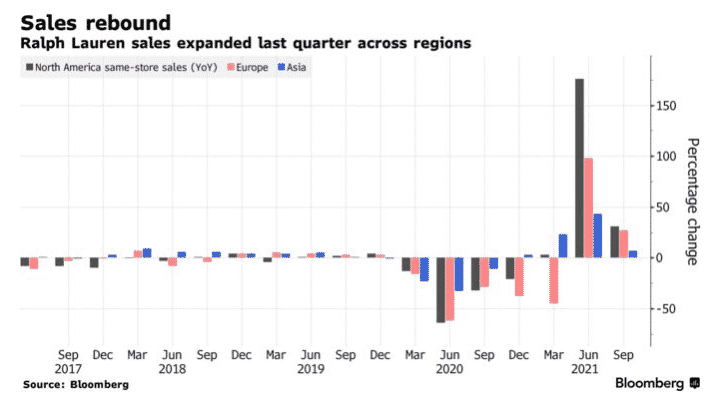

(Ralph Lauren) Shares of Ralph Lauren Corp. fell up to 6.7% in New York trading, the most since May 20, despite reporting a 26% jump in Q2 2022 revenues to $1.5 billion.

The fall in Ralph Lauren’s shares happened as investors were concerned that the company was recovering too slowly from the Covid slump.

Managing Director at GlobalData, Neil Saunders, says although Ralph Lauren’s stock has risen by 25% this year, it is still off the track from its 30% decline in the prior year.

Analysts are also concerned that despite Ralph Lauren’s revenue beating estimates, the company has lagged behind its peers.

Ralph Lauren CEO Patrice Louvet is still adamant that the company has outpaced expectations and succeeded in luring new customers which has helped it boost revenue outlook for the FY22.

Louvet says the apparel brand is attracting shoppers with demand for “sophisticated” casual items, as well as younger customers. He says the company is well positioned ahead of the holiday season despite huge backlogs following factory closures in Vietnam.

RL: NYSE is down -6.33%