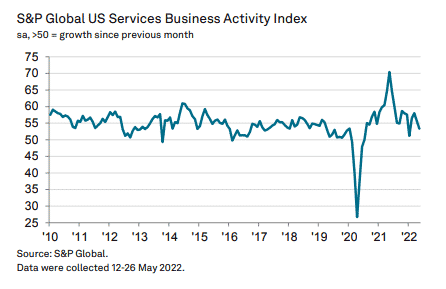

(S&P Global) US services sector showed slowdowns in May, with the PMI at 53.4, below 55.6 in April. The index signaled the slowest expansion since January.

Domestic and foreign demand was pointed to be on a decline, with the fall attributed to supplier delivery delays and higher selling prices.

New businesses still continued to rise in May as client demand expanded robustly, although the growth was the slowest since September.

Cost pressures were on the rise in May, with recent hikes in energy prices pushing input prices to the highest on record. Output charges slower than the record pace in April.

Firms continued with hiring, with job additions rising sharply in anticipation of a higher output over the coming year. Backlogs of work rose at a strong pace, despite softening from March’s record rate.

Despite the slowdowns in the service sector, firms were upbeat on the next 12-month outlook. The degree of confidence rose from April levels to remain robust in May.

SPY is down -1.49%, DXY is down -0.45%.