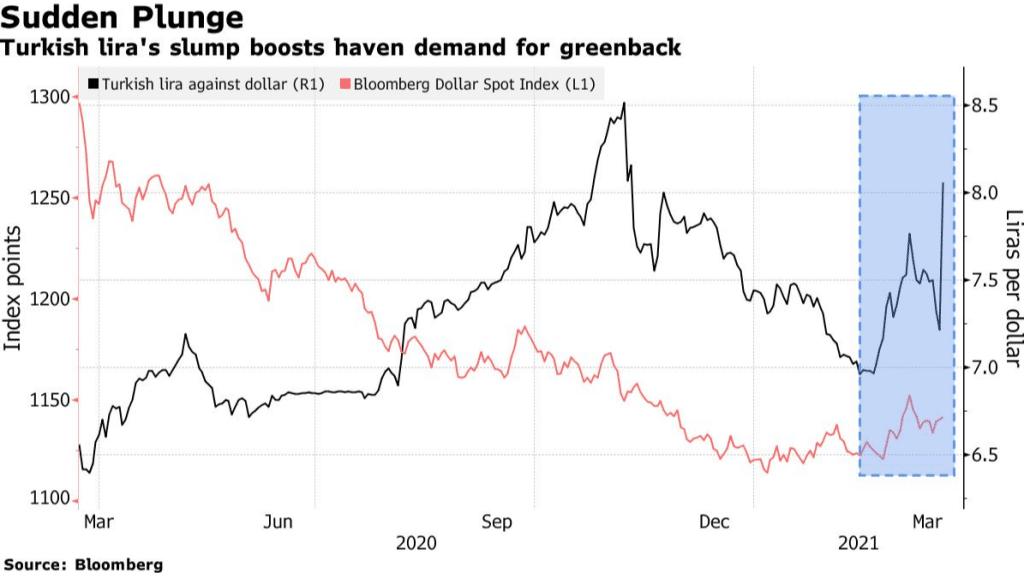

Turkish markets plunged, after Erdogan dismissed the country’s central bank Chief Naci Agbal. The fall in the stocks, bonds, and the lira follows concerns that Turkey is headed for a full-blown currency crisis.

The Borsa Istanbul Index shed more than 8%, while the lira fell almost 15% as yields on Turkish local and dollar bonds soared.

The dismissal of Agbal occurs after just four months, ending his period of policy orthodoxy that restored lira’s fortunes after a 20% plunge last year.

The dismissal decision raises concerns that the country will prematurely ease interest rates.

Analysts point that the dismissal of Agbal is a big blow to the markets, which had been warming up to a more normalized monetary policy since November.

Agbal’s successor Sahap Kavcioglu, a columnist and university professor, has been a critic of recent interest-rate hikes under Agbal’s stewardship.

On Monday, Treasury and Finance Minister Lutfi Elvan said Turkey would stick to free markets and a liberal foreign-exchange regime.

Turkish markets are currently declining. USDTRY is up 10.52%, XU100 Index is down 9.44%,