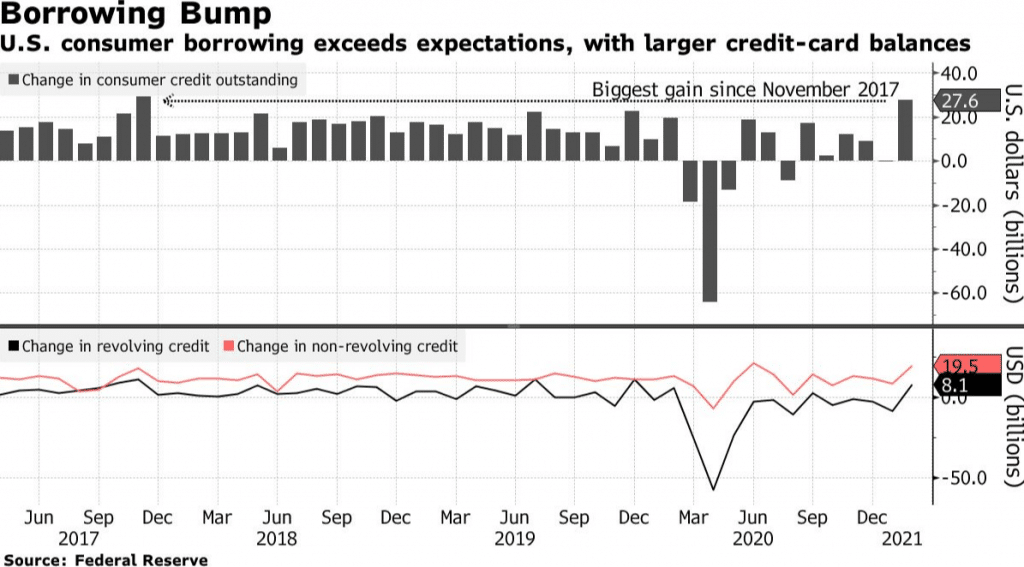

U.S. consumer credit rose 7.9% on an annualized basis in February, according to the Federal Reserve press release. Total credit jumped $27.6 billion from January, the largest gain since November 2017.

Revolving credit rose at an annualized rate of 10.1% or $8.1 billion, the most since December 2019.

Non-revolving credit jumped at an annual rate of 7.3% or $19.5 billion, the biggest increase since June.

Lending by the federal government, comprising mainly of student loans, increased by $5.7 billion

The jump in borrowing highlights growing economic confidence as job growth picks up and more states lift coronavirus restrictions.

U.S stocks are currently gaining as the dollar loses. SPY is up 0.31%, QQQ is up 0.93%, EURUSD is up 0.34%