The number of Americans in retirement is growing fast. Data compiled by Statista shows that the number has increased from more than 33.5 million in 2009 to more than 45.1 million in 2019. As life expectancy continues to increase, this figure will continue rising. At the same time, most Americans are not prepared for retirement. A recent study showed that more than 64% of people are not prepared for their retirement. In this article, we will look at some of the best strategies for retirement planning.

Start investing for retirement early

The math is easy. The earlier you start planning, the better off your life will be. For example, assume that you are 20 years old and you decide to save $100 per month. By the time you reach the retirement age of 66, your savings account will have $55,200, assuming that the funds didn’t earn any interest. On the other hand, if you start this journey at 40, you will have just $31,200 when you retire.

Therefore, we recommend that you open a retirement savings and investment account as early as you can. As you will realize, the process will be so simple that you won’t even feel the pain.

Your IRA, Roth IRA, 401ks, and annuities

Another excellent retirement strategy is about your Individual Retirement Account (IRA). For starters, as the name suggests, this is a type of retirement tool that provides essential tax benefits to investors.

There are three main types of IRAs:

- Traditional IRA, where the investment’s taxes are tax-deferred. This means that you don’t include it in your annual tax returns.

- Roth IRA, where you pay taxes when making the investment. As such, you will not pay any taxes when you withdraw it during your retirement.

- Rollover IRA, which happens when you move funds from your 401k to either your Roth and traditional IRA.

Therefore, it is important that you create your IRAs as early as possible. Fortunately, there are many institutions in the country that can help you create a well-balanced IRA plan. Some of these are Vanguard, Fidelity, and Blackrock.

What is 401 (k)?

Another important retirement asset you can invest in is known as a 401 (k). A 401 (k) is similar to an IRA but the main difference is that the former is opened by your employer. The funds are deposited to your 401 (k) directly through automatic payroll withholding.

While a 401 (k) plan is ideal, a better option is to also match your employers’ payment. For example, if the employer pays 5% of your salary to your 401(k), you can decide to automatically pay a similar or less amount to your 401k.

Saving for retirement through insurance

Another concept in retirement we will only briefly look at here is an annuity. An annuity is insurance that you take from a regulated company. The idea is that you contribute a certain amount to the annuity plan in exchange for guaranteed payments for life.

In the United States, some of the biggest companies offering annuities are Allianz, New York Life, TIAA, and Lincoln Financial, among others.

Create a personal investment portfolio

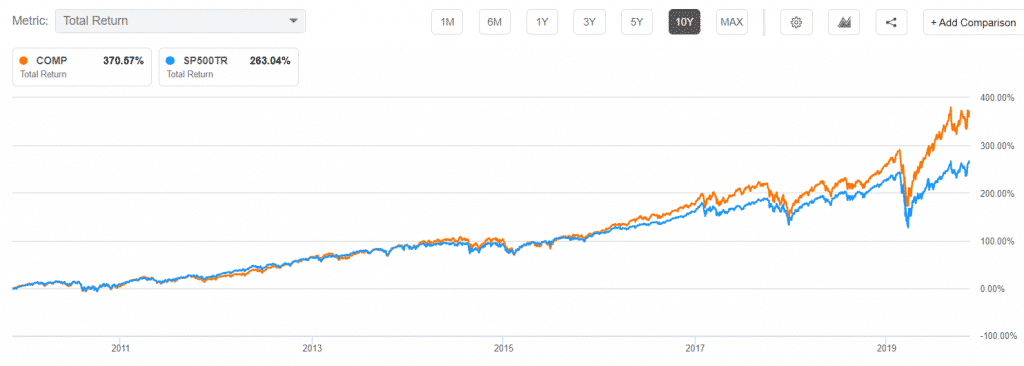

Another excellent retirement planning strategy is creating a personal investment portfolio. This is simply the process where you take your money and buy various assets. Going by history, the most efficient method of investment has been to put your money in index funds.

For example, in the past decade, the Nasdaq 100 index has had a total return of more than 400%. That means, if you invested $1,000 in the index ten years ago, it would now be worth $4,000. In the same period, the S&P 500 index has returned more than 300%.

Nasdaq 100 vs. S&P 500

The benefit of investing in index funds is that while they fluctuate in the short-term, the overall trend is usually positive. Another benefit is that an index fund is usually made up of many companies, which helps you ensure that it is diversified well.

Another approach is to select individual investments by yourself. There are several approaches to this. A popular way is creating a basket of investments. 40% of these investments can go to growth stocks like Amazon, Twilio, and Palantir Technologies. 25% of the assets should go-to dividend stocks like AT&T, Comcast, and Verizon.

At the same time, you can allocate 15% of your portfolio to risk assets like gold, Bitcoin, and silver. Finally, you can allocate the remaining 20% of your funds to bonds and international stocks.

Finally, if you are not well-versed in portfolio creation, you can decide to invest in a basket of low-cost exchange-traded funds (ETFs). Indeed, you can invest in sectoral ETFs like real estate, technology, consumer staples, and energy. By creating such a portfolio, you will be buying hundreds of companies while owning just 4 ETFs.

Invest in alternative assets

As demonstrated above, stocks or index funds are the best retirement investment assets. However, it is also worth setting aside some of your funds into alternative assets. Some of these assets are good hedges against risk and inflation. Others offer excellent returns that are uncorrelated to traditional assets. Some of the best alternative assets to add to your retirement funds are:

- Cryptocurrencies. We recommend that you only invest in the biggest digital currencies, like Bitcoin and Ethereum. Since these tend to be highly volatile, invest just a small portion of your portfolio in them.

- Real estate. Investing in real estate, especially rentals, can help you generate quality cash flow.

- Precious metals. You can invest in precious metals like gold, palladium, and silver.

- Private equity. While it is difficult for individuals to invest in private equity funds, you can still invest in public firms like Blackstone and Carlyle.

- Art, watches, cars, and wines. These assets tend to have excellent returns in the long-term.

Bitcoin has outperformed the S&P 500

Final thoughts

Retirement is an excellent time – if you are prepared well. It should be a time to travel the world, live in a good home, and ensure that all bills are paid. With the life expectancy rate growing, it means that you are likely to live for decades after retirement. Therefore, following these retirement strategies can help you maximize your returns and have a great retirement.