Tickmill Group Limited operates as a brokerage entity running offices under the trademark Tickmill ltd in different sections of the globe. The company’s offices hover around Seychelles, Cyprus, among other places, while its head office operates in London, Britain. Tickmill Ltd strives to provide forex and CFDs trading to retail and institutional traders with ultra-fast executions and tight spreads in diverse markets.

Pros

- Low trading commissions

- $30 welcome account bonus

- Tight spreads starting from 0.0 pips

- Well-furnished educational sources

- Hedging and scalping allowed

- 85+ available trading instruments

- Deposit fees waived for one-time bank wire transfers of $5,000

- Copy-trading — yes, through myfxbook

- Dozens of trading tools, including Autochartist

- No requotes

Cons

- High minimum deposit compared with other brokers. The deposit is capped at $100

- Fees on the markup spread, especially for the classic account, as the spread starts from 1.6 pips

- Overnight swap fees

- Less tradable instruments compared to other brokers

Tickmill Group Limited pioneered in the financial trading space in 2014. The brokerage company aimed to deliver FX and CFDs trading services to both retail and corporate traders. Over time, it expanded to attain this milestone and now operates a stream of offices worldwide serving large pools of newbies, intermediaries, and veteran traders.

Under the trademark Tickmill Ltd., the conglomerate offers retail and institutional clients a portfolio of assets trading with tight spreads starting from 0.0 pips and execution speeds of up to 0.20 seconds.

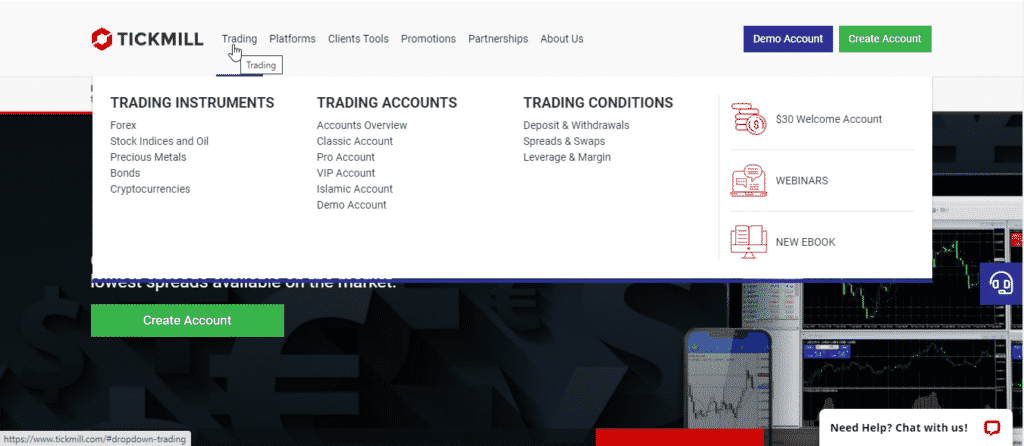

The asset basket holds products such as:

- Forex pairs

- Stock indices and oil

- Precious metals

- Bonds

- Crypto

These asset classes yield 80+ tradable instruments that traders access through the broker’s accounts, giving Tickmill traders a chance to diversify their portfolios. However, with the spectrum of account types offered, clients face different trading conditions. Some experience fees on the markup spread, while others incur low trading commissions.

The array of accounts includes:

- Classic

- Pro

- VIP

- Islamic

The minimum deposit also varies through the accounts as classic account traders only need a minimum of $100 while the amount stretches to $50,000 for VIP clients. But the broker waives all fees on deposits of up to $100 and one-time deposits of $5,000. To meet the demands of its array of clients, Tickmill provides multiple deposit and withdrawal methods.

