What is a commodity currency?

A commodity currency refers to a currency whose value is influenced by the price movements of its major natural resources. Typically, such a currency will strengthen when the price of the commodity in question is higher. The correlation is founded on the fact that the currency’s demand will increase as the nation exports the commodity.

Examples of commodity currencies

Comparing the movement of some key commodity currencies in relation to various commodities will give you a better understanding of this group of currencies.

New Zealand dollar (NZD)

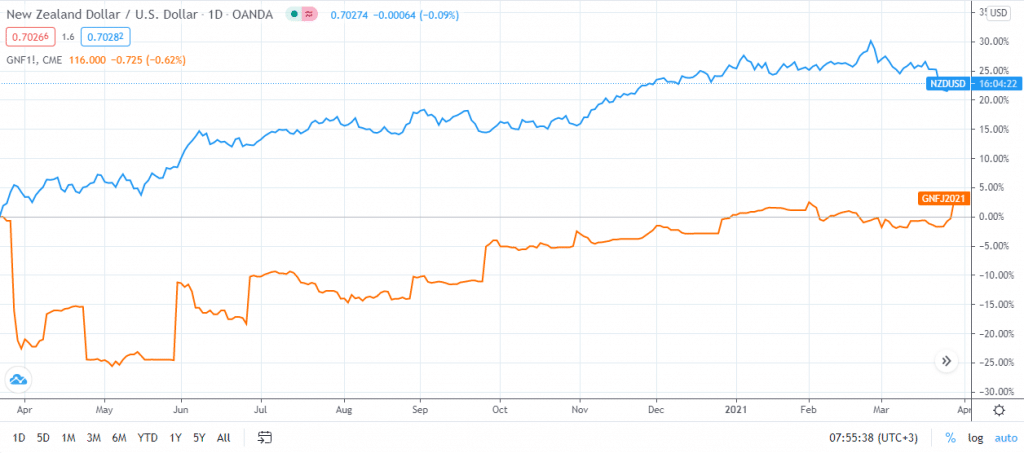

As one of the major commodity currencies, the value of the New Zealand dollar tends to have a direct relationship with milk prices. This correlation is founded on the fact that the nation is the top exporter of agricultural products. Subsequently, the rise in milk prices often strengthens the New Zealand dollar as the commodity’s demand rises. The country is also a major producer of meat and lumber.

NZD vs. milk price

Australian dollar (AUD)

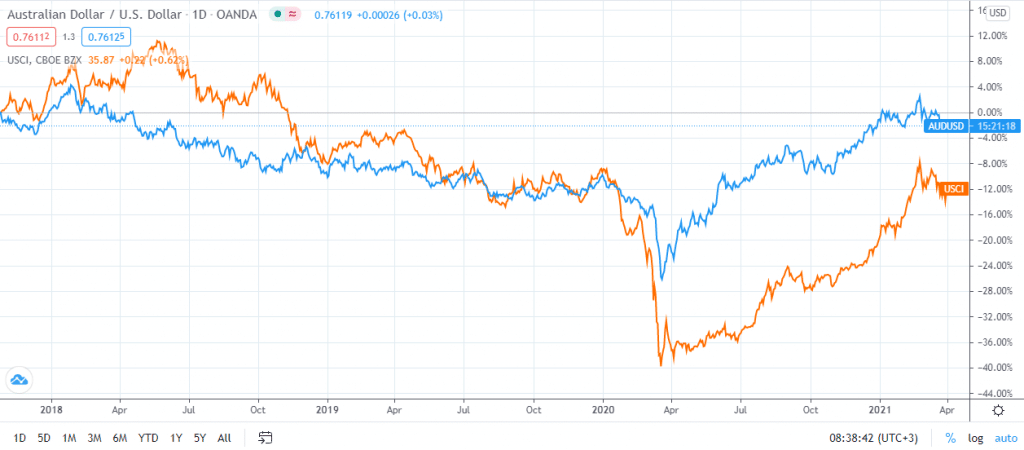

Australia is filled with various natural resources, including zinc, copper, and gold. Minerals account for 7% of the country’s GDP. According to Geoscience Australia, the nation is ranked the top producer of iron ore and bauxite and second in lead, gold, and zinc. Besides, it is in the world’s fourth position in silver and black coal production and fifth in copper, cobalt, and aluminum.

With its vast mineral reserves, AUD is often impacted by the price movements of these commodities. The chart below compares the movement of AUD/USD with the commodity index. Between mid-March 2020 and mid-February 2021, commodity prices surged as a weak US dollar made it cheaper for buyers. During the same period, the Australian dollar strengthened steadily against the US dollar.

