Tokenization of financial assets

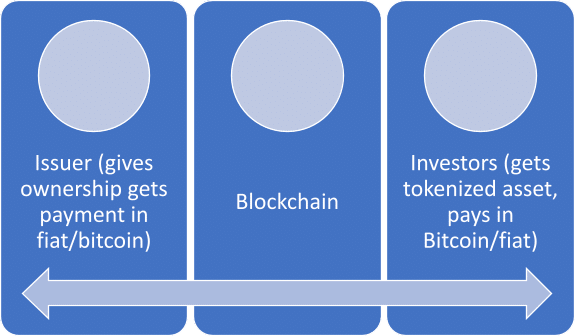

After the introduction of Bitcoin, the financial sector has been subjected to another wave of revolution in the form of tokenized assets. In the context of financial assets, tokenization involves the issuance of a blockchain token as a digital representation of the actual tradable asset. Tokenized stocks have become one of the popular forms of tokenized assets. The creation of the resultant tokens involves an initial coin offering (ICO), which is the cryptocurrency’s version of the initial public offering (IPO). The summarized system of tokenized assets is as shown in the figure below.

What is a tokenized stock?

Now that you have a better understanding of the tokenization process, let’s narrow our discussion down to tokenized stocks. A tokenized stock is a digital representation of a company’s shares. The token is a derivative rather than a security. As opposed to being pegged to a fiat currency, the token is usually tethered to the stock in question.

Reasons behind the growing popularity of tokenized stocks

Can be traded 24/7

Just like cryptocurrencies, one can trade the tokenized stocks at any time of day or night. Even when a major exchange such as the New York Stock Exchange is inactive, you can still buy/sell the stocks and earn your profits.

More options

With tokenized stocks, one is able to trade in several stocks and cryptocurrencies at a go. For instance, FTX and Bittex Global have availed the SPDR ETF. This specific bundle comprises stocks in the S&P 500.

Fractionalized shares

When dealing with tokenized stocks, one does not have to purchase a large number of shares. In fact, one of the reasons why this concept is gaining popularity is the ability to purchase a fraction of a share (fractionalized shares). As such, a trader with a limited amount of funds is able to own a piece of large companies like Amazon and Apple Inc.

Reduced fees

Tokenized stocks have removed the need for a broker. Subsequently, there are lesser fees involved compared to the traditional system.

Access to US stocks globally

Trading stocks at such a major entity as the New York Stock Exchange has always been reserved for the US citizens and well-established financial institutions. Tokenized stocks are rewriting that narrative by enabling individuals in all parts of the world to trade in tokens. A retail investor in a small town in Africa can now trade in stocks of a major company such as Tesla.

How to trade tokenized stocks

FTX and Bittrex Global stand out among the companies that allow investors to trade in tokenized stocks. Notably, trading these derivatives is similar to the traditional form of stock trading. A trader is able to trade into major entities like FAANG (Facebook, Amazon, Apple, Netflix, and Alphabet).

At the moment, the assets are traded on spot markets. However, it is impossible to transfer the stocks to another platform or exchange it for the underlying share. As the blockchain technology continues to advance, the provisions of tokenized assets like stocks are likely to expand with time.