Cryptoasset definition

Cryptoassets are often confused with cryptocurrencies, and understandably so because they both rely on cryptography. Cryptography is the approach of using codes to protect information from unauthorized parties. It is important to note that cryptocurrency is an example of cryptoassets, but it’s not an interchangeable term for the same.

A simpler way of understanding the difference between the two components is comparing ‘gold’ and ‘commodity’. Gold is a key commodity in the financial market, but is not used to represent all the commodities.

With that understanding, a cryptoasset can be defined as a digital asset that relies on the cryptography technology to create and maintain a decentralized currency or application.

Types of cryptoassets

While cryptoassets are a fairly new investment option, it encompasses an array of financial products to invest in.

Cryptocurrencies

This is arguably the most common type of cryptoassets. It is a digital currency that allows one to pay for various goods or services, or engage in the ‘buy and hold’ form of trade. In the latter scenario, traders purchase a cryptocurrency and store it in their digital wallets in anticipation that their value will increase significantly over time.

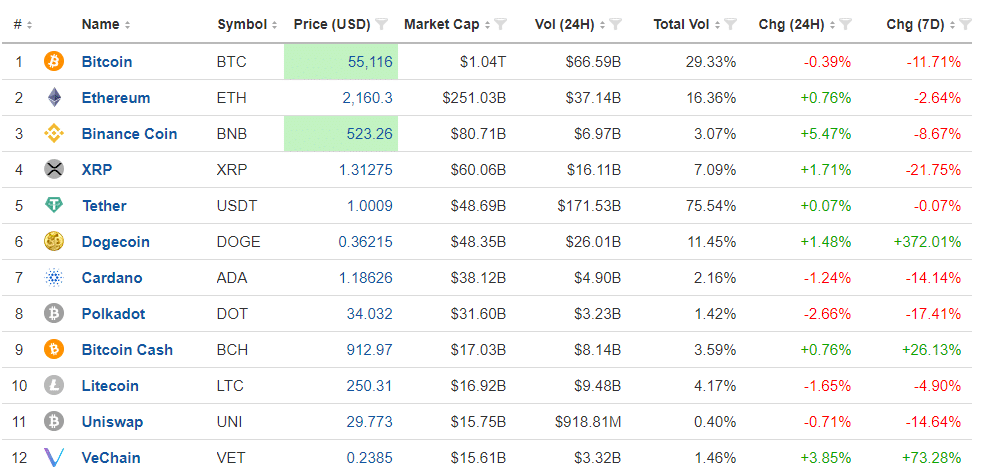

Besides, it is possible to day trade in the crypto market, especially now that the digital currencies have become a widely accepted product in financial markets. Some of the major cryptocurrencies include Bitcoin, Ethereum, Dogecoin, and Ripple.

The screenshot below, which includes the daily trading volumes of each entity, is a sign that cryptocurrency is the current big thing.

Utility tokens

It is a digital token distributed to investors in exchange for funds in an initial coin offering (ICO) or other cryptocurrency projects. In an ICO, the utility token gives the investors a stake in its product rather than the firm itself. However, utility tokens are a rather risky investment option as investors buy them based solely on the optimism that the product’s value will increase significantly.

Cryptocurrency funds

A crypto fund enables investors to invest in the crypto world by purchasing and trading the assets on behalf of the individual. Similar to a typical mutual fund, the portfolio manager decides on the digital currencies and companies to include or avoid. Some of the viable crypto funds, which double up as cryptoassets, include 21Shares Ripple XRP ETP and Grayscale Bitcoin Trust.

Blockchain stocks

The blockchain technology is the foundation of cryptoassets. With the overwhelming acceptance of cryptos, blockchain stocks are a viable investment option. This includes publicly traded companies whose focus is on a specific aspect within the crypto industry. For instance, Marathon (NASDAQ: MARA) is a crypto mining firm. With the value of Bitcoin surging by about 799% over the past year, this stock is set to rally by 7,600% during that period.

Tesla, which now accepts Bitcoin as a mode of payment is another viable blockchain stock. Other options include Mastercard and Riot Blockchain Inc.

In addition to the identified types of cryptoassets, other examples include security tokens and stablecoins.