Shares of Tesla dropped 6.4% in premarket trading on Monday after being added to the S&P 500 Index. The slip follows Friday gains of about 5% when tens of millions of Tesla shares were bought by Index-fund managers.

- Market strategists have been divided on how the addition of Tesla’s volatile stock would impact the S&P benchmark gauge.

- “There is strong precedence for positive returns for stocks prior to S&P 500 inclusion and post-announcement, but very limited precedent for near term outperformance post inclusion”- Toni Sacconaghi, Sanford C. Bernstein analyst.

- Interactive Brokers’ Chief Strategist Steve Sosnick expects daily moves of about 4% up and down of Tesla’s stock, which could end up budging the S&P 500 index by about 2 points.

- Tesla has gained 731% this year in anticipation of historic inclusion, making it the biggest company to be added to the S&P 500 benchmark.

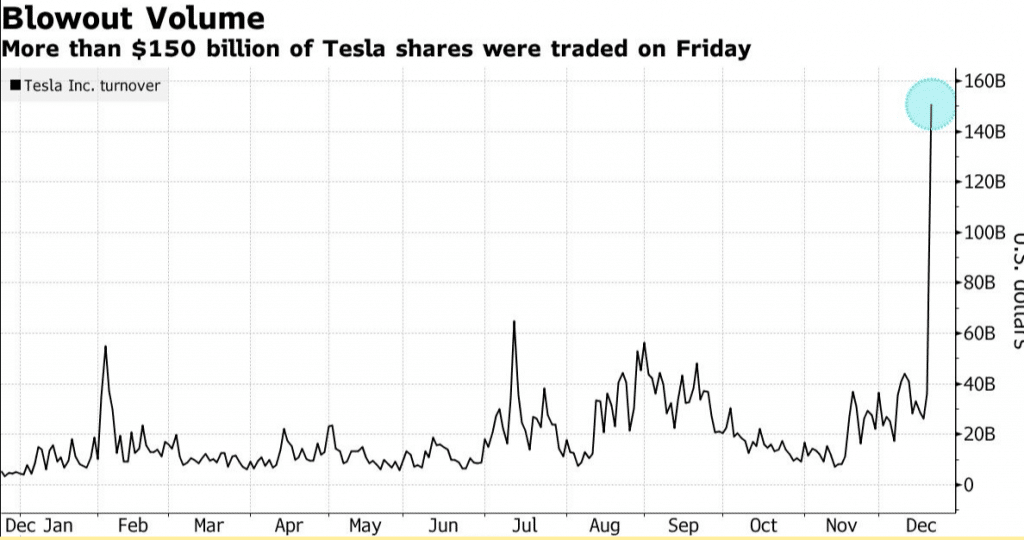

- More than $150 billion worth of Tesla shares traded on Friday, ahead of inclusion into the benchmark

- Overall, future contracts on S&P fell by 2.5% as European stocks traded lower following a suspension of travel from the UK on concerns of a new coronavirus strain.

Tesla’s stock is currently declining. TSLA: NASDAQ is down 4.79% on premarket