(Bloomberg) S&P Global Ratings says China’s move to cut the reserve requirements ratio adding liquidity to the economy, would not save its property developers already in a debt crisis.

S&P director Esther Liu says the developers were already facing a funding crisis as main investors shunned them in the face of default risks. She expects heightened restructurings of debt in the wake of the crisis.

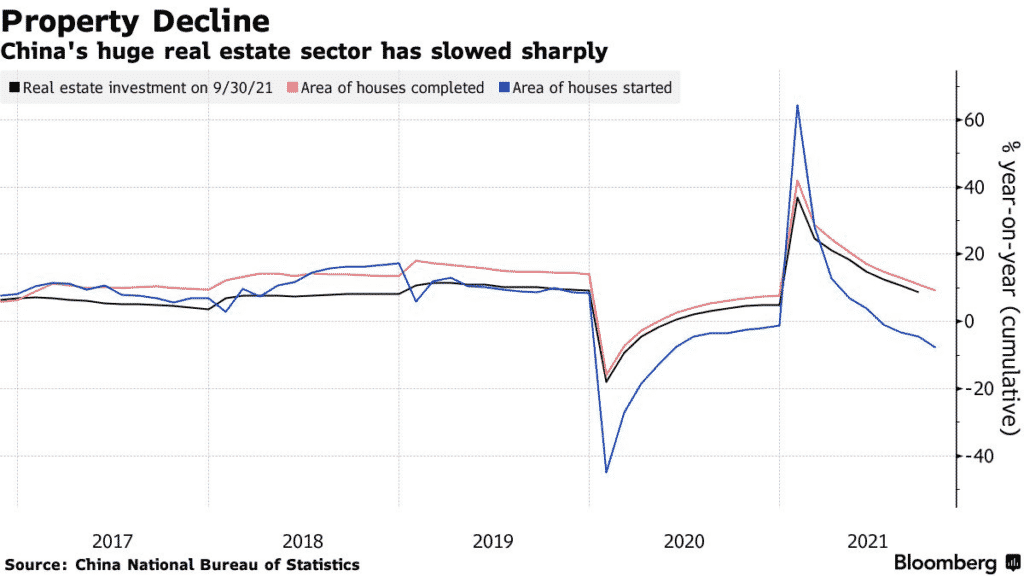

The global rating agency says the slump in the property market would continue given the credit tightening and Beijing’s restrictive policies in the sector.

S&P projects a 10% decline in residential sales in China in 2022 and a further 5% -10% slump in 2023. A third of Chinese developers could face liquidity over the next six months or a year in a worst-case scenario.

The comments by S&P happened after China’s central bank cut its reserve ratio by 0.5%, boosting the economy with $1.2 trillion yuan or $188 billion of liquidity.

3333: HKG is up +1.10%, 1638: HKG is up +1.10%.