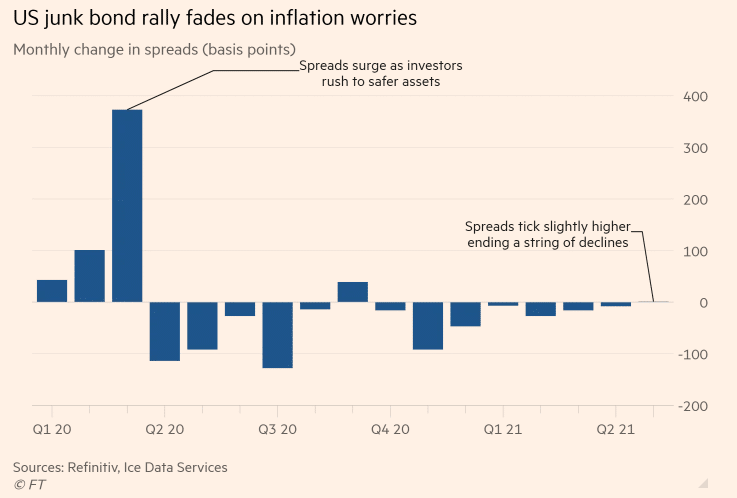

Rising inflation worries are resulting in a loss of momentum on U.S junk bonds, according to Financial Times. Additional yields for holding the junk bonds to U.S Treasuries were almost unchanged in May, the second time in 14 months the spreads have failed to narrow.

Spreads on the junk bonds rose to a high of 3.42 percentage points in early May from 3.21 points at the start of April, before dropping slightly to 3.29 points on Friday.

The wavering junk bond market raises concerns that the rally witnessed during the pandemic is coming to an end.

Analysts now read signs of caution in the high-yield bond market which was preferred by investors seeking to shield themselves from high volatilities in government bonds and stocks.

Spreads on the junk bonds fell from a pandemic high of almost 11 percentage points in March last year, as economic stimulus measures and vaccine rollouts gained momentum.

Prospects of higher inflation that could prompt the Fed to withdraw support are weighing down on the bonds.

About $5.6 billion has been withdrawn from exchanges that trade in the U.S junk bonds in six weeks, even as bond issuance hit over $270 billion this year.