They include:

- Bank wire transfers

- E-wallets like Skrill and Neteller

- Credit/ Debit cards like Visa

Amid funding the account, the broker provides a good trading experience aided by unique trading platforms. It provides diverse versions of the MT4 and MT5 available on a wide range of interfaces and integrates with sophisticated tools and plugins such as:

- Autochartist

- Myfxbook copy trading

- Economic calendar

- FX calculators

- VPS

Nonetheless, the broker claims to provide tamper-proof security of clients’ funds through several strategies. It notes holding its clients’ funds in top-tier banks and segregates it from the broker’s capital. Besides, it also offers negative balance protection and curbs clients from inactivity fees. Moreso, Tickmill reiterates having regulation from bodies such as:

- The FCA

- The FSA of Seychelles

- The CySEC

- The FSA of Labuan

- The FSCA

Regulation

As mentioned in this review, Tickmill Ltd is authorized by reputable regulatory agencies. These include both top-tier and two-tier regulatory bodies making the broker safe for financial trading services. Generally, the broker holds the following regulatory licenses.

- License number SD008, issued by the Seychelles Financial Services Authority (FSA)

- Registration number 717270, credited by the Financial Conduct Authority (FCA)

- License number 278/15, granted by the Cyprus Securities and Exchange Commission (CySEC)

- License number MB/18/0028, attained from the Labuan Financial Services Authority

- License number FSP 49464, issued by the Financial Sector Conduct Authority (FSCA) of South Africa

Pros

- Solid regulation background

- Regulated by both top-tier and two-tier agencies

Cons

- Unavailable in the US and in a couple of other nations

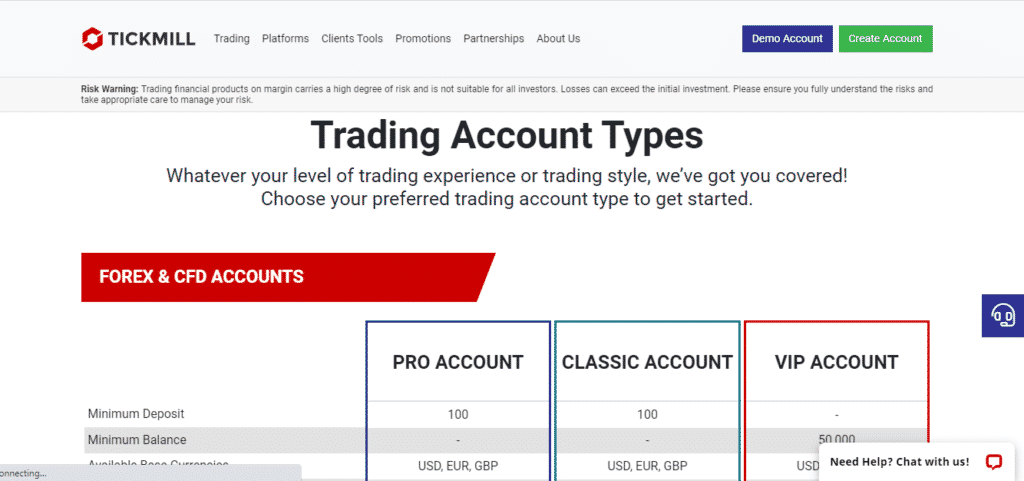

Account Types

Tickmill offers clients multiple accounts that come with varying trading conditions to speculate on Forex and CFDs.

