Artificial intelligence (AI) continues to be a driving force in the technology sector, as evident in the recent surge of technology company shares. An example of this is Google’s parent company, Alphabet, which experienced a rally in its stock following reports of enhancements to its Bard generative AI software. Alphabet’s move is aimed at challenging OpenAI’s ChatGPT for dominance in the emerging field.

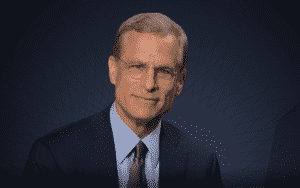

In line with this trend, mega-cap tech stocks are no longer the sole beneficiaries of stock gains. According to JJ Kinahan, Chief Executive of IG North America and President of its brokerage tastytrade, the rally is spreading beyond the so-called ‘Magnificent Seven’ tech companies. This shift in momentum is attributed to the growing optimism surrounding new revenue streams stemming from the AI sector.

However, the supply of specialized semiconductors may impose some limitations on the potential of AI-driven revenue streams. Kinahan raises concerns about the availability of these semiconductors and suggests that despite the smoke surrounding AI, it remains to be seen if there is a fire in terms of sustained success.

Meanwhile, it has come to light that the Federal Trade Commission is investigating whether ChatGPT, developed by OpenAI, has caused harm to individuals by publishing false information about them. This inquiry reflects the need for ethical considerations to be prioritized as AI technologies continue to evolve.