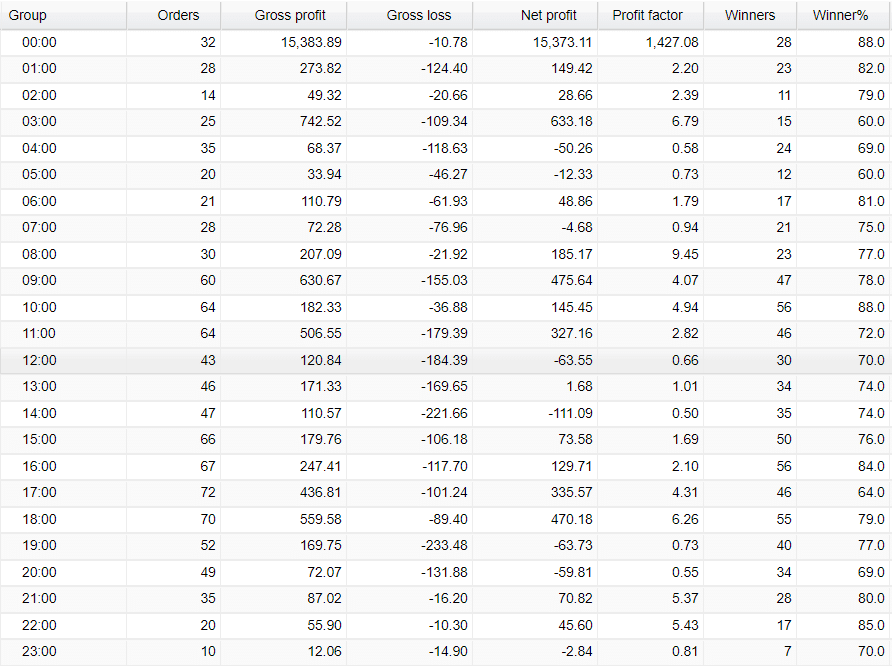

Monday (214 deals), Thursday (204), and Friday (201 deals) are the most traded days. It looks like the system works all days equally.

Most trading activities are going during the European trading hours.

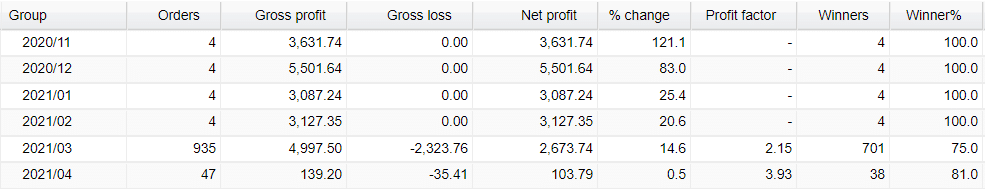

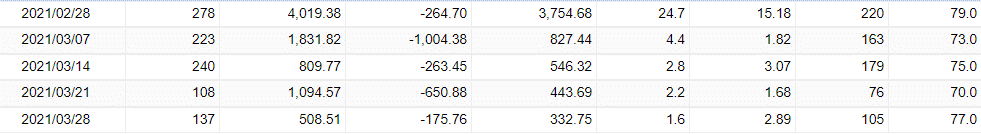

The robot was unleashed in March 2021.

Trading frequency has decreased significantly from 278 to 137 deals a week.

Very Well Trader Reputation

There’s no special reputation behind the company or the EA. The sale proceeds through a Click2Sell platform. So, we’re safe. The system is just half a year old. We couldn’t manage to find people’s feedback on Forex Peace Army or Trustpilot websites.

Very Well Trader Review Summary

- Strategy – score (2/10)

- Functionality & Features – score (5/10)

- Trading Results – score (8/10)

- Reliability – score (5/10)

- Pricing – score (6/10)

Conclusion

Very Well Trader is a robot that has kept running a real account, increasing its balance. The EA can work with four pairs, but EUR/USD was excluded from the pairs it works with. The presentation is simple and doesn’t include backtest reports and people feedback. So, we don’t know for sure if the EA can provide these results on clients’ accounts.