United States-based brokerage company TD Ameritrade offers both trading and investment services of financial assets. There are stocks, options, futures, mutual funds, among an array of other instruments.

The broker notes having over 40 years in the trading industry and holding a portfolio of awards bolstered by the quality of investment and trading services it offers to clients.

Pros

- No commissions and hidden fees

- Excellent order routing for best stock prices

- Several asset classes to trade or invest in

- Over 40 years in the trading industry

- Well-established company

- Multiple accounts to choose from

- No minimum deposit for standard account users

- Several payment methods

- Quality trading platform with smart tools and plugins

- 24/7 customer support

Cons

- Not available to worldwide clients — only offered US-based clients a spectrum of Hong Kong and Singapore clients

- Investing or trading conditions vary depending on the account type

- The deposit amount depends on the account type. For example, margin account traders must fund the account with $2,000 and above

- Offers fewer forex pairs compared with other brokers

- Authorized just by the SEC in the US

- Some assets have trading commissions

Founded four decades ago, TD Ameritrade’s objective hovers around putting smiles on its client’s faces in terms of financial freedom. The conglomerate serves millions of clients in America and an array of international clients with more than 175 branches scattered around the United States. TD Ameritrade confirms to offer quality investment services in stocks and a bunch of other assets and trading.

The assets offered include:

- Stocks

- Options

- ETFs

- Mutual funds

- Futures

- Forex

- Bonds

Clients trade and invest in these assets with no commissions nor hidden fees. They also experience the best stock prices due to the broker’s excellent order routing capabilities.

The broker’s accounts include:

- Standard account

- Retirement accounts

- Educational accounts

- Specialty accounts

- Managed portfolio accounts

- Margin trading account

The account clients choose on their trading and investment goals. The trading conditions differ through the accounts to meet different clients’ ambitions. For example, clients looking for retirement investments select retirement accounts tailored to provide valuable investment services.

As the trading conditions vary through the accounts, the minimum deposit changes as well. Only the standard account traders experience limitless deposit amounts with their minimum deposit capped at $0, but the broker emphasizes a minimum of $50 for effective trading and investments.

TD Ameritrade’s deposit methods include:

- Electronic bank deposit

- Wire transfer

- Check/cheque

- Account transfer from another brokerage firm

Amid funding your selected account, the client experiences efficient trading of the broker’s assets through smart trading platforms integrated with sophisticated tools and plugins. The broker offers clients the ability to trade from any screen interface using its proprietary trading platform, dubbed the thinkorswim.

Clients access the platform as:

- Web platform

- Desktop platform

- Android platform

- IOS platform

Regulation

TD Ameritrade abides by financial asset trading laws aired and imposed by America’s Securities and Exchange Commission (SEC) with the US-based imprint.

Pros

- Regulated by the SEC

- Well-established in America

Cons

- Only available to US clients and a few clients in Hongkong and Singapore

Account Types

As reiterated in this review, TD Ameritrade offers diverse account types tailored to provide trading and investment services to various clients depending on their preferences.

Standard account

- Comprehensive investment products

- Access to intuitive platforms

- Flexible accounts, including individual and joint accounts

- Hava ability to upgrade and tailor your accounts to options, futures, or forex

- No minimum funding required to the standard account

- But electronic funding minimum is capped at $50 for effective trading and $2,000 for margin or options privileges

Retirement accounts

Diverse retirement accounts designed to meet client’s income and lifestyle needs.

Traditional IRA account

- The traditional IRA account provides immediate tax benefits

- Place up to $6,000 of tax-deferred income in the IRA

- IRA account owners also contribute an additional $6,000 per year

- Account owners aged 50 years and above contribute an additional $1,000

- No income limits

- No minimum initial deposit required to open the account

- No maintenance fees

- Commissions, services, and exception fees still apply

Roth IRA

- Traditional IRA contribution limits apply to the Roth IRA account, but no tax deductions

- Earnings grow tax-free

- Withdrawal funds at your own time

- The above privileges apply to 59 and half years aged clients, disabled, or passed away clients

- No minimum initial deposit

- No maintenance fees

Rollover IRA

- Allows clients to consolidate their retirement by rolling their old 401k over into one account

- Clients experience fast and hassle-free processes

- No initial minimum deposit

- No maintenance fees

SEP IRA

Simplified Employee Pension Plan (SEP) IRA serves self-employed individuals and small business owners and employees.

