Clean energy-focused exchange-traded funds are attracting significant investments. Governments and entities are increasingly boosting their investments in alternative sources such as solar, wind, and hydrogen as the need to combat climate change and reduce reliance on fossil fuel heats up.

Amid the investment spree, numerous solar energy ETFs have cropped up, providing an ideal opportunity to gain exposure in the burgeoning sector.

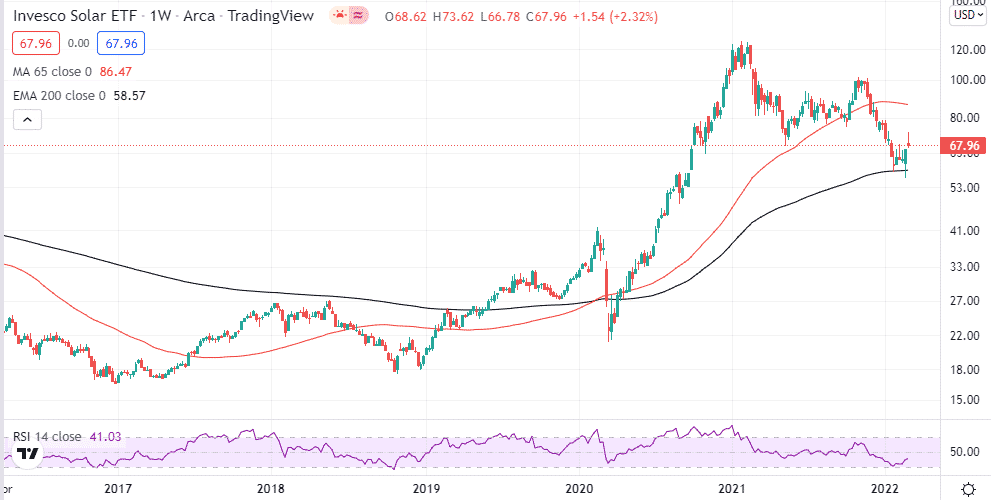

Invesco Solar ETF

It stands out as one of the best for gaining exposure in the burgeoning sector as it invests purely in companies that manufacture solar panels and electrical components. The company boasts of a diversified portfolio. It is also ranked as the second-largest alternative energy ETF with over $3 billion worth of assets under management.

Source: Tradingview.com

Alt-Text: chart showing Invesco Solar ETF bottoming out

The ETF allows investors to gain exposure in a basket of some of the biggest solar energy stocks. It also offers geographic diversifications as most of its holdings are spread far and wide. Some of the ETF’s top holdings include investments in SolarEdge Technologies, Enphase Energy, First Solar, Xinyi Solar, and Sunrun.

Its assets are also diversified to include information technology companies, utilities, financials, and materials. It is also ranked higher when it comes to environmental, social, and governance principles, given its increased focus on green energy

Additionally, the fund boasts of a low expense ratio of about 0.6%.

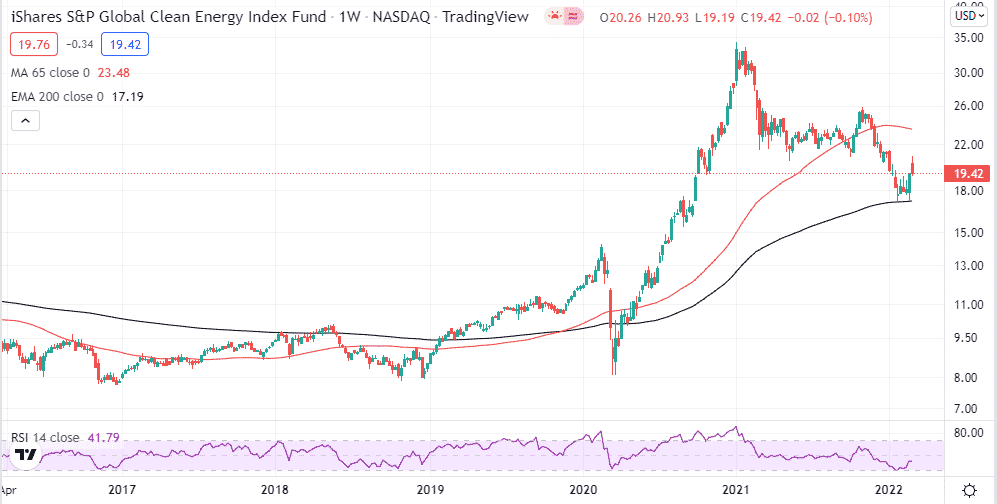

IShares Global Clean Energy ETF (ICLN)

While it can be extremely difficult to find an ETF dedicated solely to solar energy companies, there are other alternative energy plays. The ETF fits the bill as some of its biggest investments are around solar energy companies.

