Robinhood FX EA is a weird robot that has an even weirder presentation. Everything looks like an iconic scam and can’t be trusted by word. The developers decided not to write the main claim about how good the system is.

Robinhood FX EA trading strategy

- We don’t know details but it looks like a Grid of orders strategy.

- It works with EURUSD.

- The only time frame is H1.

Robinhood FX EA features

Let’s get all the details together. There are not many ones, so we have to come up with the rest looking at how the system works.

- The system knows how to execute orders automatically for us.

- It opens and closes orders for us.

- It works on the market 24/7.

- There’s money and trade management applied.

- The advisor doesn’t use Martingale.

- It cuts losses as quickly as possible.

- The devs claimed that “the real trading systems don’t have such a nice equity curve. They have their drawdown and stagnation.” We don’t think so. Smooth profitability is a must.

- There are two main ideas behind the system: “Real Proper Capital Management and Specific and carefully calculated Trade Entries and exits.”

- The system calculates lot sizes for us automatically.

- The advisor covers SL levels from a broker.

- The stop losses are very tight.

- If all conditions are met, the system opens a trade.

- If conditions go down, it closes an order.

- It can work under any market conditions.

- Risk management is based on an automatic lot based on the current balance.

- We can work with it on any broker.

- It supports ECN, STP, Micro, or Cent accounts.

- There’s a built-in magic number.

- It works well with default settings applied.

- We can trade on EURUSD.

- The time frame is H1.

- The advisor requires $200 for a 0.01 lot size.

- The system doesn’t have the requirements for our trading experience.

- We are free to ask any questions that we want.

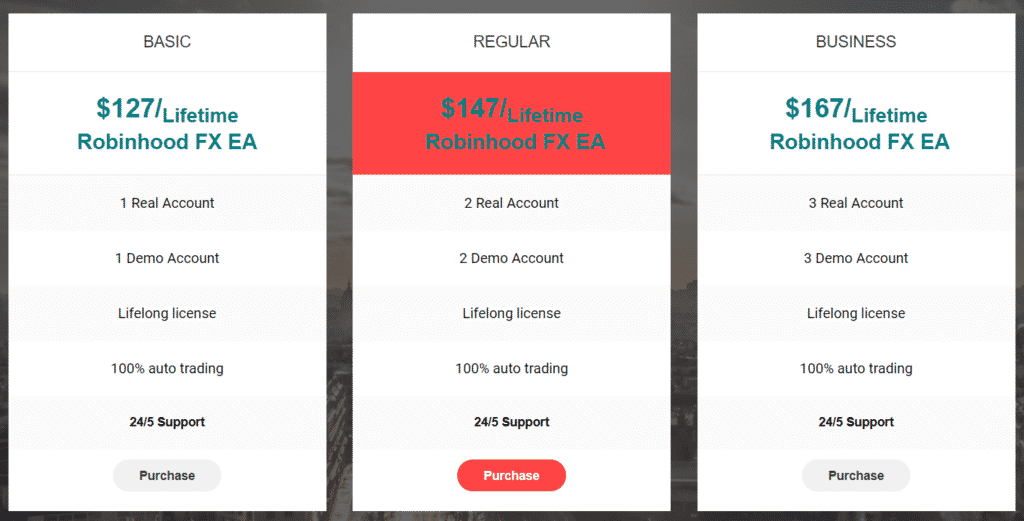

The Basic pack costs $127. There’s one real account license, one demo account, and 24/5 support. The Regular pack costs $147. We can rely on two real and two demo accounts. The Business pack costs $167 and includes three real and three demo accounts.

Robinhood FX EA backtesting results

The presentation doesn’t include a backtest report that would help us to understand how the system functioned in the past. At the same time, we don’t know details about the accuracy rate that the system could achieve running the past tick data from a determined broker.