- Quick and easy to set up

- No employer tax filing

- No specific annual funding requirements

- Flexible contributions

- For employees 21 years and above

- No initial minimum deposit

- No maintenance fees

Educational accounts

529 plans account

- Offers potential tax benefits

- No income limitations

- No minimum annual contributions

Coverdell education savings account

- It helps pay a student’s qualified education expenses

- Money is tax-deferred

- The monetary size grows faster

- Contributions favor only individuals under 18 years

- Contributions are limited to tax deductions

- No minimum amount required to open an account

- $2,000 maximum per designated beneficiary

Specialty accounts

TD Ameritrade specialty accounts are tailored to provide services to specific individuals and institutions.

Trust account

- Owners can transfer assets to trustees to manage the assets

- No minimum funding required to open the account

- Margin or options privileges require a $2,000 minimum

Limited partnership

- Established for two or more individuals running a business for profits

- No minimum amount required to open the account

The specialty account bracket holds about ten accounts tailored to different services.

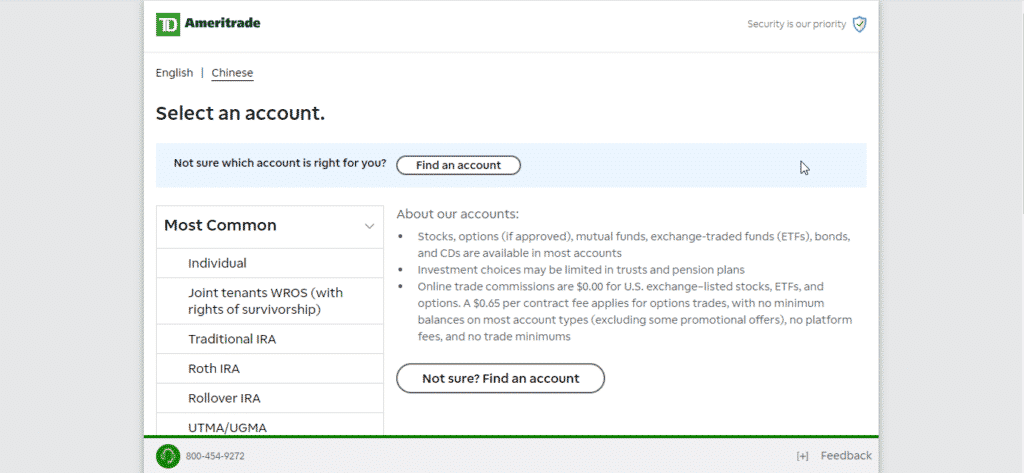

How to open a TD Ameritrade account

TD Ameritrade provides an effective account opening portal on its website aided by good customer service with a portfolio of accounts available to traders for both trading and investments.

The account opening process involves:

Step 1: Log in to their official website and click the open account button.

Step 2: Select your preferred account type.

Step 3: Fill the form that pops up asking for your details.

Step 4: Verify your account.

Step 5: Fund the account through any method provided and start trading. If it’s an investment account, contribute the amount required.

Fees and Commissions

TD Ameritrade waives several fees for clients but imposes charges and commissions on several trading and investment services. The broker mitigates the minimum deposit to $0 to a prospect of clients and skyrockets the value to $2,000 for clients looking for margin or options privileges.

Other fees include $0.65 on potions applicable to US exchange stocks per contract. Clients also pay for interactive voice response trading and a broker-assisted fee of $25.00. The broker also imposes a $2.25 fee on futures and options per contract. Other fees range from certificate of withdrawal fees, checkbook, stop payment, among others.

Payment options

As mentioned in this review, TD Ameritrade offers clients a spectrum of payment options, each offering unique transaction conditions. Electronic bank deposit takes only five minutes and averages between $50-$250,000, while wire transfers stretch up to 1 business day with no monetary limits. Else, cheque deposits take up to 1-3 business days, and broker to broker fundings takes almost a week with no limits.

Pros

- Multiple payment options

- No limit on deposits or withdrawals on some options

Cons

- Lots of service fee

Deposit

Deposit methods at TD Ameritrade include:

- Electronic bank deposit

- Wire transfer

- Cheque

Withdrawals

Deposit methods also apply for withdrawals.