Classic account

- Minimum deposit — $100

- Minimum balance — $0

- Available base currencies — USD, EUR, GBP

- Spreads from — 1.6 pips

- Max leverage — 1:500

- Min Lots — 0.01

- Commissions — no

- All strategies allowed — yes

- Swap-free Islamic account option — yes

Pro account

- Minimum deposit — $100

- Minimum balance — $0

- Available base currencies — USD, EUR, GBP

- Spreads from — 0.0 pips

- Max leverage — 1:500

- Min lots — 0.01

- Commissions — 2 per side per 100,000 traded

- All strategies allowed — yes

- Swap-free Islamic account option — yes

VIP account

- Minimum deposit — unlimited

- Minimum balance — $50,000

- Available base currencies — USD, EUR, GBP

- Spreads from — 0.0 pips

- Max leverage — 1:500

- Min Lots — 0.01

- Commissions — 1 per side 100,000 traded

- All strategies allowed — yes

- Swap-free Islamic account option — yes

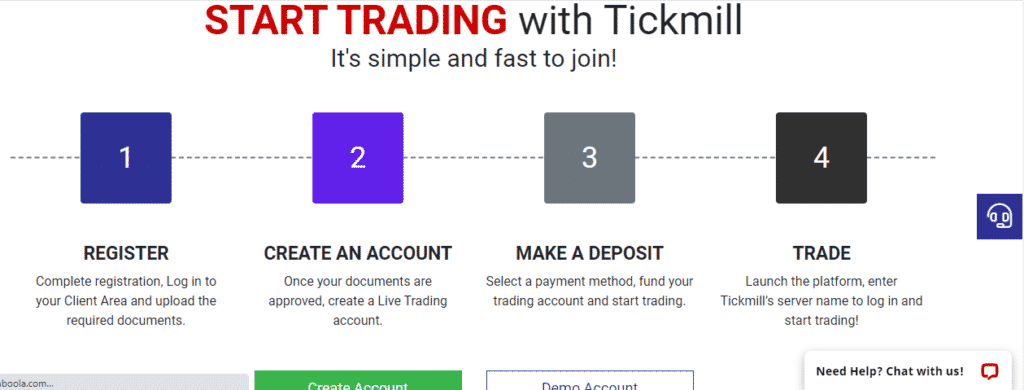

How to open a Tickmill account?

Clients have the opportunity to create either a demo account or a live account. The demo account acts as a learning tool for clients to upgrade their trading skills. However, creating a live account takes the following steps.

Step 1. Log in to Tickmill’s official website and click the create account button.

Step 2. Fill in your details on the form that pops up.

Step 3. Agree on the terms and submit the form.

Step 4. Verify your account by submitting KYC documents.

Step 5. Log into your account and fund it.

Step 6. Start trading.

Fees and Commissions

Tickmill Ltd waives almost all fees for clients but includes some fees depending on the volume of trades, on the markup spread, and on deposits above $100. It also charges fees on governing swaps. The minimum spread for some clients starts from 1.6 pips, suggesting the broker charges fees on the markup spread. Other clients incur 2 and 1 per side commissions on 100,000 trade volumes.

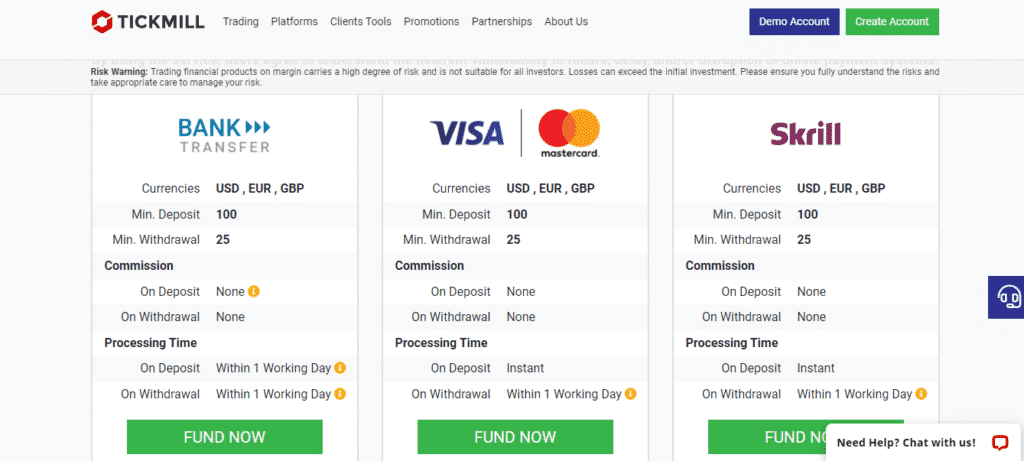

Payment options

The broker provides multiple funding methods with no fees or commissions. As noted in this review, clients have an array of payment options such as bank wire transfers, bank cards, and e-wallets to choose from when making transactions to their Tickmill trading wallet. The accepted currencies include USD, EUR, and GBP, and the minimum withdrawal amount is capped at 25 for all currencies.

