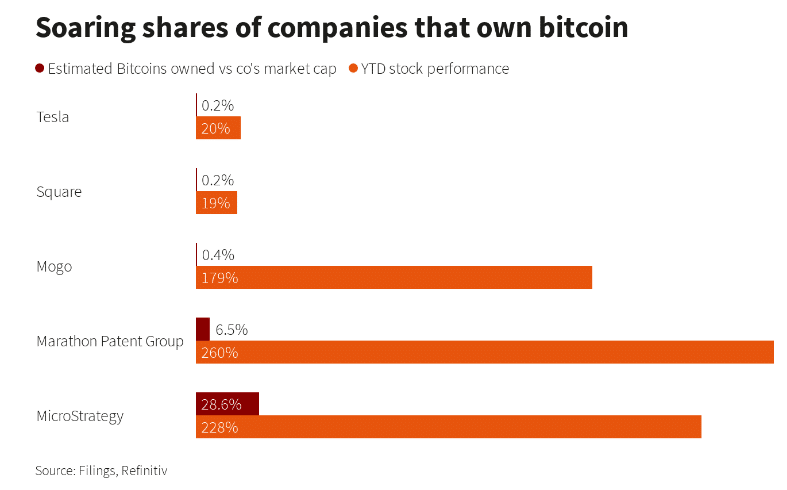

Shares of companies that have invested in Bitcoin have outperformed on Wall Street due to Tesla’s $1.5 billion bet on the digital currency, according to Reuters. Bitcoin hit a record high of over $48,000 on Tuesday after Tesla bought the digital currency and said it would soon accept it as a payment method.

- Some other Bitcoin-related companies listed on U.S stock exchanges were also buoyed by news that Tesla has added the digital coin to its balance sheet.

- Although Tesla’s Bitcoin purchase is minor relative to its market cap, it bolstered the digital currency’s emerging credentials as a mainstream financial asset.

- Tesla gained after disclosing the Bitcoin investment on Monday, although it dipped 1.6% on Tuesday to retain a total gain of 20% in 2021, above S&P 500’s 4% rise.

- In October, PayPal Holdings joined the cryptocurrency market, allowing customers to buy, sell, and hold Bitcoin and other virtual coins, and its stock has gained 21% in 2021.

Bitcoin holding companies’ stocks are currently mixed. TSLA is up 0.0047% on premarket, SQ is up 1.27% on premarket, MOGO is up 43.62%, MSTR is down 2.66% on premarket, MARA is down 3.19%