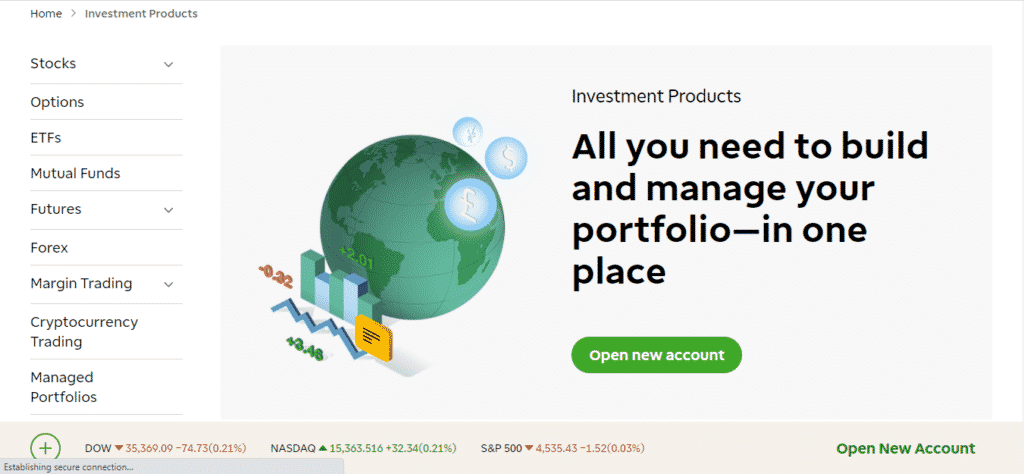

Available Markets

TD Ameritrade offers a spectrum of trading and investment products to clients. As noted in this review, the broker’s instruments include assets such as stocks, options, ETFs, mutual funds, among others.

Stocks

TD Ameritrade offers effective stock trading and investing 24/5 with real-time customer support. The instruments trade with $0 commissions and include domestic and international stocks offered via ADRs or IPOs. The broker also waives all fees on platforms and mitigates subscriptions for clients.

Other stock trading and investing features include:

- Intelligent order routing

- Powerful stock trading platforms

- Free independent research

- Helpful stock trading tools and research

Options

Traders hedge positions to yield good income. Options help traders double their income at times of high market volatility. TD Ameritrade provides a suitable environment for options trading using innovative platforms, educational resources, straight forward pricing, among other tools. The options market trades with no hidden fees and 24/7 customer support.

ETFs

TD Ameritrade offers both new and seasoned investors commission-free ETF trading from the most trusted brands in the ETFs niche. It blends these instruments with more innovative helpful tools to deliver the best ETFs trading and investment experience. Some of the tools and features that aid ETFs trading include:

- Helpful tools

- Comprehensive education

- Objective research

- 24/5 trading hours

- No hidden fees

Mutual funds

The broker allows clients access to more than 13,000 funds that trade 24/5 with a range of investment objectives and 0 transaction costs.

Other features include:

- Morningstar research services power the premier list

- A complete mutual funds toolbox

- Fully customizable

- Well diversified

Futures

TD Ameritrade futures market trades 24/6 with about 70 future products for clients to trade. The broker also offers micro futures on assets. This allows clients to diversify their portfolios and hedge against the rising prices of these assets.

Other trading features include:

- No hidden fees

- Extensive product access

- Innovative platforms

- Superior service

Forex

TD Ameritrade offers forex trading 23/7 through its accounts. It allows clients to trade 70 currency pairs composed of both significant and minor forex pairs. Clients experience effective trading fueled by world-class technology, innovative tools, and knowledgeable customer service.

