S&P Global Inc. has agreed to acquire IHS Markit Ltd for about $39 billion in stock, according to Bloomberg. S&P will offer 0.2838 shares for each IHS Markit share, about a 4.7% premium to IHS Markit’s last close, which translates to about 10 times earnings before interest, taxes, depreciation, and amortization (EBITDA).

- The deal brings together S&P, a famous name in financial markets, and a research firm that supplies forecasts and pricing for bonds and credit default swaps.

- The combined company will result in annual savings of about $480 million a year including optimizing the real estate footprint.

- After the deal, S&P shareholders will own about 68% of the combined company.

- The deal has an enterprise value of about $44 billion, including S&P’s assumption of $4.8 billion in net debt.

- The enterprise value is about 10 times IHS Markit’s revenue in the last financial year and 28.2 times EBITDA

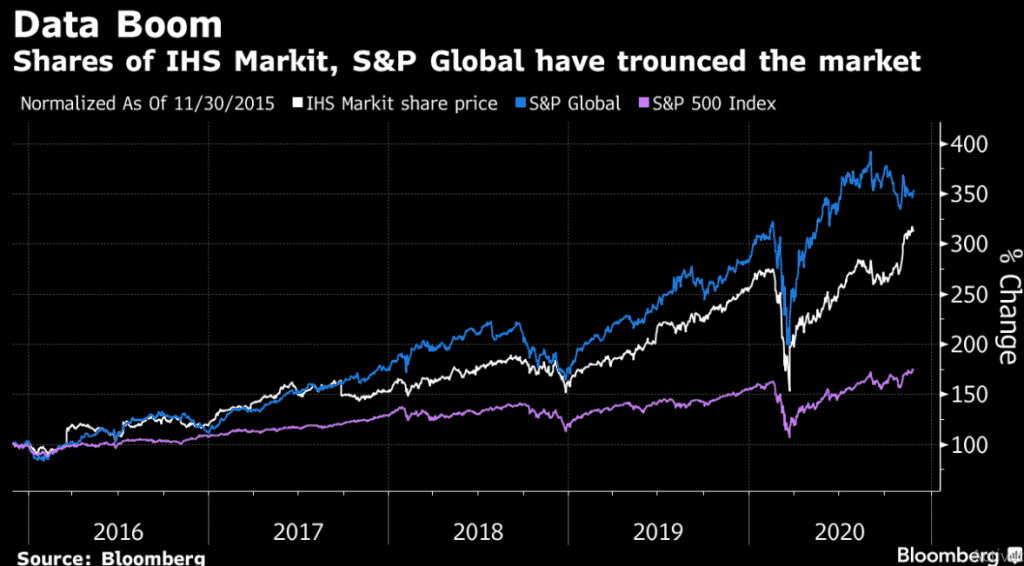

- Shares of S&P Global and IHS Markit have more than tripled in the past five years, providing sufficient liquidity for the deal

- A 2014 IPO valued IHS Markit at $4.5 billion, and the company has more than 5,000 analysts, data scientists, financial experts, and industry specialists.

- S&P and IHS deal could be hampered by regulatory scrutiny since both firms are data providers

S&P-IHS Markit’s deal would be the world’s second-largest acquisition of 2020. SPGI: NYSE is up 1.79%, INFO: NYSE is up 7.13%