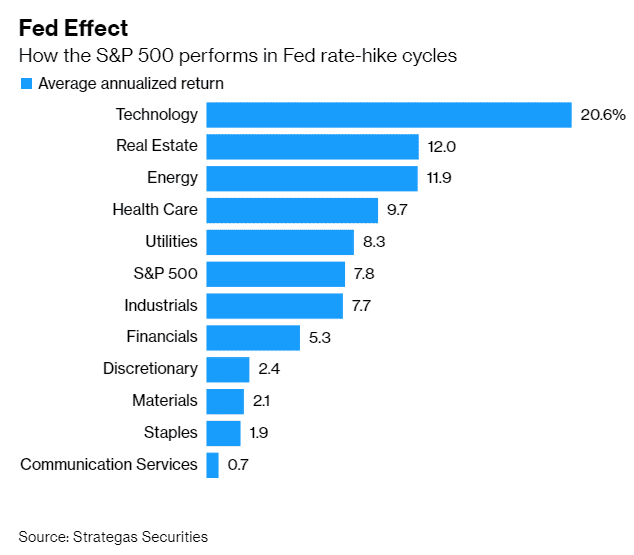

Nasdaq 100 rose 0.1% in late trading in New York on Monday, emerging from the ruins of a five-day selloff that gripped the markets after the Federal Reserve said it would hike rates sooner than expected.

Nasdaq components such as Microsoft and Apple had fallen up to 8.5% from the November record, pushing the index down in the last five days.

S&P 500 traded down 0.1%, a recovery from a loss of 2% earlier on Monday, with the decline connected to the Fed statement and concerns of the omicron variant which was seen to peak in New York.

Defiance ETFs chief investment officer Sylvia Jablonski says there are real risks relating to potential rate hikes by the Fed. She says the market is in a “fairly good spot,” with great buy opportunities following the dip.

Markets are still cautious, with the US inflation data, which is expected to show an increase on Wednesday, adding pressure to the central bank to tighten policy.

Goldman Sachs sees the Fed raising rates four times in 2022 and beginning its balance sheet rebalancing latest in July. The Fed had four distinct periods of interest rate increase cycles in the last three decades.