Robinhood FX EA trading results

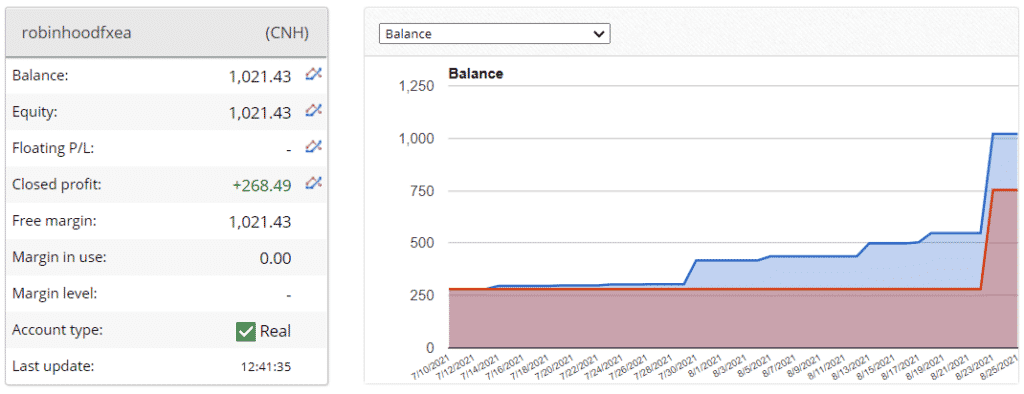

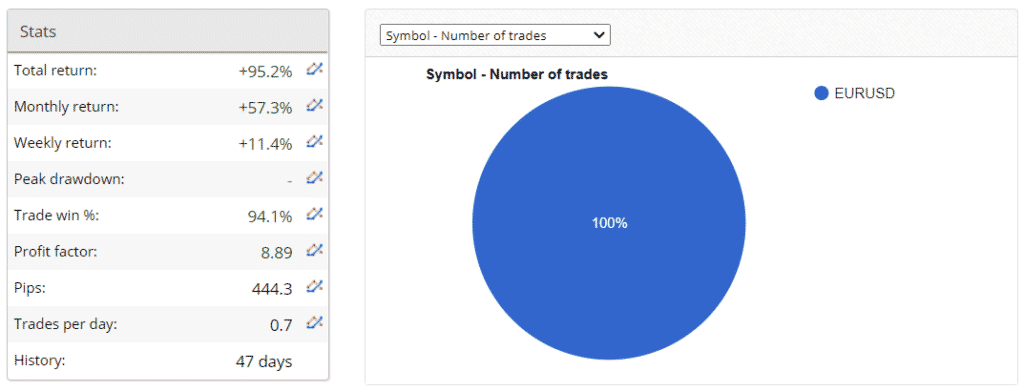

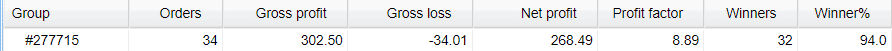

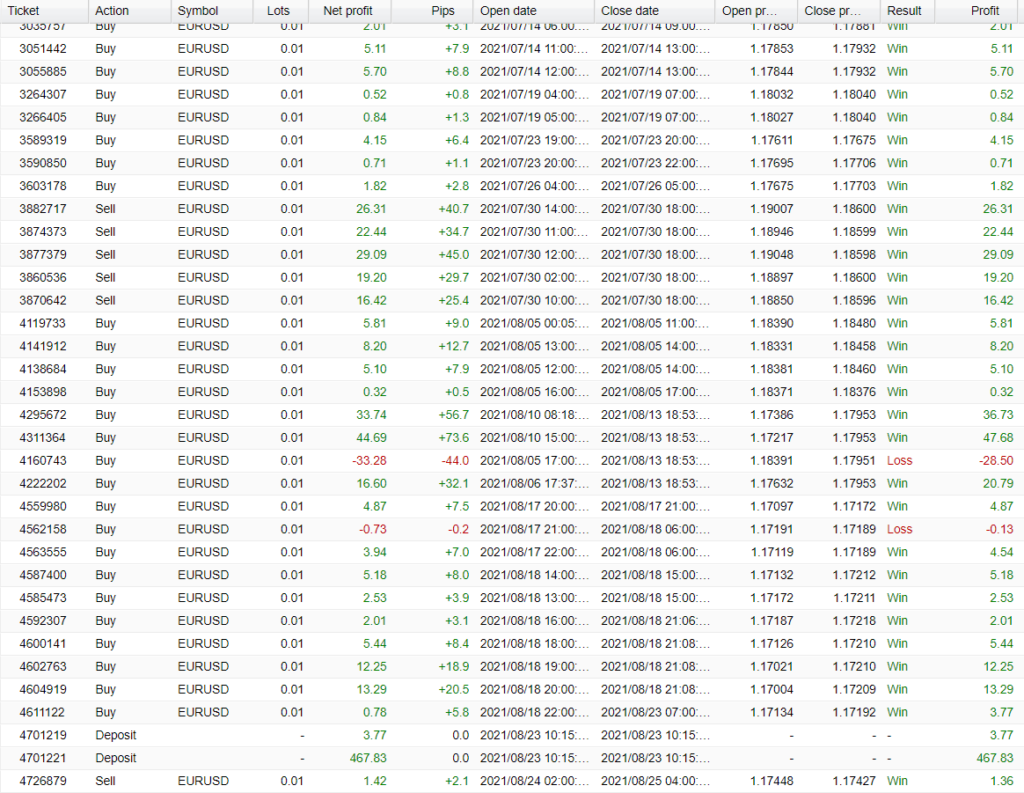

The system is set on a CNH account. The closed profit is $268.49. There are no open orders on the market.

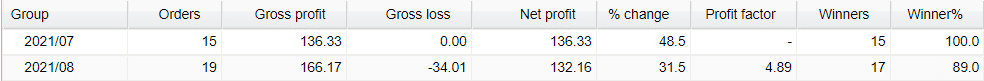

The total return is 95.2%. An average monthly gain is 57.3%. The win rate is 94.1%. The profit factor is 8.89. An average trade frequency is 0.7 orders daily. The account has been in use for 47 days.