Pros

- Multiple payment options

- Deposit and withdrawal is free

Cons

- Clients incur transaction fees for any deposit amount above 100

Deposit

Tickmill accepts deposits from these methods:

- Bank Cards like Visa, Mastercard

- E-Wallet transfers like Skrill and Neteller

- Bank wire transfers

Withdrawals

Deposit options apply to withdrawals.

Available Markets

As briefly introduced, Tickmill offers clients diverse markets to trade forex and CFDs aided by 24/5 multilingual customer support. It claims the markets’ instruments execute at speeds of about 0.20 seconds. Its spectrum of markets holds significant currency pairs, stock indices, and commodities such as oil, the world’s valuable metals, among others.

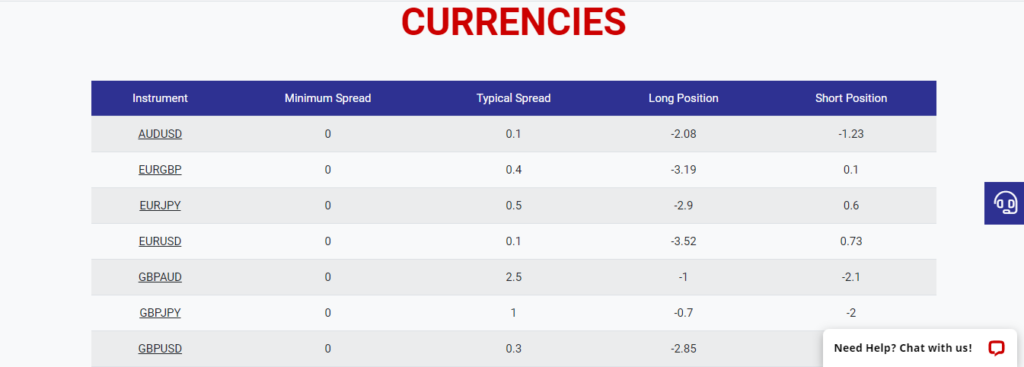

Forex

The foreign exchange market at Tickmill trades 24/5 with expert client support and holds 60+ currency pairs. These instruments include major pairs such as EUR/GBP, EUR/USD, and both minor and exotic pairs. They trade with spreads starting from as low as 0.0 pips to average around 0.4 pips and a leverage of up to 1:500.

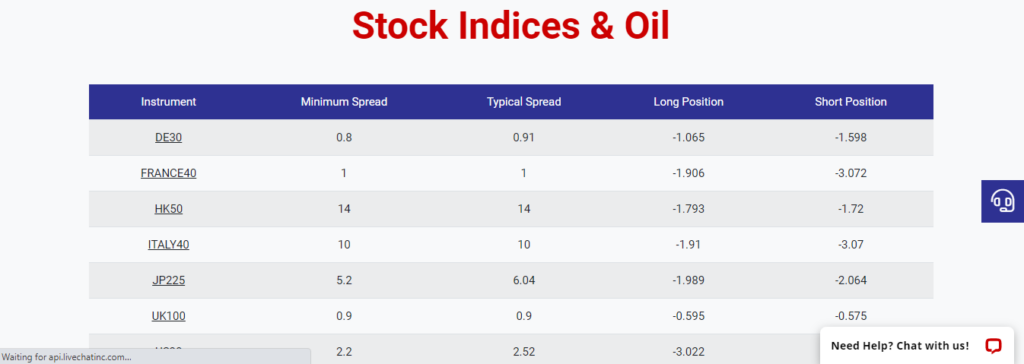

Stock indices and oil

Tickmill also opens the door for clients to trade a group of stocks as one tradable instrument through its stock indices market hosting the world’s global stock indices. These instruments trade with low spreads and leverages of up to 1:100. The broker also provides articles on how to trade stock indices and oil.