Source: Tradingview.com

The ETF focuses on companies that offer solar, wind, and other renewable energy sources. While it has almost 80 holdings, its biggest allocations are Enphase Energy and SolarEdge Technologies, some of the biggest plays around solar energy.

It also has allocations in companies that invest in solar energy inverters as well as companies that operate solar energy facilities. Therefore, it is an ideal play for any investor looking to gain exposure in companies that produce energy free of any carbon emissions.

The ETF also ranks highly when it comes to environmental, social, and governance factors. It also boasts of a much lower expense of about 0.42%.

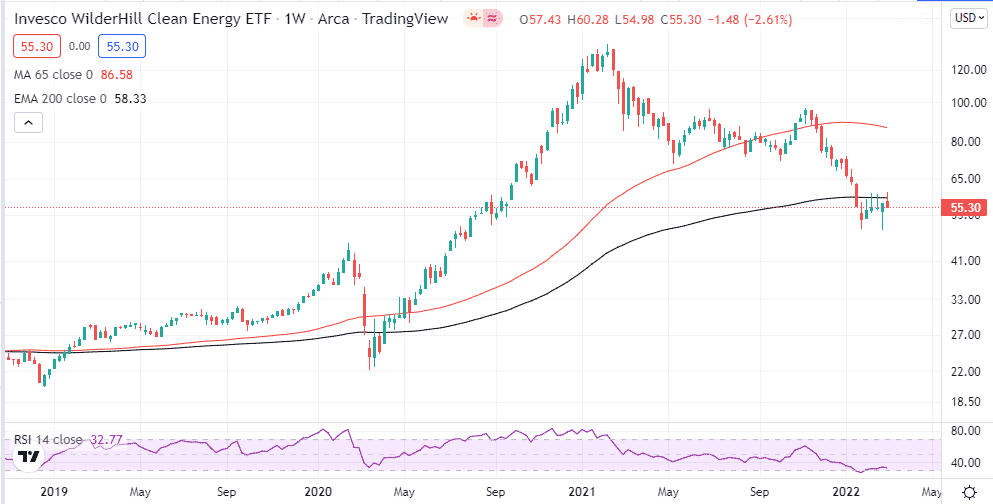

Invesco WilderHill Clean Energy ETF

It is another fund offering exposure to an array of green energy companies, including solar energy plays. While the ETF has almost 80 holdings, some of its biggest plays are in solar energy companies, thus fitting the bill as one of the best solar energy ETFs.

The ETF invests in companies spread across a wide array of sectors thus, offering investors exposure to a broad approach to renewables. Most of its holdings are of companies operating in the US. The ETFs boast of holdings in Sunlight Financial, Sunnova Energy, and Jinko Solar.

Source: Tradingview.com

While the ETF does not have any ESG rating, most of its investments are in companies with strong environmental, social, and governance factors, given their increased focus on developing clean energy solutions.