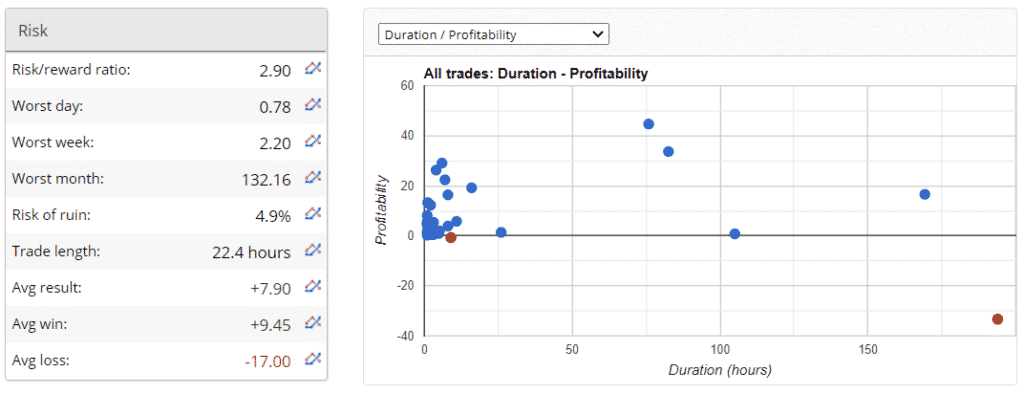

The system works with 2.90 of the ROI. The risk of ruin is 4.9%. An average trade length is 22.4 hours. An average result is $7.90. An average win is $9.45 when an average loss is $17.00.

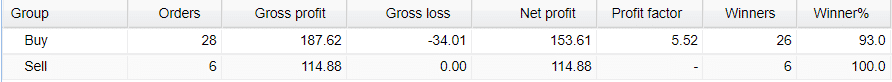

The buy direction is traded almost five times more frequently than the sell direction.

The system uses a single magic number to execute orders on the market.

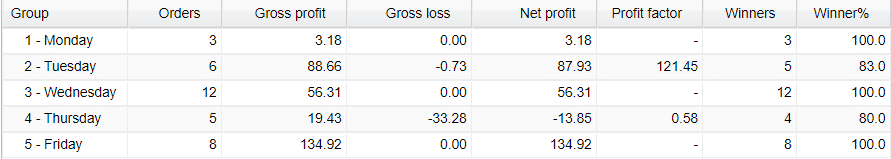

Wednesday is the most actively traded day with 12 orders. Friday is the most profitable – $134.92.

