The tokenized asset market projected to hit $16 trillion by 2030, with Ripple aiming to lead innovation.

Ripple President Monica Long has expressed optimism regarding extending tokenized assets in the banking sector in 2025. Her comments came in response to the growing interest from major financial institutions in tokenization and crypto custody solutions. According to Long, 15 of the world’s 25 largest banks have already piloted tokenized asset projects, with several expected to launch market-ready offerings in the United States next year, assuming regulatory clarity is provided.

Long emphasized the importance of regulatory clarity, noting that it could significantly impact how banks engage with digital assets. The Ripple President believes that with clearer guidelines, banks can play a pivotal role in transforming the financial landscape through tokenization. She stated that tokenization could unlock new opportunities for global finance, particularly in sectors such as real estate, where Ripple focuses on creating solutions.

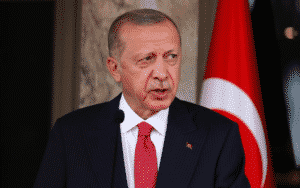

The prediction echoes general suggestions that the U.S. government will likely change its approach to regulating cryptocurrencies under President-elect Donald Trump. According to recent news, the Trump administration has reportedly planned to rescind the SAB 121 policy, which has been a subject of much debate, where banks holding cryptocurrency are forced to treat it as a liability. This policy has reportedly led to a lack of enthusiasm by the financial institutions to get involved with crypto assets.

Trump’s move to repeal SAB 121 is expected to profoundly impact the market, particularly in enabling large banks to offer crypto custody services. Financial analysts, including Frank Chaparro, believe this could unlock significant liquidity in the market. Chaparro explained that by allowing banks to custody crypto, the overall market structure could see a transformation, with institutions able to provide credit that supports liquidity. This could potentially reduce volatility in the crypto space and help stabilize the market.

Ripple has been actively participating in the tokenization process, defining it as a market leader. Its activities in the real estate tokenization market, represented by the partnership with Hong Kong’s Fubon Bank, prove that the company is ready to be at the forefront of this process. The initial project covers the integration of cryptocurrencies with the tokenized real estate sector and will enable individuals to secure loans with their real-world assets.

Given that the tokenization market is expected to hit $16 trillion by 2030, Ripple’s efforts to champion change in this space are strategic. The company’s work alongside the large financial institutions is projected to intensify as more banks embrace tokenization. Ripple’s work could pave the way for broader adoption of digital assets, particularly if regulatory clarity continues to improve.