Definition of a bag holder

In a stock market, a bag holder is an investor who holds on to a position even when the security is clearly underperforming. They end up being the owners of a worthless investment. All this while, such investors hang on to the hope that the asset’s value will bounce back. Granted, there are instances when security’s prices shoot back up. However, this is often the exception rather than the norm.

Bag holding should not be confused with the cancellation of market noises. The latter case is characterized by intraday volatility and short-lived price corrections. On the other hand, bag holding becomes evident when you are holding on to an asset whose value has been steadily declining. Besides, the fundamentals usually substantiate the fall.

The reasoning of a bag holder

There are several psychological theories that explain the decision made by a bag holder. To start with, an investor could hold on to loss-making equity due to their unwillingness to accept that they made an irrational investment decision. Hanging on the security even when it is clearly underperforming becomes a way for the trader to prove the system and everyone else wrong while proving him/herself right.

The disposition effect theory also explains the psychology behind the bag holding habit. According to this phenomenon, humans detest losing way more than they enjoy a win. This explains why one would choose to have $100 all to himself rather than get $200 and then have to give away $100. From this perspective, an investor may end up selling shares whose prices are on an uptrend while holding on to an investment that is on a downtrend.

A real-world example of the bag holding

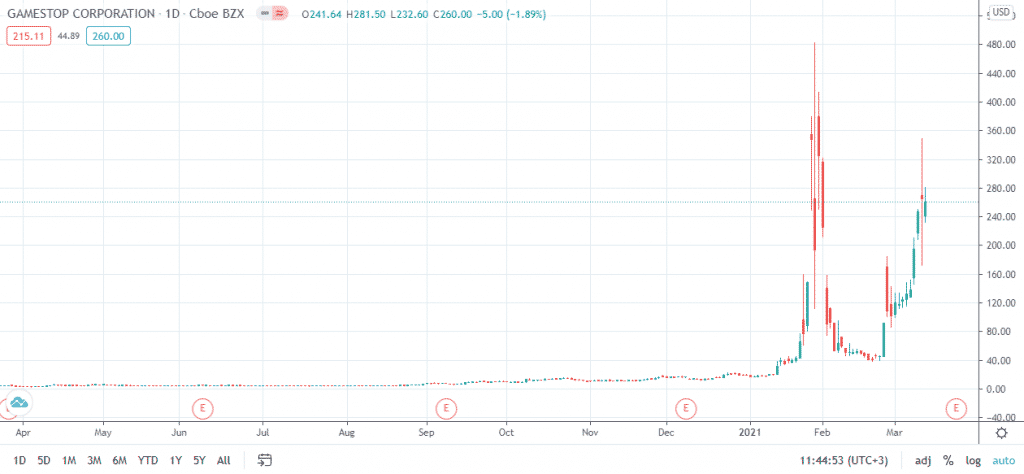

One of the recent and practical examples of the bag holding habit is the GameStop saga. In January 2021, hedge fund managers and other professional investors were of the opinion that the company’s shares would decline further. At that point, GameStop was one of the unattractive stocks in the market. However, retail traders in the r/WallStreetBets community managed to push its share prices to unimaginable heights. Within a few days, the market value of the video game retailer had shot from $2 billion to $24 billion.

All of a sudden, the company whose share price had remained below $20 for a long period was now past $480. During this period, a large number of retail traders bought the firm’s shares with the hope that the prices would continue to soar. However, some of them held on to the equity even as it dropped drastically to below $50. This group of traders, who maintained the position that the shares would surge again, are referred to as bag holders.

While it is a risky and unreliable approach, there are rare instances when bag holding pays off. The example in question is one such scenario. Since late February, the company’s share price has been on an uptrend. In what looked like a déjà vu moment, the prices surpassed the $350 mark on 10th March. This is seen as an apt moment for the bag holders to exit the trade as a way to cap their losses.