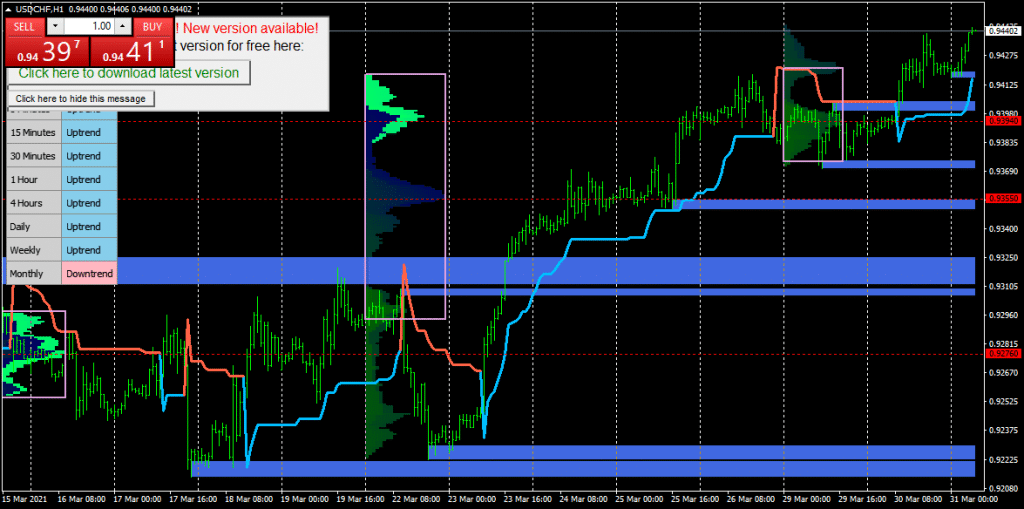

- USD/CHF follows the bullish candle arrangement where traders get a breather around intraday high off-late.

- The pair retests and settles the upswing line to 0.9500 after impermanent decreases.

- Overbought RSI, downbeat Momentum challenges the pair’s further potential gain as it becomes over the sign level.

USD/CHF keeps on moving week after week 0.9500 resistance after a transient decrease. The pair stays bullish and resumes its uptrend movement. It has enlisted a higher high of 0.9445 area, passing the previous high of 0.9416.

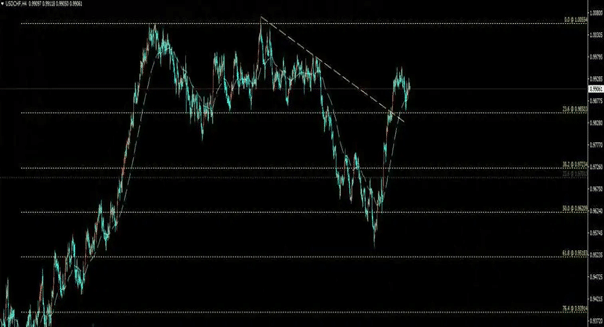

USD/CHF standpoint is bullish and could keep on expanding despite the impermanent declines as long as it stays over the uptrend line. It might diminish to 0.9316 to retest before bouncing higher once more. The signal of 0.9375 in a disadvantage snag, viewed as essential support in the trend line.

The pair is relied upon to drop and settle under 0.9416 if the descending development endures. Besides the uptrend over the level of 0.9230 in the daily chart, it moves toward the level of 0.9500 resistance. When this resistance broke, the following objective was the 0.9650 level territory. It is possible because the Swiss franc showed its macroeconomic information having an unfortunate outcome.

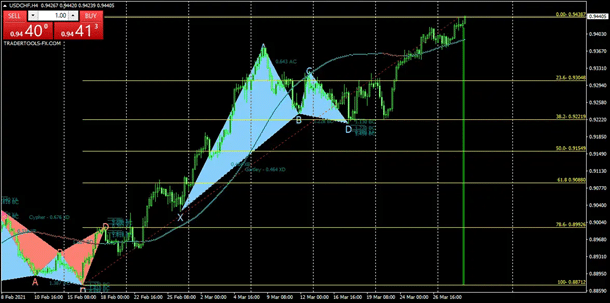

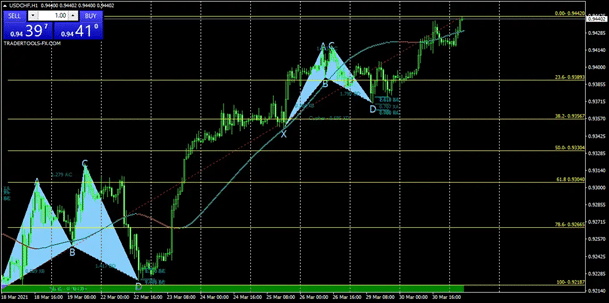

In light of the H4 outline, the price broke over to 0.9380 and pulled back to recover a similar level. As indicated by the momentary bullish inclination, the price likewise sticks over the moving averages appropriations. For this situation, the opposition will expand further to 0.9388, going to the potential resistance key level of 0.9500. Concerning the Easter value high of 0.9431 to the current cost of 0.9390, the price is presently speeding up towards the H4 moving averages and skipping upwards with great strength.

As of late, the USD/CHF pair is exchanging underneath the pattern line to begin testing the critical help of 0.9850. However long the price is over the pivot level, the pair bullish viewpoint will stay unblemished for the coming time frames. The pair will have the following key objective of 0.9965 and a break of 0.9850. The price will draw back the adjustment to the next target of 0.9723.

On the H1 diagram, USD/CHF is trying the 200 times of multiple moving averages close to the zone of 0.9422. It just shows that the cost and purchase signal is skipping upwards from the moving midpoints region. As we can see on the H4 diagram, a climbing pattern line upholds the 0.9400 area. Indeed, even the pattern line showed bogus breakout weeks before an uptrend is still quite visible. This even breakout fortifies the upturn development of the pair.

Then again, the daily chart shows the persistent upturn and everyday rising pattern linebacking of 0.9375. A week ago, the USD gave the USD/CHF time to recover enough. Nonetheless, the USD resumption of uptrend development will come right away. Ricocheting to the 0.9400 area from the 0.9470 is a decent sign that the test backing of 0.9500 is continuous.

As should be obvious, the USD/CHF value shows a solid opposition on the daily and weekly periods at the overbought level. It is additionally advancing a lot of potential gains over the moving averages high of 0.9440 area. So better to get your buying positions and reconsider selling the pair.

The big deal traders will surely take the chance to exchange enormous measures of pairs to drop the value down to the drift line.

Also, USD/CHF may bounce above 0.9445 previous high to address the buying signal. For the most part, the pair is relied upon to continue its development once it hovers over the sign level.