(FT) US biggest banks are sending mixed market signals as they adopt different strategies in investing in securities in the various government debt markets.

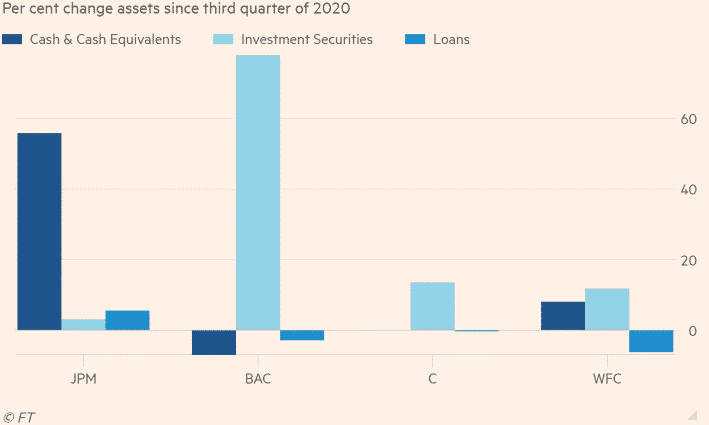

Bank of America got a boost in its third-quarter revenue from interest income earned in a debt security portfolio, which has increased 77% in the past year. The bank had a 10% net jump in the interest income despite a 3% drop in its loan book in the third quarter.

JPMorgan increased the size of its debt security portfolio by 3% in the last year, while CitiGroup and Wells Fargo increased theirs by 14% and 12%, respectively. JPMorgan’s CEO Jamie Dimon now says he is fearful of a drastic fall in Treasuries prices.

Wells Fargo’s CFO sees upside risks for rates in the near and medium-term. The bank, which had started accumulating debt securities in the first half of the year, has since retreated as rates continued to soar.

Treasuries and mortgage-backed securities provide some yield to the banks, but in the case of inflation, banks are forced to mark them down, missing other lending opportunities.

Analysts say large banks are rushing to use their piled-up deposits accumulated following the government stimulus package. The loans market is reportedly slow, with most companies now accessing funds through the bonds market as consumers pay debts using credit cards.

BAC: NYSE is up +0.19% on pre-market, JPM: NYSE is up +0.1% on pre-market, WFC: NYSE is down -0.25% on pre-market.