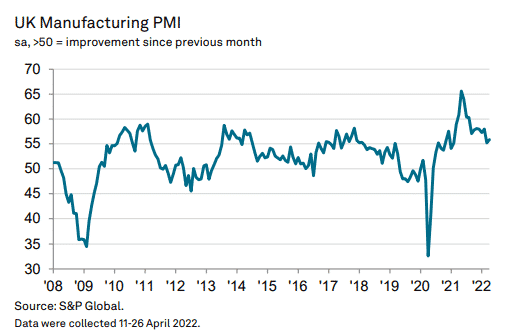

(S&P) The PMI gauging the manufacturing activity in the UK was recorded at 55.8 in April, rising from March’s five-month low of 55.2.

Manufacturing output was noted to have increased across investment, consumer, and intermediate goods categories.

Firms attributed the rise in manufacturing production to an increase in new business intake, easing delivery challenges, and clearing of backlogs.

Firms hired more to clear backlogs, with the employment rate rising for the sixteenth straight month.

Firms still continued to face headwinds, with new order increases weakening to the lowest in fifteen months. The weak order growth was caused by lower intake of new export business and higher selling prices.

Inflationary pressures were also cited as headwinds by UK manufacturers, with the input costs rising at the second-fastest rate in history. Output costs rose to a record extent, with 61% of firms reporting increasing selling prices.

Lead times rose again, reflecting headwinds caused by shortages of materials, port congestion, limited transportation capacity, and Covid-19 outbreaks.

FTSE 100 is down -0.36%, GBPUSD is up +0.53%