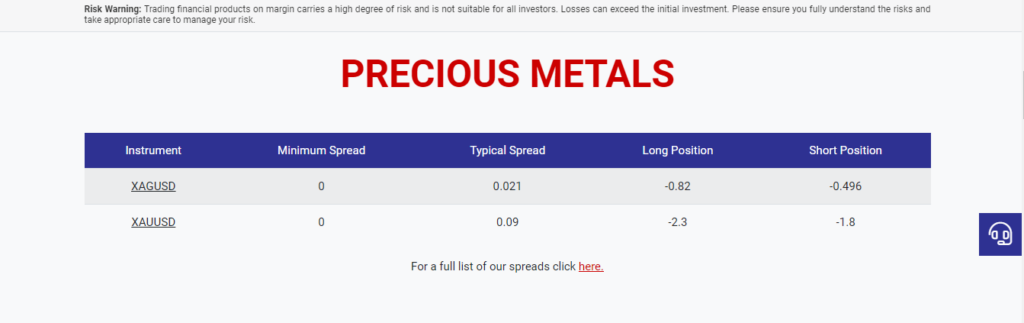

Metals

Tickmill allows clients to speculate on the value movement of the world’s valuable metals like gold and silver with spreads starting from 0.0 pips and a leverage of up to 1:500.

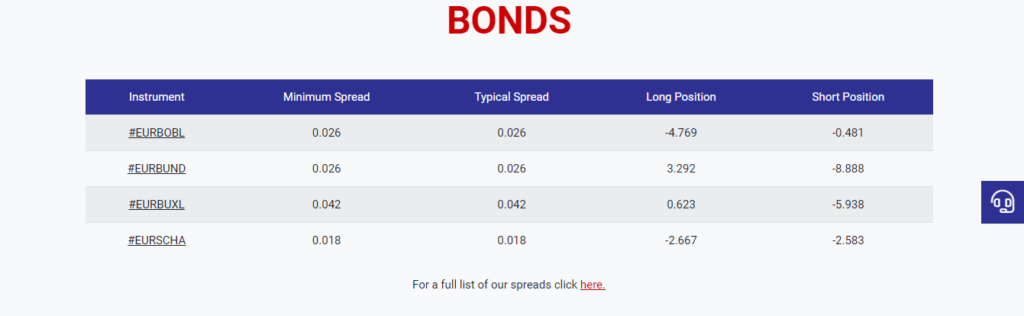

Bonds

Bond assets also trade on Tickmill as traders gamble on the falling and rising of these treasuries through CFDs. The instruments traded include the EURBUND, EURO BUXL, with spreads from 0.0 pips and a leverage of up to 1:100. Clients also have access to German bonds.

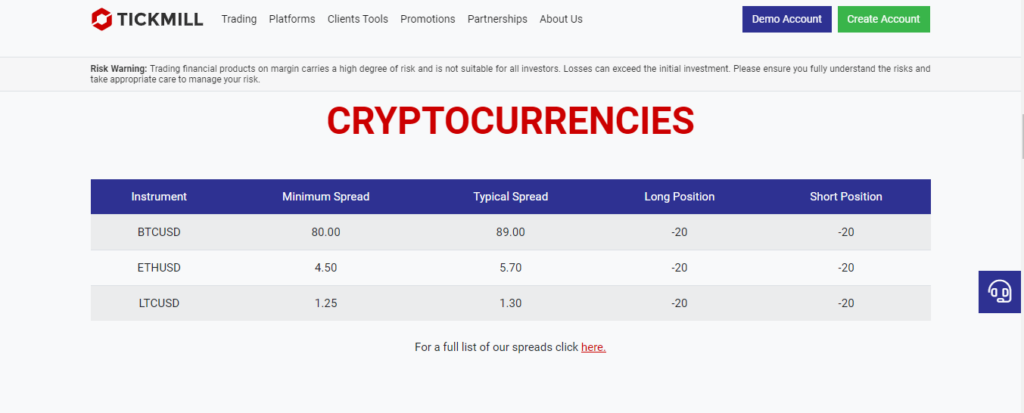

Cryptocurrencies

Traders have the chance to go long and short on one of the world’s most volatile markets. At Tickmill, the crypto market holds instruments such as BTC, Litecoin, and Ethereum, trading with ultra-fast executions and leverage up to 1:2.

