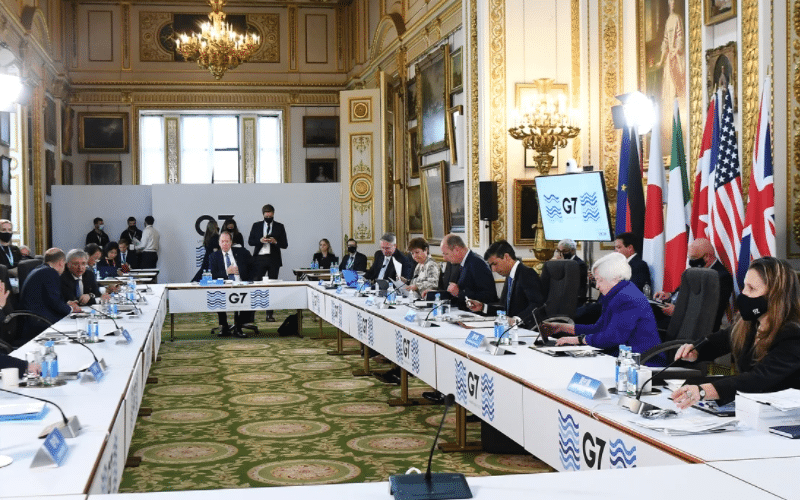

(WSJ) G-7 countries are backing U.S calls for rules taxing multinational companies at a 15% minimum corporate rate.

The agreement by G7 ends stalemate between the U.S and the large European countries that have rejected calls by Washington for an international system of taxing multinationals.

G-7 members will now back a global minimum tax on corporate profits and means of sharing revenues from the entities.

Multinational companies will be required to pay a minimum tax of 15% in the countries of operation under the new agreement.

Further details of the agreement will be worked out before the new rules are rolled out globally.

Support from the G-20 countries, as well as developing economies is required for the adoption of the new rules.

The G-7 agreement is expected to raise levies for digital businesses, even as executives of such businesses call for certainty in tax rules.

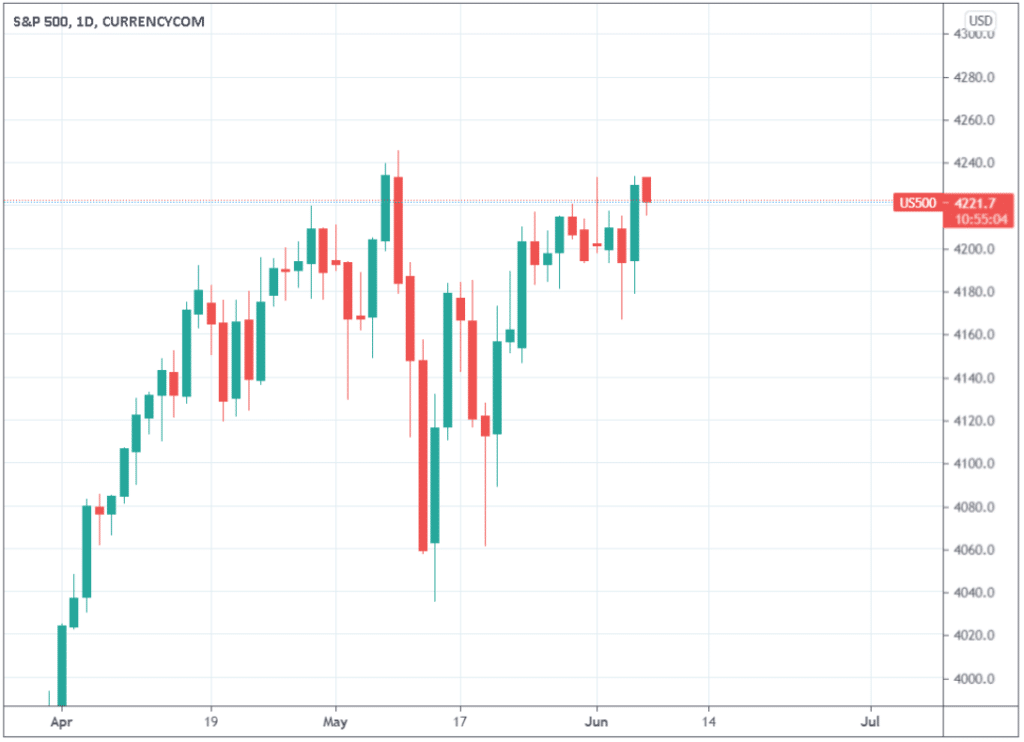

Global markets react to news. SPY is down 0.24% on premarket, DAX is down 0.0078%, CSI 300 is down 0.88%, EURUSD is down 0.06%