Other features that give traction to a good forex trading environment include:

- No hidden fees

- Access to the thinkorswim trading platform

- Mobile trading

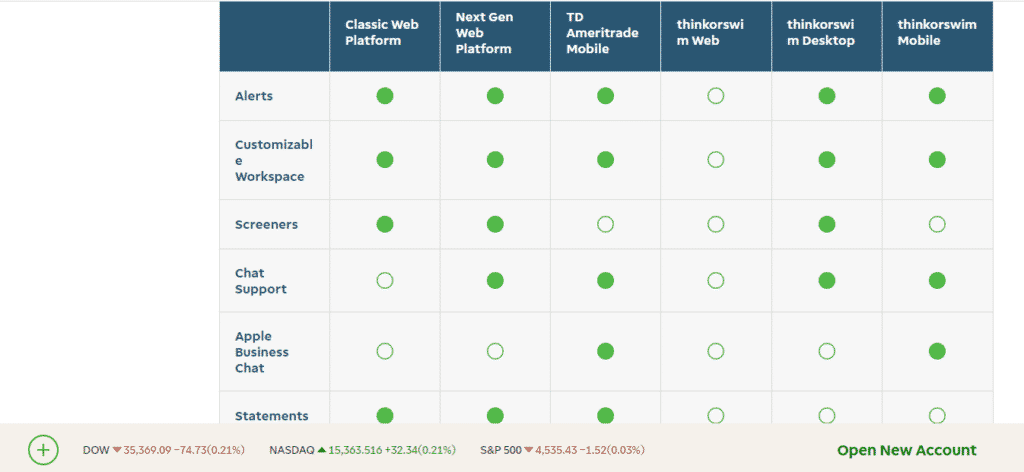

Trading Platforms

TD Ameritrade provides multiple trading platforms integrated with smart plugins and tools. Its proprietary trading platform, thinkorswim, meets the demands of clients trading a wide range of assets.

Analysis of the platforms

Classic web platform

- Trades all assets except futures and forex

- Market alerts — yes

- Customizable workspace — yes

- Screeners — yes

- Chat support — no

- Apple business chat — no

- Statements — yes

- Tax documents — yes

- Transaction history — yes

- External and internal cash transfers — yes

- Mobile check deposit — no

- Conditional orders — yes

- Level II quotes — yes

- Network and CNBC streaming — yes

- Visual positioning — no

- Virtual trading — no

Next-Generation web platform

- Trades all assets except futures, forex, and bonds

- Market alerts — yes

- Customizable workspace — yes

- Screeners — yes

- Chat support — yes

- Apple business chat — no

- Statements — yes

- Tax documents — yes

- Transaction history — yes

- External and internal cash transfers — yes

- Mobile check deposit — yes

- Conditional orders — coming soon

- Level II quotes — yes

- Network and CNBC streaming — yes

- Visual positioning — no

- Virtual trading — no

TD Ameritrade mobile

- Trades all assets except futures, forex, mutual funds, and bonds

- Market alerts — yes

- Customizable workspace — yes

- Screeners — no

- Chat support — yes

- Apple business chat — yes

- Statements — yes

- Tax documents — yes

- Transaction history — yes

- External and internal cash transfers — yes

- Mobile check deposit — yes

- Conditional orders — no

- Level II quotes — yes

- Network and CNBC streaming — yes

- Visual positioning — yes

- Virtual trading — no

Thinkorswim platform

- Trades all assets

- Market alerts — no for the web (but available on other interfaces)

- Customizable workspace — no for the web (but available on other interfaces)

- Screeners — no but available for the desktop version

- Chat support — no for the web but available for the other versions

- Apple business chat — only available for the mobile version

- Statements — no

- Tax documents — no

- Transaction history — yes

- External and internal cash transfers — only for the mobile version

- Mobile check deposit — no

- Conditional orders — yes

- Level II quotes — yes

- Network and CNBC streaming — yes

- Visual positioning — only for the desktop version

- Virtual trading — yes

Features

TD Ameritrade features generally include:

Trading tools

- Virtual trading

- Customizable interfaces

- Charting tools

Analytical tools

- Market watch information tools

- Technical analysis tools

- Indicators

- Signals

Education

TD Ameritrade provides rich education resources like guides, articles, and videos on trading and investing. Traders access these materials via its official website under the education button.

Customer Support

TD Ameritrade provides clients with real-time customer support 24/5 and sometimes 24/7 to a group of clients. Its customer support sources include a FAQ section, a live chat, and a contact us section.

Review Summary

TD Ameritrade provides trading and investment services to US-based clients and a small stream of international clients in Hong Kong and Singapore. The broker prides itself with over 40 years of experience serving both new and veteran traders in the trading industry. It operates under the US SEC laws making it a safe broker to invest and trade with.