(Bloomberg) A hawkish surprise from the Fed, overvaluation concerns, and expected slowdowns in growth have done little to deter S&P 500 rise. The index has defied odds to rise for seven months without a drawdown of 5%.

Fed’s hint on raising rates twice at the end of 2023 did so little to deter buyer sentiment as S&P rebounded from an initial 1% plunge to recover 50% of losses.

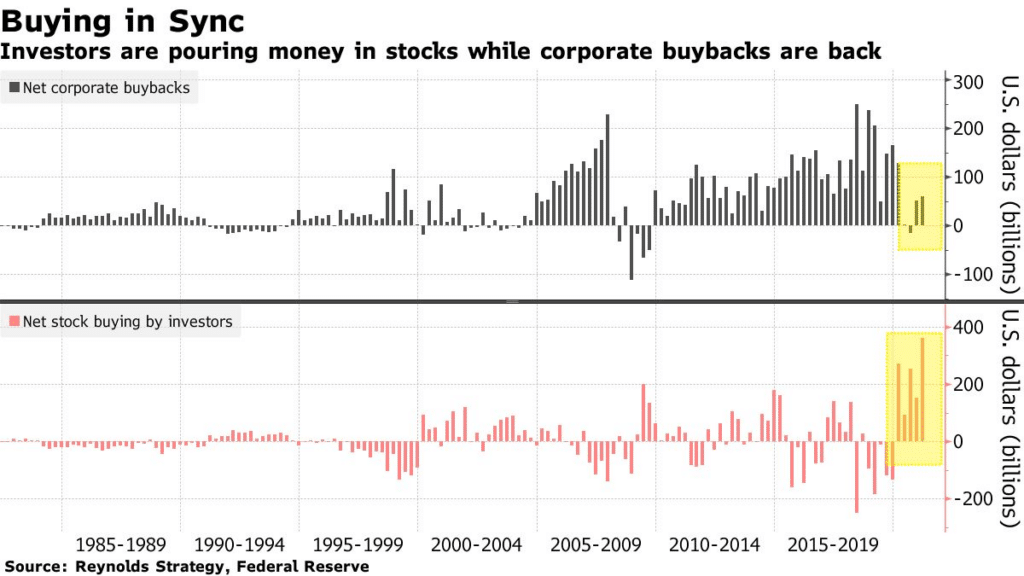

Analysts see a hunger on S&P driving up prices, with buyers spread across day traders, exchange traded funds, and hedge funds.

S&P 500 is now up about 90% from its March 2020 levels and is yet to make a 10% correction amid the ongoing market noise.

Analysts are warning of a major pullback, with a BofA survey showing that cash levels of money managers have declined below the 4% threshold.

S&P 500 is down -0.070%.