It also offers an affordable expense ratio of about 0.61%

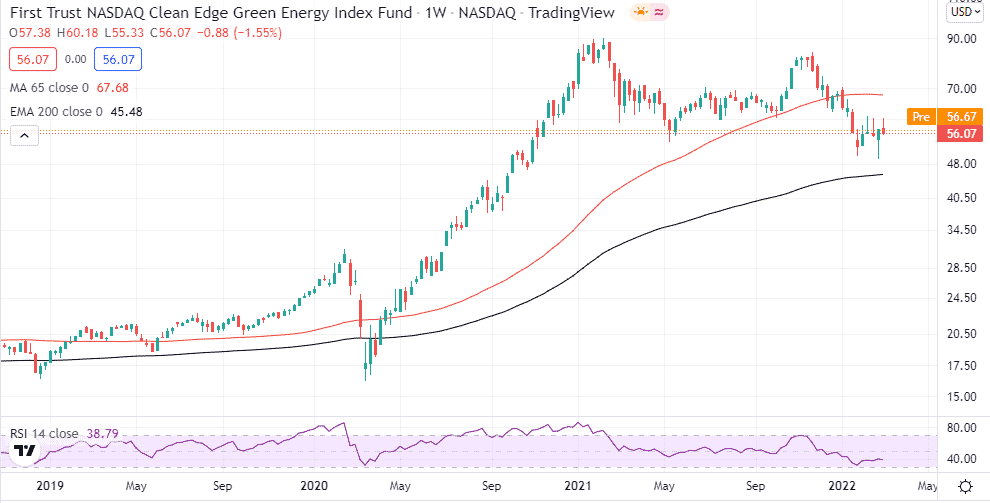

First Trust NASDAQ Clean Edge Energy Index Fund

It is ranked as one of the biggest energy ETFs. It stands out given its diversified holdings in companies listed in some of the biggest exchanges. It mostly focuses on companies that manufacture, develop, and distribute renewable energy technologies. Its specialty is around solar, wind, battery storage, and fuel cells.

Source: Tradingview.com

For any investor looking to gain exposure on some solar stocks in addition to other energy plays, it’s worth noting that Enphase is one of the biggest holdings in the fund. It also offers exposure to some big corporations, including Tesla, Nio, and Albemarle Corporation.

The index fund also ranks higher when it comes to environmental, social, and governance factors backed by a 0.6% expense ratio.

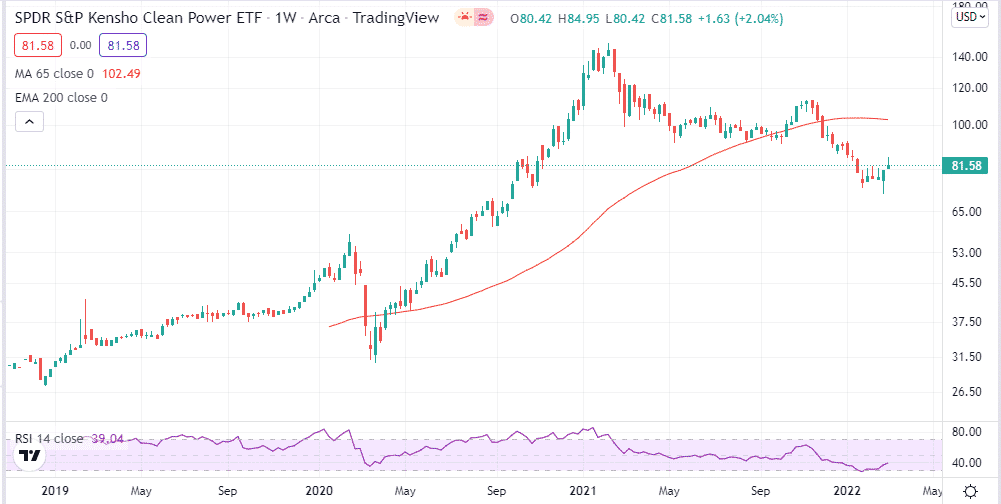

SPDR Kensho Clean Power ETF (CNRG)

It’s been one of the best performing ETFs amid a surge in oil prices to multi-year highs. It is up by more than 10% amid the carbon-free energy boom. Solar energy stocks are some of the biggest holdings in the ETF.

Source: Tradingview.com

The ETF already has holdings on solar specialist Sunrun, which is up by about 33% year to date. It also boasts of allocations in Sunlight Financial, Sunnova energy Financial. The fund could offer more upside potential in the years to come as countries shift to carbon-free energy sources to reduce dependence on fossil fuels and other countries.

Since its inception in 2018, the ETF has returned an average of 36% annually.

Final thoughts

Demand for renewable energy is on the rise after oil and natural gas prices increase to multi-year highs. Focus is now shifting to clean energy sources as they race to combat carbon emission heats up. In addition, governments are increasingly exploring ways to reduce their dependence on other nations on energy matters in the aftermath of the Ukraine-Russia stalemate.

Consequently, green = energy companies are eliciting strong demand from the investment community looking to take advantage of the emerging opportunities. Solar or clean energy ETFs are turning out to be ideal investment vehicles for gaining exposure in the burgeoning sector.