Sodobe Scalper is present at the MQL 5 marketplace and takes an average of 12 trades each month. The robot comes with live account performance and can work with a deposit of $200. The developer recommends using the system with low spread brokers. We will go through all the features and the cons of the robot within our article and see if traders can benefit from using it on their portfolios.

Sodobe Scalper trading strategy

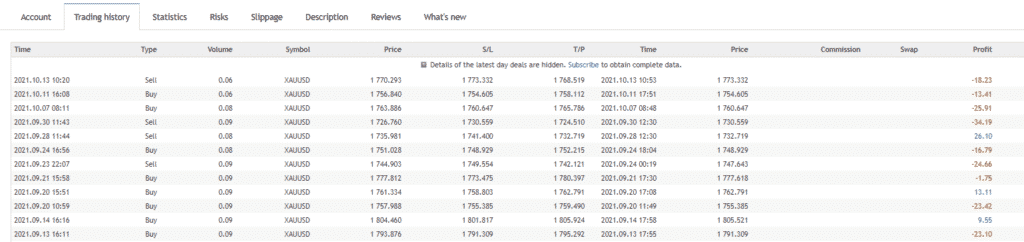

The expert advisor trades on gold with a scalping approach and uses a fixed take profit that corresponds to 5 ATR and a stop loss with 8 ATR. The average holding time ranks at 45 minutes which points at an intermediate approach between day trading and scalping. From the trading history, we can observe that it uses auto risk management to adjust the lot size according to the balance.

Sodobe Scalper features

The robot has the following features:

- It uses a fixed stop loss and take profit for each trade.

- The EA has multiple settings that traders can tweak.

- There is an auto lot management system.

- The minimum deposit requirement is only $100.

Price

The software comes with a one-time payment of $490, and there is no money-back guarantee as per the rules of the MQL 5 marketplace. Traders can also rent it for three months and one year at $90 and $270, respectively.

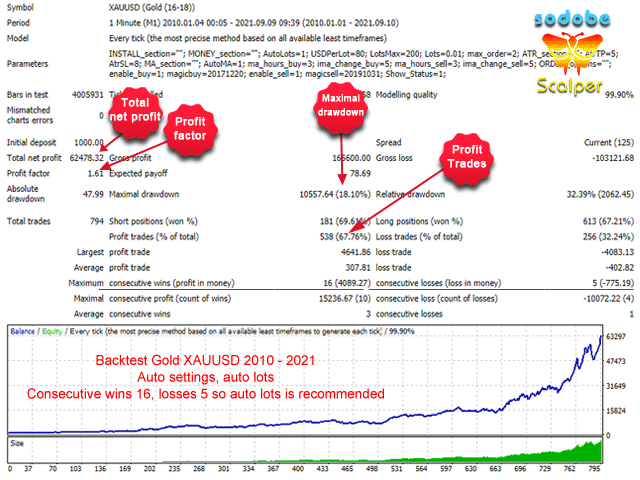

Sodobe Scalper backtesting results

Backtesting results are available for XAUUSD, where the relative drawdown was around 32.39%. The winning rate was 69.61%, with a profit factor of about 1.61. The starting balance was $1000.

The robot tanked an average profit of $62478.32 during this period in 794 trades in total. The best trade was $4641.86, while the worst one was -$4083.13.

Sodobe Scalper live trading results

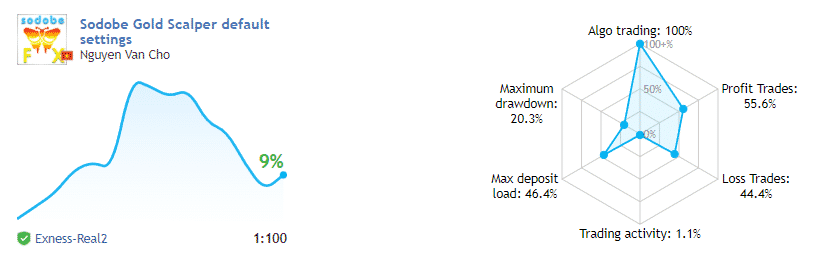

Verified trading records on Myfxbook show performance from July 12, 2021, till the current date. The system made a total growth of 9%, with a drawdown of 20.3%. The stated drawdown is way higher than the monthly output giving us a poor risk-reward ratio.

The winning rate stood at 55.55%, with a profit factor of 1.40. The best trade was $52.95, while the worst was -$34.90 in a total of 27 trades. The developer made $772.58 in deposits and $500 in withdrawals.

The live results are different from the backtesting when we contrast the win ratio. This results in poor output. The drawdown value may also increase in the future.

Sodobe Scalper reputation

Only three customer reviews are available at the MQL 5 marketplace. A user states that he is receiving a stable drawdown after using the algorithm. We can not trust such a short amount of feedback. We need more comments from other traders who have used the system for a long time to consider them for analysis and help us with purchasing decisions.

Is Sodobe Scalper a good EA to invest in?

Sodobe Scalper does not have a good total gain, and the drawdown is high. The robot lives for a short duration and works under a few market conditions. We cannot suggest investing in the system for now, and traders should wait to see if the EA works in the future.

Sodobe Scalper review summary

| Strategy | 3/10 |

| Functionality and features | 4/10 |

| Trading results | 4/10 |

| Reliability | 5/10 |

| Pricing | 3/10 |

Sodobe Scalper is not fit for use as the current output is not satisfactory at all. We can not invest a good amount of cash in a high drawdown and a poor risk-reward. Traders should avoid using the system as of now.