The chief of the New York Federal Reserve recently addressed the current state of the US interest rate, emphasizing that it has reached or is close to its peak level. However, he also stressed the importance of keeping borrowing costs high for a significant period to effectively combat inflation.

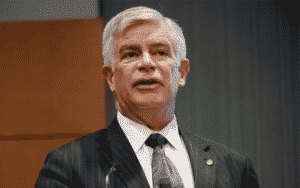

According to New York Fed President John Williams, while inflation has decreased from its peak in the previous year, it still remains unacceptably high. He believes that there is still work to be done in order to fully restore price stability.

Unfortunately, Williams was unable to deliver this speech in person due to an urgent family matter, as stated by the Fed.

Williams acknowledged that progress has been made in the fight against inflation. He specifically highlighted a significant slowdown in the rising costs of goods, which was achieved by resolving supply-chain bottlenecks.

Nevertheless, Williams identified the most significant challenge as ensuring that the costs of housing and labor continue to ease. The recent surge in inflation has been mainly driven by escalating home prices, rents, and wages.

However, he did observe that shelter costs have somewhat subsided and the labor market is also cooling off. Despite these positive developments, the Fed still needs to witness further slowdowns in both categories to be confident that inflation is moving towards the desired 2% goal. Currently, inflation is running at approximately double that rate.

Williams projected that the rate of inflation would gradually decrease to 3.25% by the end of 2023, 2.5% in 2025, and ultimately close in on 2% in that same year.

To achieve this, Williams believes that a restrictive monetary policy should be maintained for an extended period.

Last week, the Fed decided to keep its benchmark short-term interest rate unchanged within a range of 5.25% to 5.5%. However, it kept the possibility of another rate hike before the end of the year open if inflation does not further subside toward the Fed’s 2% target.

Nevertheless, not all members of the Fed are in agreement regarding an additional rate increase. Out of the 19 governors and regional bank presidents, 12 predicted one more hike, while seven expect rates to remain at the current level.

In a surprise move for Wall Street, senior Fed officials also revised their prediction from four rate cuts to just two for next year, reinforcing their strategy of a more prolonged period of higher rates.

Read: Fed predicts ‘soft landing’ for the economy – low inflation and no recession