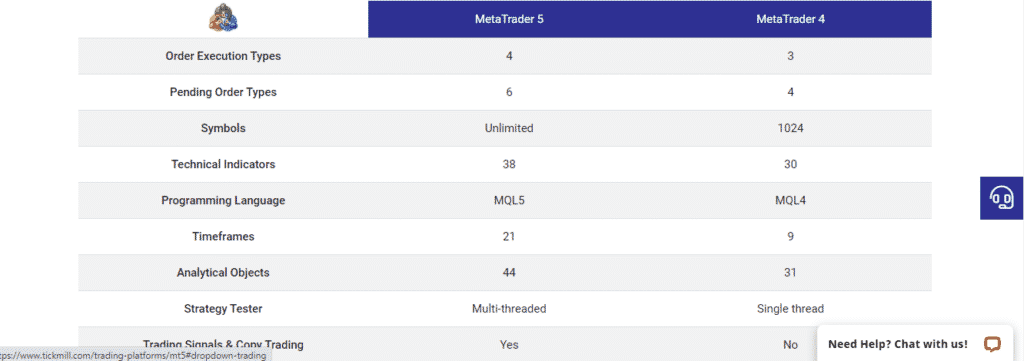

Trading Platforms

MetaTrader 5

- Order execution types — 4

- Pending order types — 6

- Symbols — unlimited

- Technical indicators — 38

- Programming language — MQL5

- Time frames — 21

- Analytical objects — 44

- Strategy tester — multi-threaded

- Trading signals & copy trading — yes

- Reports — charts & tables

- Built-in Economic calendar — yes

MetaTrader 4

- Order execution types — 3

- Pending order types — 4

- Symbols — 1024

- Technical indicators — 30

- Programming language — MQL4

- Timeframes — 9

- Analytical objects — 31

- Strategy tester — single-threaded

- Trading signals & copy trading — no

- Reports — tables only

- Built-in Economic calendar — no

Features

Tickmill features generally include:

Trading tools

- Autochartist

- Expert advisors

- Trading calculators

- charting tools

- Tickmill VPS

Analytical tools

- Market watch information tools

- Technical analysis tools.

- Indicators

- Signals

Education

Tickmill helps traders upgrade their trading skills and knowledge using its vast and resourceful education materials. It provides rich educational sources such as Ebooks, Video tutorials, articles, seminars, webinars, among others, on its website.

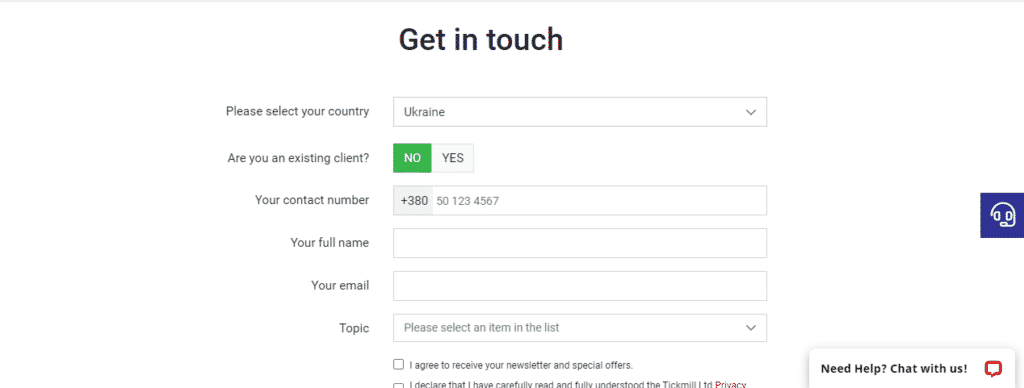

Customer Support

The broker provides multilingual customer support accessed via the website through the contact us button. Traders interact with the live support 24/5 by calling, sending a message, or filling a direct form. In addition, the broker also offers a furnished FAQ section that solves the most obvious client questions.

Review Summary

Tickmill Ltd is deemed as a safe broker due to its reputable regulation background and huge clientele. The brokerage company made its debut in the financial trading space in 2014, aiming to offer forex and CFDs trading services to both retail and institutional traders. In the last 7+ years, the company expanded, opening offices around the globe and diversified its assets.

Currently, more than 150K+ clients trade a wide range of assets with fast executions and low spreads, proving to be a good platform for all sorts of traders.