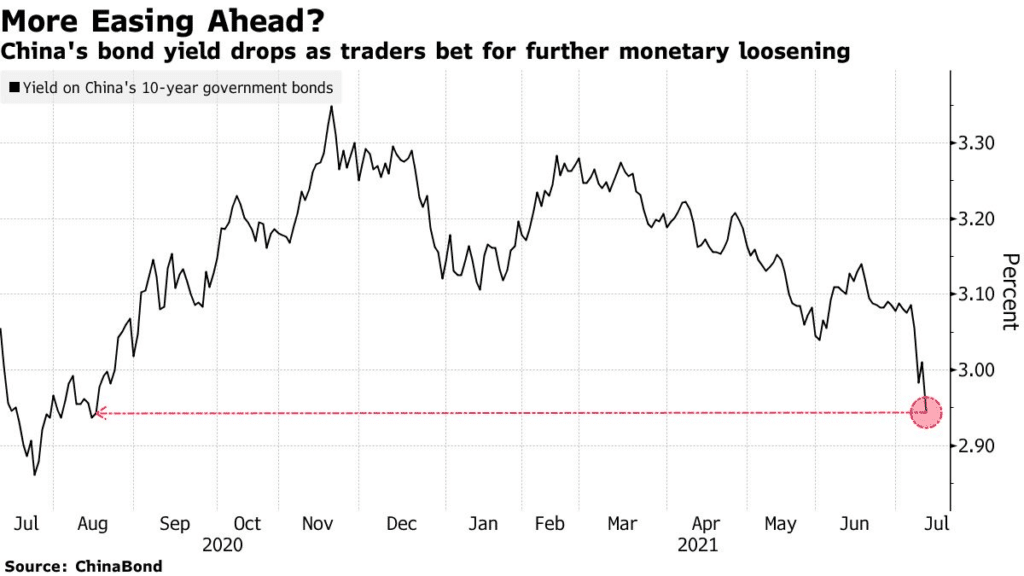

(Bloomberg) Chinese central bank added market uncertainty on Friday after saying it will cut bank reserve requirements by 0.5% amid economic slowdowns.

Analysts are uncertain of the extent of China’s economic slowdown and how far the central bank is going to ease policy.

Strategists led by UBS Asset Management and Citic Securities read more rate cuts in coming months as China’s economy slows.

Nomura Holdings Inc. and NatWest Group Plc don’t project more easing of policy and expect China to adopt more targeted measures.

Most analysts anticipate China to be aggressive in monetary deployment as the economy continues to face heightened risks of stagnation.

China’s central bank said on Tuesday that the cuts in reserve requirements was a step to build liquidity and will still maintain a prudent policy.

CSI 300 is up +0.18%, USDCNY is down -0.13%