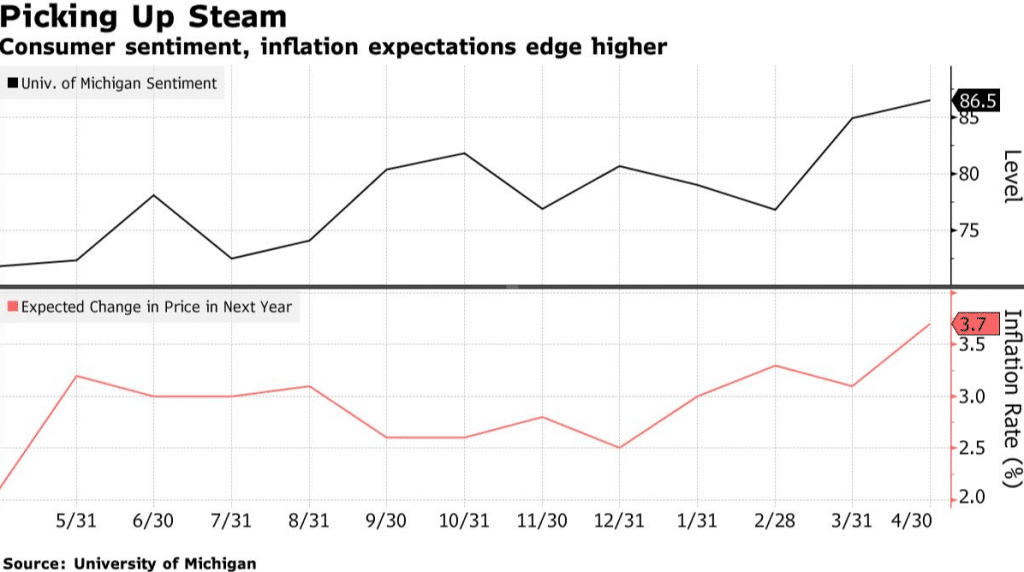

U.S consumer sentiment index jumped to 86.5 in April from 84.9 in March, according to the University of Michigan’s press release. The sentiment index was lower than the expected 89 forecast, but remains at a pandemic high.

Consumers expect inflation to rise 3.7% over the next year, the highest since March 2012

Consumers expect prices over the next five years to increase 2.7%, down from 2.8% last month.

The gauge of current conditions climbed to 97.2, while a measure of expectations held at 79.7

Consumers were more upbeat about their current financial situation and buying conditions remained solid.

A surge in pent-up consumer demand is expected to propel the economy to its pre-pandemic strength, even as policy makers watch to see how prices increase as growth takes off.

U.S stocks are currently gaining as the dollar loses. SPY is up 0.21%, QQQ is up 0.073%, EURUSD is up 0.11%