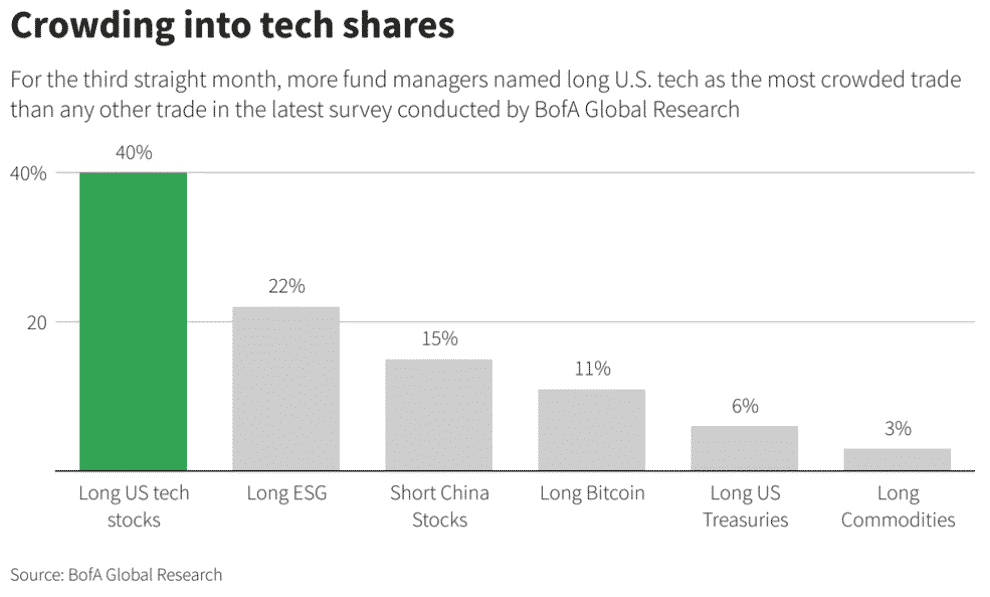

(Reuters) The US Investors are hesitant to cut technology stocks in their portfolio amid poor stock market performance that has seen most indices dip.

S&P 500 technology sector index dipped 6.7% from a record high on September 2. This compares to a 5.2% drop in the overall index.

Nasdaq Composite index is almost at a 10% correction with a decline of 7.3% from its high recorded on September 7.

Most investors expect that tech stocks, which have topped the stock market for long, will deliver good earnings despite the tough economic times.

The sector ranks the highest at 27.7% weight in the S&P 500, trading at 25.8 times forward 12-months earnings estimates.

Higher Treasury yields, Federal Reserve monetary policies, and the Congress tussle about the U.S. tax ceiling are all to blame for the tumbling stock market.

SPY is down -1.29% on pre-market, DXY is up +0.15%