(WSJ) The sale of low-rated company debt is surging towards a record high at $361 billion as of September, driven by economic recovery and high demand.

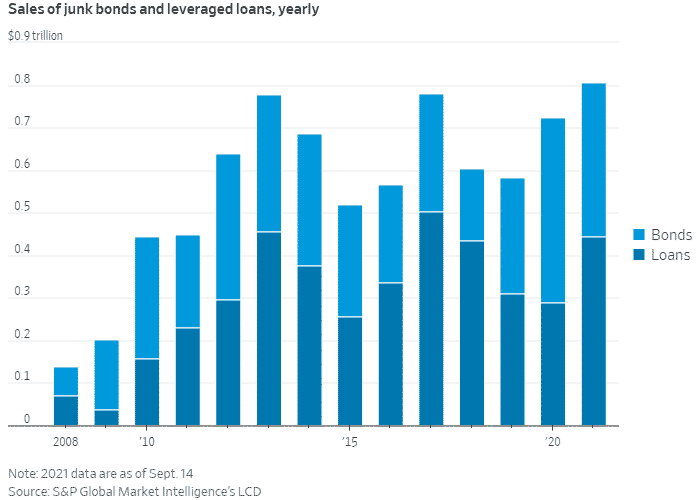

Fig: Yearly Sale of Junk Bonds and Leveraged Loans

At $361 billion, US companies have sold the second most junk bonds in the year after a record of $435 billion sold in 2020.

The sale of junk bonds and leveraged loans by US companies is at a one-year’s high of $786 billion.

Analysts project that the sale of junk bonds and leveraged loans will both close the year at record highs amid the current strong market conditions.

The short-term rise in junk bond spreads is expected to slow down and close the year at 3.23 percentage points.

Investors in the junk bonds have reaped over 4.9% returns as of last week, and Triple C bonds have returned around 10%. Investment-grade corporate bonds are at 0.05% return.