After an impressive 700%-plus rally in the past year, Super Micro Computer Inc. is showing no signs of slowing down. The company is set to embark on a new convertible-debt offering, yet this news did not deter investors as the stock’s momentum continued to soar on Thursday.

Riding the Chip Sector Enthusiasm

Super Micro shares (SMCI) surged by 21% in morning trading, capitalizing on the positive sentiment in the chip sector following Nvidia Corp.’s remarkable results and optimistic guidance. Nvidia, a key partner of server maker Super Micro, acknowledged the latter during its earnings call, further boosting investor confidence.

Outperforming Peers

Super Micro’s morning stock rally outpaced even Nvidia’s impressive 15% surge, surpassing other notable semiconductor companies as well. Arm Holdings PLC, Advanced Micro Devices Inc., and Marvell Technology Inc. also saw significant gains, reflecting the overall positive outlook in the industry.

Semiconductor Sector Thrives

The iShares Semiconductor ETF (SOXX) rose by 4.6% in morning trading, marking its most substantial one-day increase since May 26, 2023. The ETF was poised to reach a new high, underlining the strong performance of semiconductor companies.

Nvidia’s Growth Trajectory

Nvidia’s stellar financial results and optimistic forecasts, particularly in the data-center market, contributed to the overall bullish sentiment in the semiconductor industry. With significant growth potential ahead, investors remain optimistic about Super Micro’s future prospects. Explosive Growth in AI Data Centers

In a recent earnings call, Nvidia’s Chief Executive Jensen Huang highlighted the surge of AI-dedicated data centers that are revolutionizing the industry. These centers are adept at processing vast amounts of raw data and transforming it into digital intelligence. Looking ahead, Nvidia foresees the potential for a significant growth in the installed base of data-center infrastructure, projecting a doubling of its size over the next five years to reach a staggering $2 trillion.

The Significance of Liquid-Cooling Technology

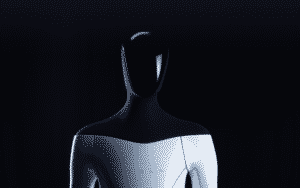

Amidst this AI boom, Super Micro is gaining attention for its innovative liquid-cooling technology. Analysts view this technology as crucial due to the high power consumption associated with artificial-intelligence workloads. By addressing this concern, Super Micro is positioning itself as a key player in the evolving landscape of data centers and AI processing.

Navigating Financial Developments

Despite facing some financial news, such as the proposal for a $1.5 billion convertible-debt offering with notes maturing in 2029, Super Micro’s stock continues to perform well. While convertible offerings can be dilutive in the long run, the potential impact on Super Micro appears manageable given the recent surge in its stock value. Although the stock experienced a slight pullback after a strong one-year performance, it is poised to bounce back after a brief losing streak.

Competitive Edge of Super Micro

As Super Micro demonstrates resilience and innovation in the face of financial changes, it solidifies its position as a frontrunner in the competitive AI market. The company’s ability to adapt to industry trends and deliver cutting-edge solutions is positioning it as a leader in AI processing and data center technologies.

In conclusion, the rapid growth of AI data centers, coupled with Super Micro’s technological advancements and strategic resilience, showcase a promising future for both companies in the dynamic landscape of artificial intelligence and data processing.