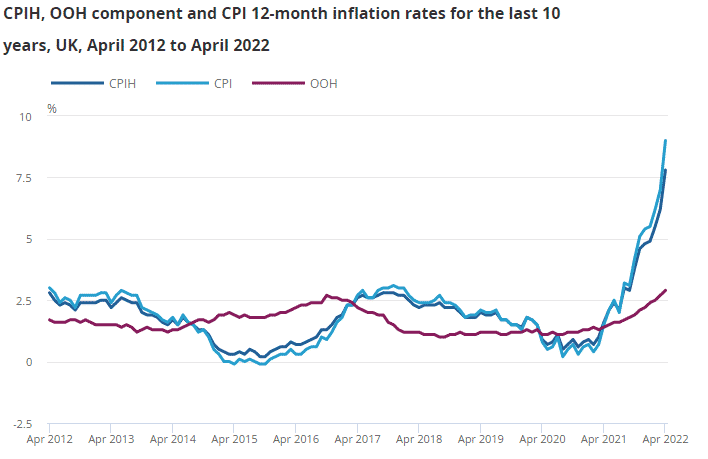

(ONS) The UK Consumer Prices Index surged by 9% in the 12 months to April 2022, accelerating from an increase of 7.0% in March.

Including owner occupiers’ housing costs, inflation rose by 7.8% in the 12 months to April 2022, an increase from 6.2% in March.

On a monthly basis, CIP increased by 2.5% in April, accelerating from a gain of 0.6% in April 2021. The inflation rose by a monthly 2.1%, including owner occupiers’ housing costs, compared to a gain of 0.7% in the prior year.

Monthly CPIH was mainly driven by housing and household services, which saw an increase of 1.27% between March and April. Clothing and footwear saw a 0.09% drop. CPIH also saw a 2.76% annual jump in housing and household services.

Output charges also surged, posting a gain of 14.0% in the year to April, compared to 11.9% in March and the highest since July 2008.

The rising inflation now adds more pressure on the Bank of England to act despite having increased its interest rates at its four straight meetings. The interest rate rose from the pandemic lows of 0.1% to the highest in 13 years at 1%.

FTSE 100 is down -0.024%, GBPUSD is down -0.82%.