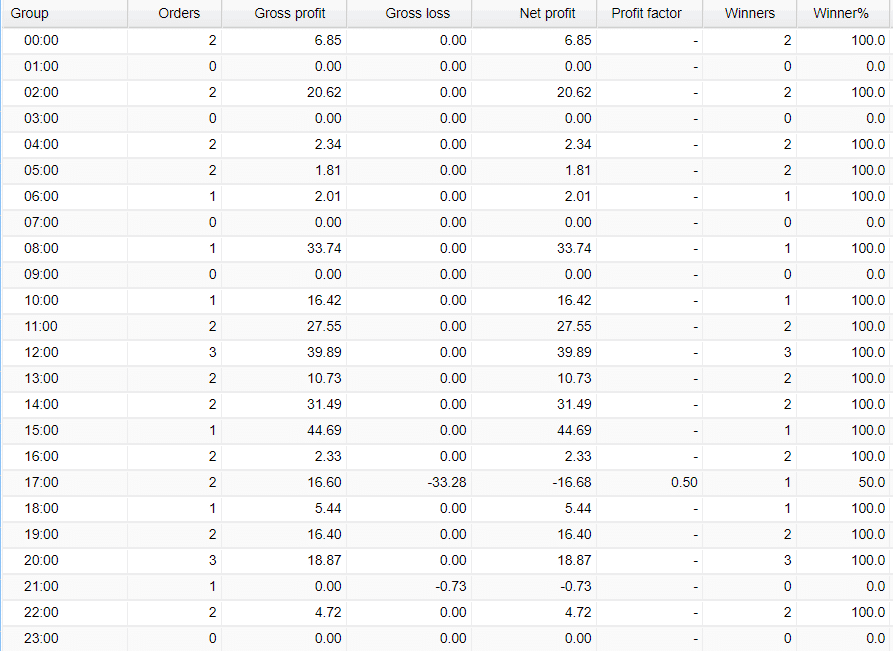

The system works mostly during the European trading hours.

The system ran for two months and was stopped.

It used a short-ranged Grid of orders without Martingale to make profits.

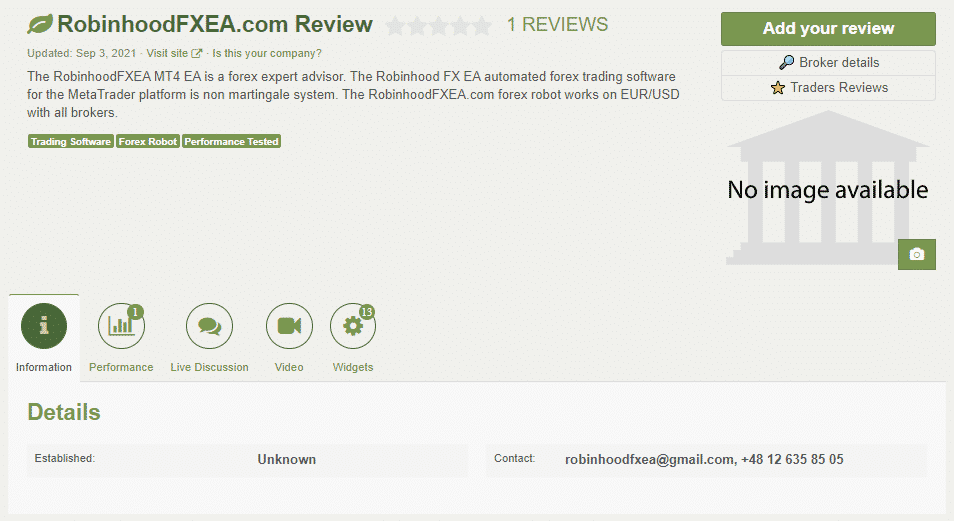

Robinhood FX EA reputation

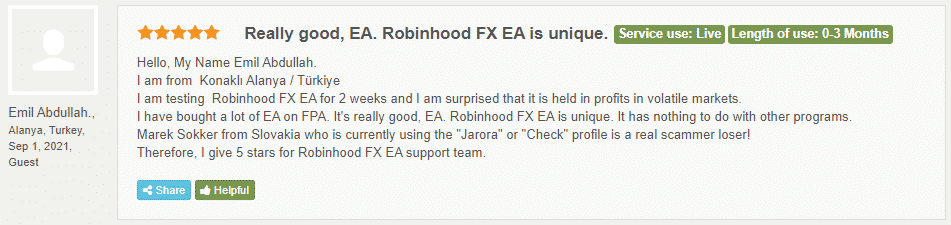

We have a page on the Forex Peace Army created with no trade accounts connected. There’s a single review written.

It sounds so positive. So, we can trust it blindly because it can be a scam.

Robinhood FX EA review summary

- Strategy – score (2/10)

- Functionality & Features – score (3/10)

- Trading Results – score (2/10)

- Reliability – score (2/10)

- Pricing – score (3/10)

Robinhood FX EA looks like a scam advisor. The presentation seems to us quite familiar, as we noted before. The presentation doesn’t look quite informative. Trading results show that the robot doesn’t work anymore. If the devs decided to stop making money, why would we have to give it a try?