(Bloomberg) Stock transactions spiked on Friday to defy Fed’s hawkish tone and uncertainty of expiration of options and futures in “triple witching” quarterly event.

Transaction volumes on S&P 500 was almost 50% above the average of the past 30 sessions as of 11.45 a.m. in New York, despite the benchmark falling by 0.9%.

Analysts warn that it is difficult to tell whether the rise in stock transactions is driven by the option expirations or business fundamentals.

The quarterly option expirations, referred to as “quadruple witching” coincides with index rebalancing that prompts major single-day volumes.

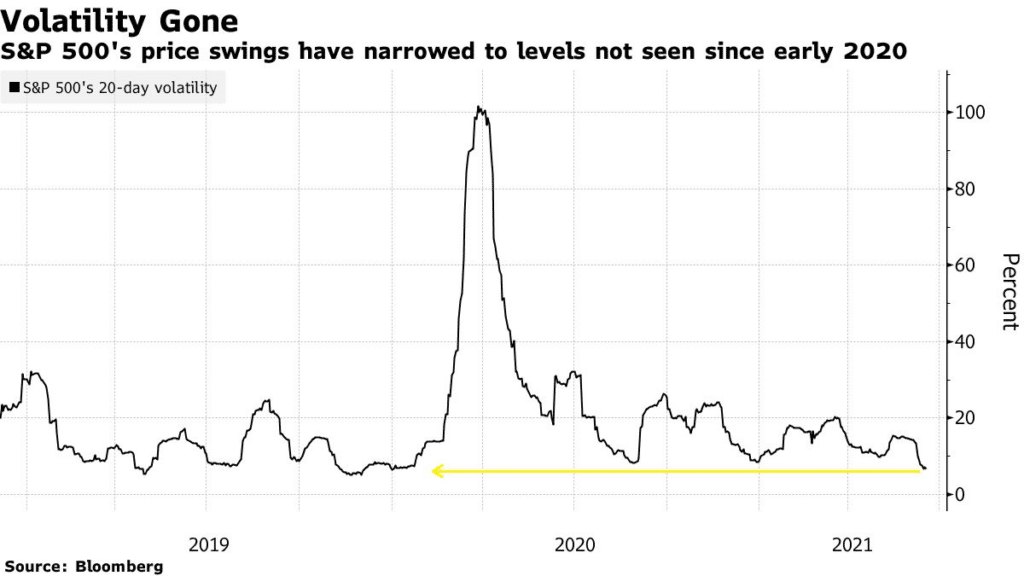

The increase in S&P 500 volumes on Friday happens after a market stillness that saw the index’s price signals fall to levels before 2020.

Charlie McElligott, a Nomura strategist, says the stability of equities despite hawkish tone by Fed is misinterpreted as prices are still following volumes.

S&P 500 is down -0.85%.