Canadian Dollar (CAD)

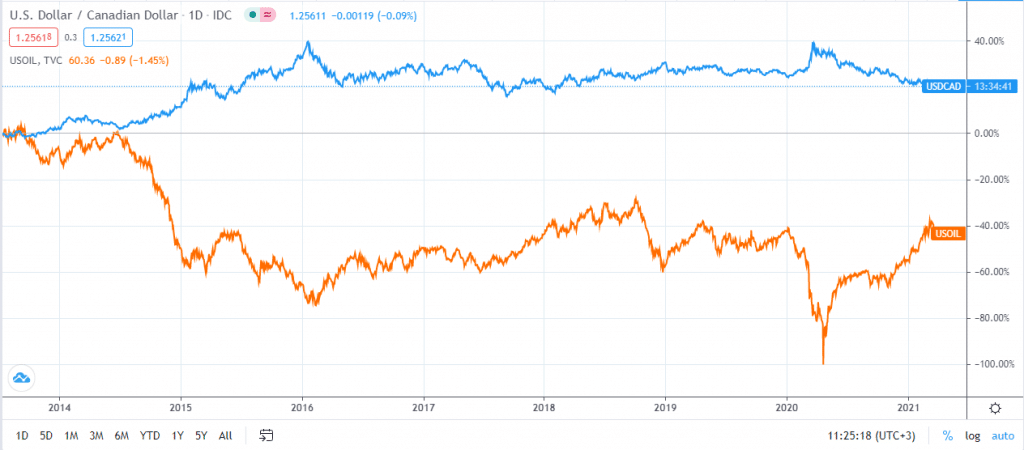

The Canadian dollar has a significant correlation with the crude oil price. The resource is the top source of foreign exchange for the country. Besides, Canada is ranked fifth in the list of major crude oil producers and exporters. 95% of its oil exports head to the United States, which equates to about 40% of the US oil imports.

A comparison between USD/CAD and crude oil price indicates an inverse relationship. This means that when crude oil prices are on the rise, the Canadian dollar strengthens against the US dollar.

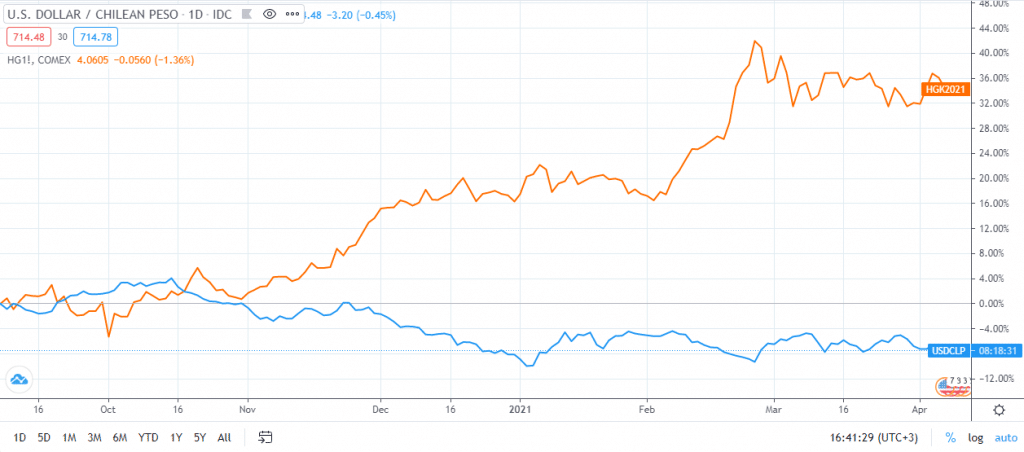

Chilean Peso (CLP)

The Chilean economy is among the emerging markets. It is ranked the top producer of copper, a resource that has positioned it as one of the key commodity currencies in the world. A look at the chart below shows an inverse relationship between copper prices and USD/CLP. This is because when copper prices are low, the Chilean Peso weakens against the US dollar and vice versa.

Other than the availed examples, there are other major commodity currencies in the market. For instance, Brazil is a key producer of agricultural commodities like soybeans and sugar. As such, the value of the Brazilian Real is often influenced by the price of these commodities, making it a commodity currency. There are also some other currencies that are not widely traded in the market. These include the Nigerian naira and Qatar rial, which are influenced by the oil prices.